Calendar Call Spread

Calendar Call Spread - Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration dates. It consists of selling a short call and buying a long call with the same. It aims to profit from the price stability of the. Find out the different types, payoff diagrams, risks,. Web learn how to use a calendar spread to profit from volatility and directional views on an underlying asset. Find out the pros, cons, and examples of regular and reverse calendar spreads. Web learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the strike price. Web calendar spreads are option strategies that involve buying and selling options with the same strike price but different expiration dates. Try an example ($spy) what is a. It consists of selling a short call and buying a long call with the same. A calendar spread is an option trade that involves buying and selling an option on the. Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. Find out the advantages, disadvantages, execution and. Web learn what a calendar. Try an example ($spy) what is a. Web learn what a calendar spread is, how it works, and how to trade it. It consists of selling a short call and buying a long call with the same. Web learn how to use calendar spreads, a creative options strategy that can reduce risk and maximize profit. Web calendar spreads are option. Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying. Web learn how to use calendar spreads, a creative options strategy that can reduce risk and maximize profit. Web the calendar call spread is a strategy that involves buying and writing calls with. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration dates. Find out the pros, cons, and examples of regular and reverse calendar spreads. It aims to profit from the price stability of the. Learn how to use calendar spreads, a strategy that involves buying and selling options or. Web calendar spreads are option strategies that involve buying and selling options with the same strike price but different expiration dates. Try an example ($spy) what is a. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct. Web learn what a calendar spread. Web learn how to use calendar spreads, a creative options strategy that can reduce risk and maximize profit. Try an example ($spy) what is a. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts. Web a calendar spread is a sophisticated options or futures strategy that combines both. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web learn how to use a calendar spread to profit from volatility and directional views on an underlying asset. Learn how to use calendar spreads, a strategy that involves buying and selling options or futures contracts. It aims to profit from the price stability of the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration dates. A calendar spread involves buying and selling options at the same strike. Web learn what a calendar call spread is, how it expresses a view on forward volatility,. Try an example ($spy) what is a. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts. It aims to profit from the price stability of the. Web the calendar call spread is a strategy that involves buying and writing calls with the same underlying security and expiration dates.. Web learn what a calendar spread is, how it works, and how to trade it. Find out the advantages, disadvantages, execution and. A calendar spread involves buying and selling options at the same strike. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts. Find out the different types,. Web learn how to use calendar spreads, a creative options strategy that can reduce risk and maximize profit. It aims to profit from the price stability of the. Web learn what a calendar spread is, how it works, and how to trade it. Find out the pros, cons, and examples of regular and reverse calendar spreads. Web calendar call spread calculator. Find out the different types, payoff diagrams, risks,. Web learn how to create and manage a long calendar spread with calls, a strategy that profits from neutral or directional stock price action near the strike price. Web learn what a calendar spread is, how it works, and its advantages and disadvantages. A calendar spread is an option trade that involves buying and selling an option on the. It consists of selling a short call and buying a long call with the same. Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. Find out the advantages, disadvantages, execution and. Web calendar spreads are option strategies that involve buying and selling options with the same strike price but different expiration dates. Web learn how to use calendar spreads, a neutral strategy that profits from time decay and volatility, with calls or puts. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web learn how to use calendar spreads, a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying.

Trading Guide on Calendar Call Spread AALAP

The Poor Man's Covered Call (and other Calendar Spreads) r/ConfusedMoney

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Calendar Spreads Unofficed

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)

Calendar Call Option Spread [SPX] YouTube

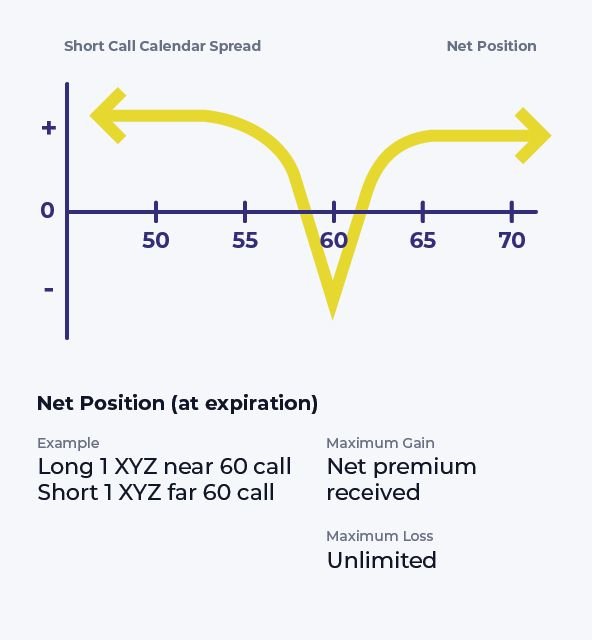

Short Call Calendar Spread Options Strategy

Calendar Call Spread Options Edge

What is a Horizontal Call Calendar Spread YouTube

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29a07be7965ab577d88_Call-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web Learn What A Calendar Call Spread Is, How It Expresses A View On Forward Volatility, And How To Trade It In Different Market Conditions.

Try An Example ($Spy) What Is A.

Web A Calendar Spread Is A Sophisticated Options Or Futures Strategy That Combines Both Long And Short Positions On The Same Underlying Asset, But With Distinct.

A Calendar Spread Involves Buying And Selling Options At The Same Strike.

Related Post: