Zerobased Budgeting Template

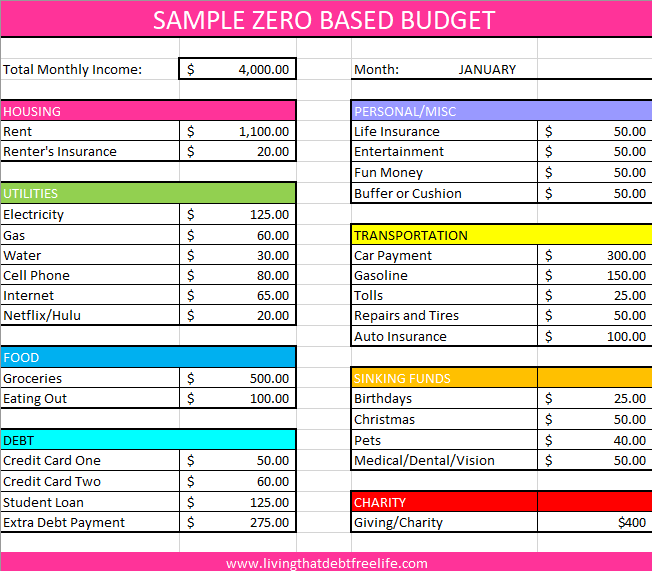

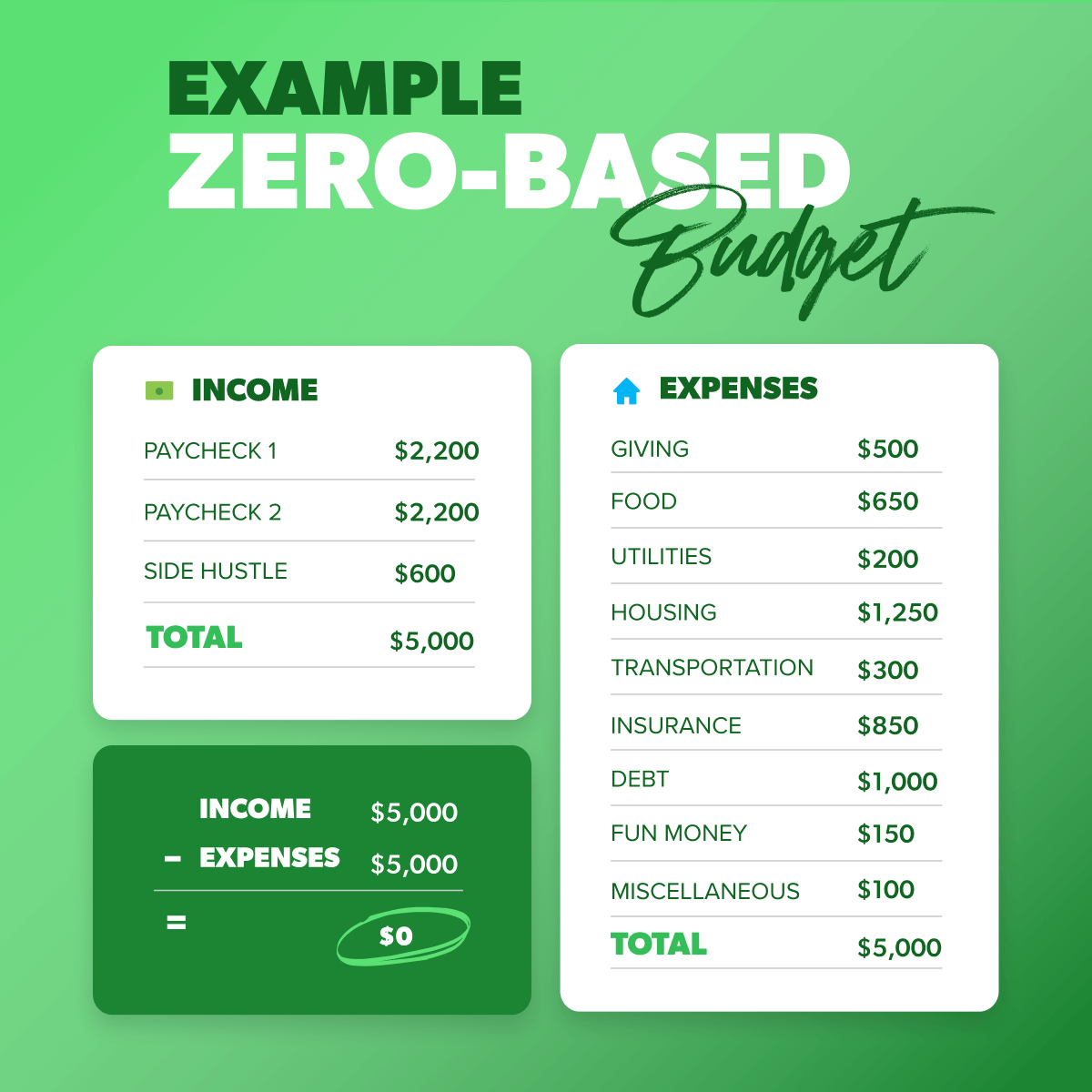

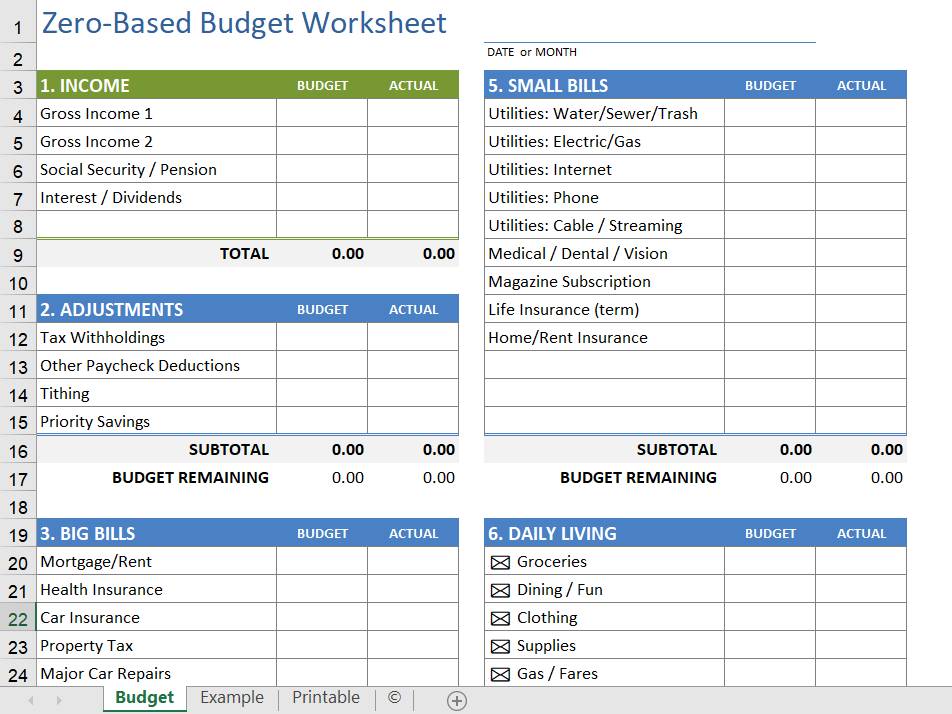

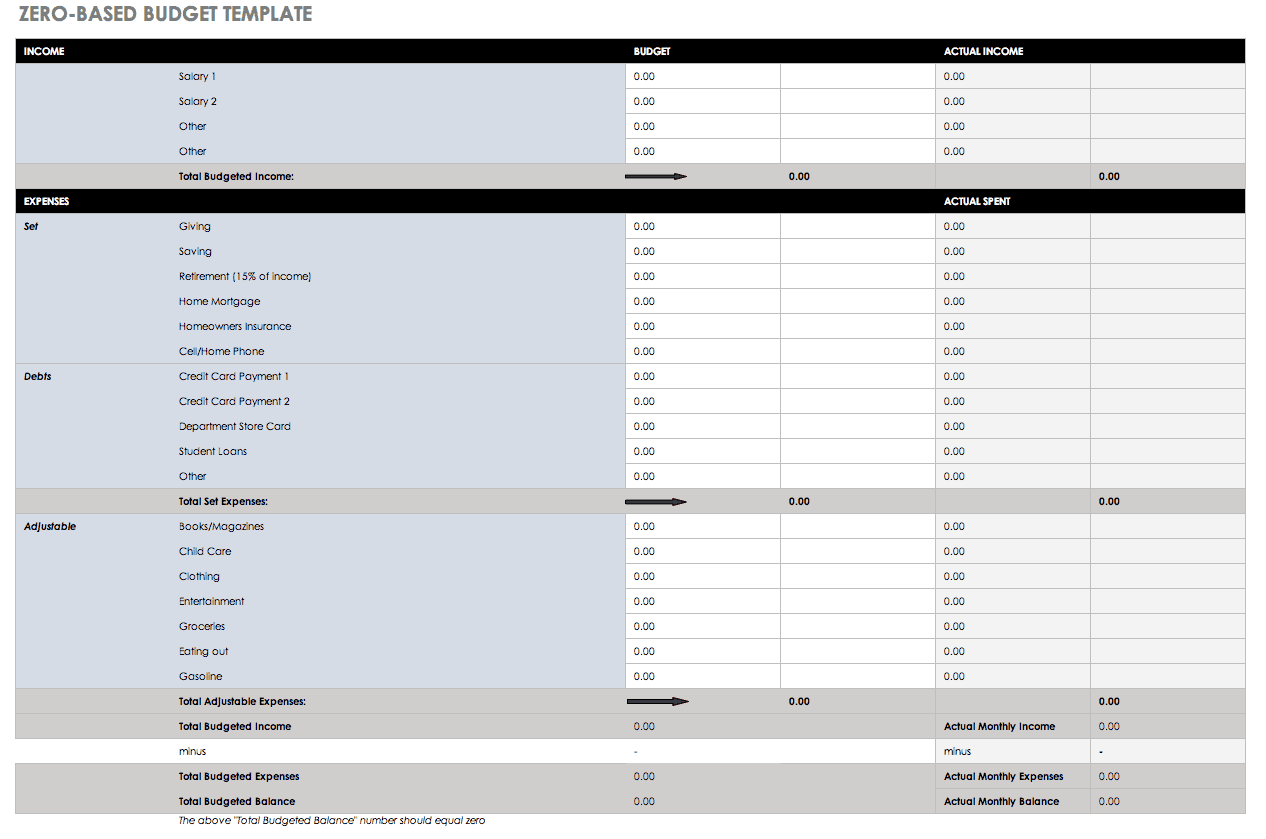

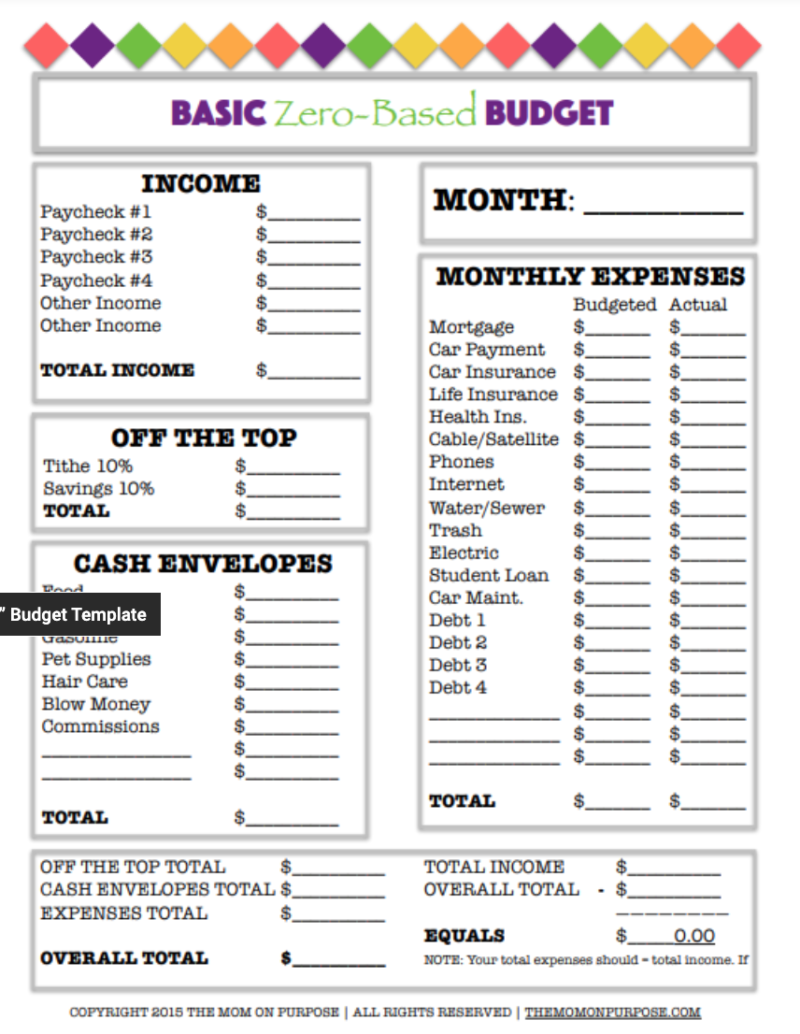

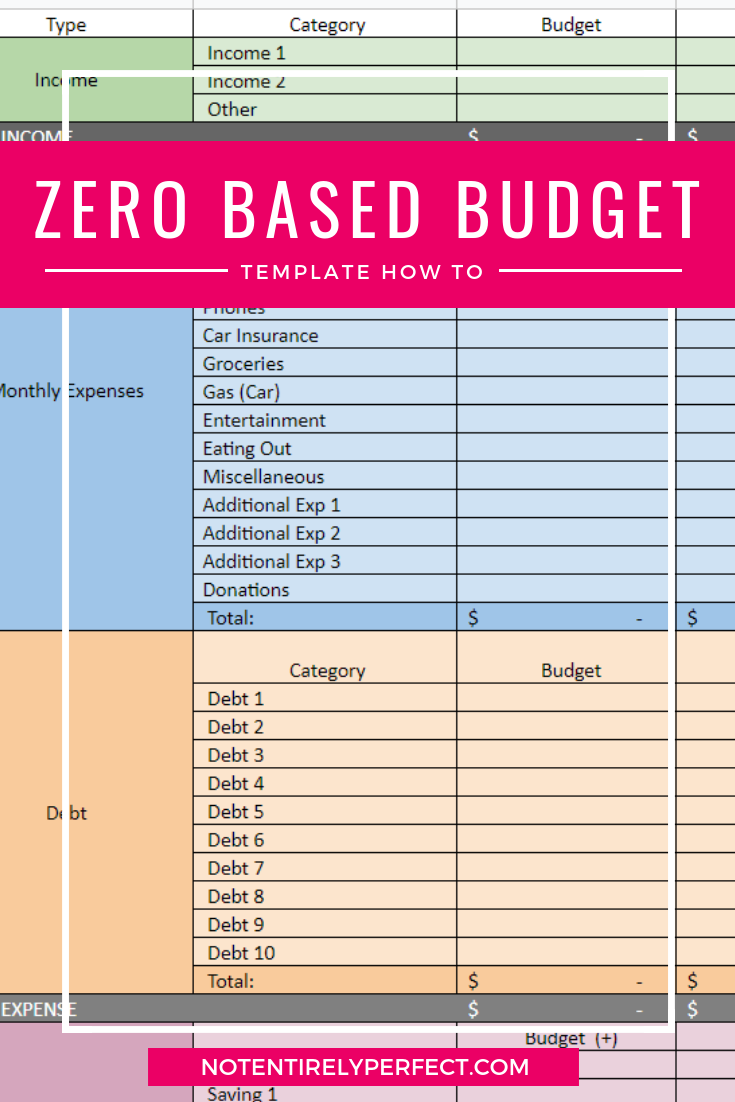

Zerobased Budgeting Template - Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. Gather all your financial information, such as your income, expenses, and savings. Reviewed by dheeraj vaidya, cfa, frm. To get started, you can grab my monthly budget template here. Monthly budgeting is a common challenge. Make a plan for leftover money. Setting up a zero based budget is a fairly simple process, it just requires you take the time to get things right. The idea is that you create a budget, input your total income for the month, and then assign those dollars a job. Updated on april 17, 2024. Typically this means you will make a plan for every dollar you earn. For personal use only, not to be copied, distributed, altered, or sold. When you use a zero based budgeting template, the basic formula is: 7 pros and cons of this budgeting method; The basic idea with a zero based budget is to give every dollar you make a job or responsibility. Reviewed