W9 Invoice Template

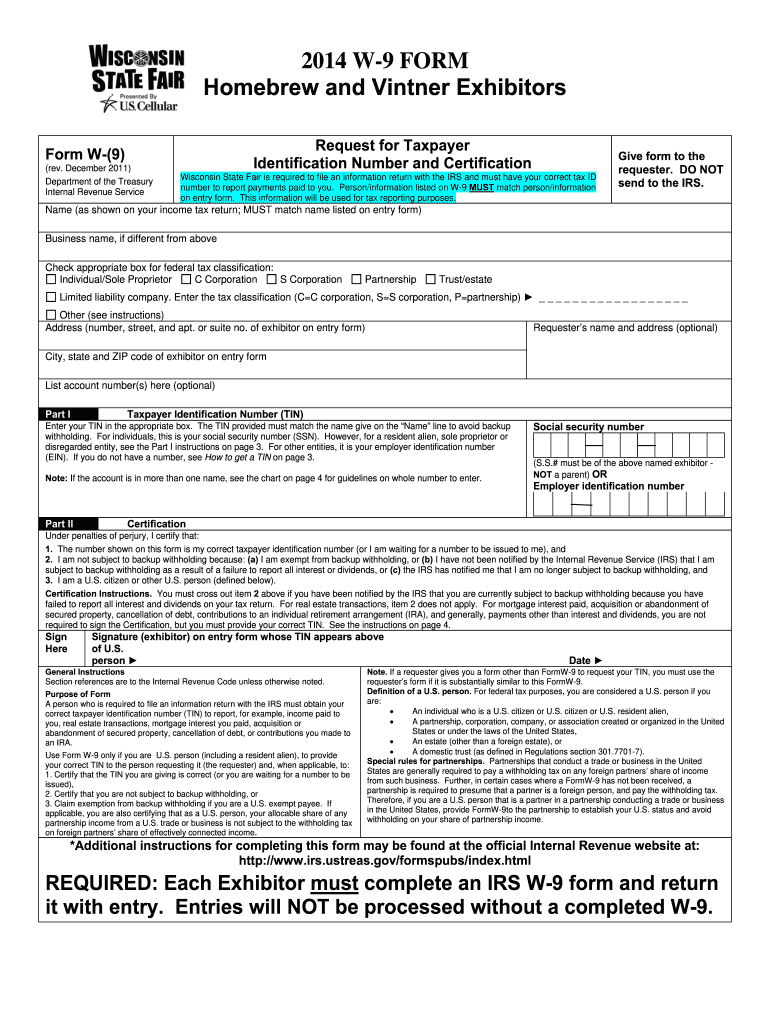

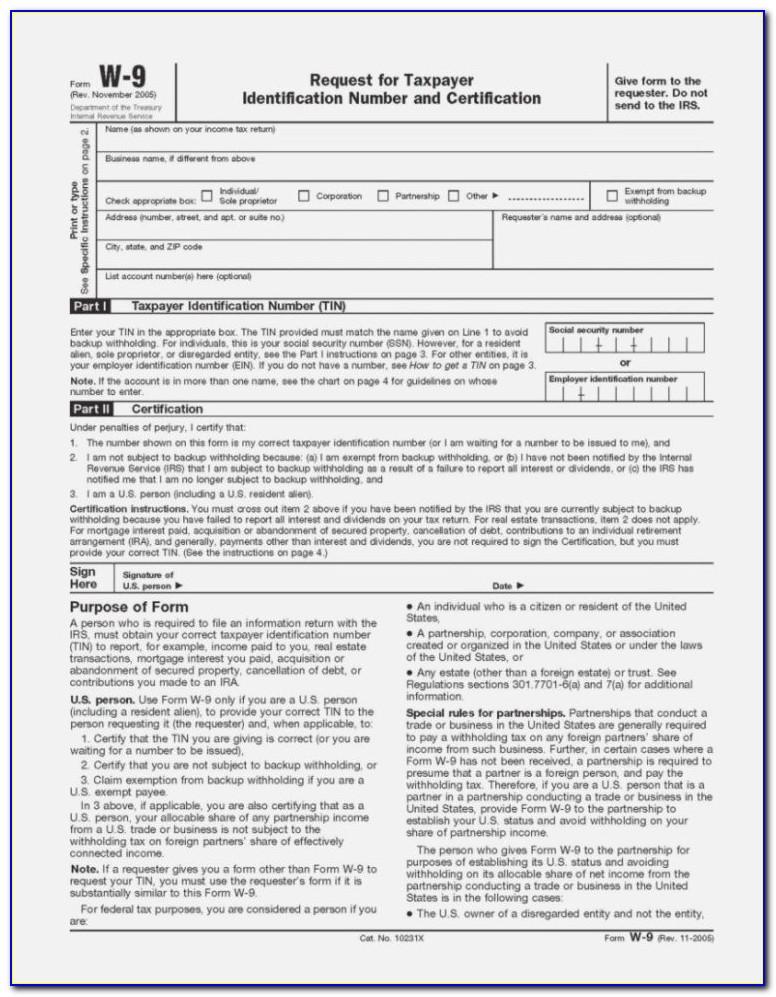