by dheeraj vaidya, cfa, frm. 7 pros and cons of this budgeting method; Determine the final totals and remaining money. Whether you’re managing your family’s finances, running a business, tracking your personal spending, or planning for college, the costs can seem endless. So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. Typically this means you will. Web zero based budget template. Enter your budget (planned saving and spending) make changes until the final budget = zero. Determine budgeting time period (month, quarterly, yearly). For personal use only, not to be copied, distributed, altered, or sold. All free printables ©saturdaygift ltd. For instance, if your paycheck is $3,000 a month, you divvy all $3,000 up among your expenses, debt payments, and savings goals until you're left with $0. Web download your free excel budget template here! 4 how does it differ from traditional budgeting? 5 min read | apr 26, 2024. There are no expenses that are automatically added to the. By andy marker | february 22, 2017. Every dollar that comes in has a purpose, a job, a goal. I desired to build generational wealth but, with no real plan for managing my finances, i. All free printables ©saturdaygift ltd. This ensures that your monthly expenses equal your monthly income. Whether you’re managing your family’s finances, running a business, tracking your personal spending, or planning for college, the costs can seem endless. List out all of your monthly expenses under different categories, such as rent/mortgage, groceries, utilities, transportation, etc. With this budget, every single dollar you earn goes toward a purpose. All free printables ©saturdaygift ltd. Every dollar that comes. There are no expenses that are automatically added to the budget. View the video tutorial below. For instance, if your paycheck is $3,000 a month, you divvy all $3,000 up among your expenses, debt payments, and savings goals until you're left with $0. Web download your free excel budget template here! Your income minus your expenditures should equal zero. Make a plan for leftover money. So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. At the beginning of each month, plan out your budget for the. List out all of your monthly expenses under different categories, such as rent/mortgage, groceries, utilities, transportation, etc. To get started, you can grab my monthly budget template here. 5 min read | apr 26, 2024. Make a plan for leftover money. Web what is zero based budgeting? Setting up a zero based budget is a fairly simple process, it just requires you take the time to get things right. By andy marker | february 22, 2017. So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. Make a plan for leftover money. Whether you’re managing your family’s finances, running. Excel 2003 (.xls) openoffice (.ods) csv (.csv) portable doc. No matter what you want to do with your money, it starts with a budget. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. With this budget, every single dollar you earn goes toward a purpose. In other words, you track what you do with every dollar. 5 min read | apr 26, 2024. 7 pros and cons of this budgeting method; Make a plan for leftover money. Web download your free excel budget template here! All free printables ©saturdaygift ltd. Set up your income and expenses. List out all of your monthly expenses under different categories, such as rent/mortgage, groceries, utilities, transportation, etc. The idea is that you create a budget, input your total income for the month, and then assign those dollars a job. Web what is zero based budgeting? Web the complete collection of monthly budget templates. By andy marker | february 22, 2017.

How to Create a ZeroBased Budget Finance Planer

Zero Based Budget Spreadsheet Free Download Healthy Wealthy Skinny

A Detailed Guide to Making A Zero Based Budget — Living that Debt Free Life

Zero Based Budget Excel Template

Zero Based Budget Template

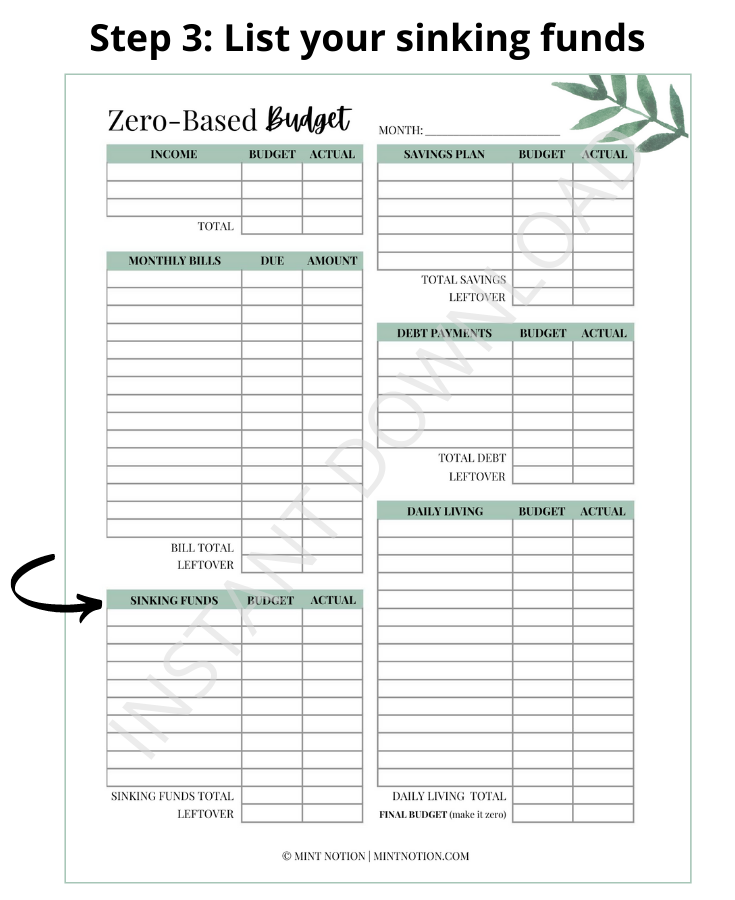

ZeroBased Budget (Printable) Mint Notion Shop

Zero Based Budget Template

ZeroBased Budget + Templates and Examples

Zero Based Budget Template Printable Templates Printable Download

Printable Zero Based Budgeting Template Printable Templates Free

5 What’s The 50 30 20 Budget Rule?

Gather All Your Financial Information, Such As Your Income, Expenses, And Savings.

Enter Your Budget (Planned Saving And Spending) Make Changes Until The Final Budget = Zero.

Your Income Minus Your Expenditures Should Equal Zero.

Related Post: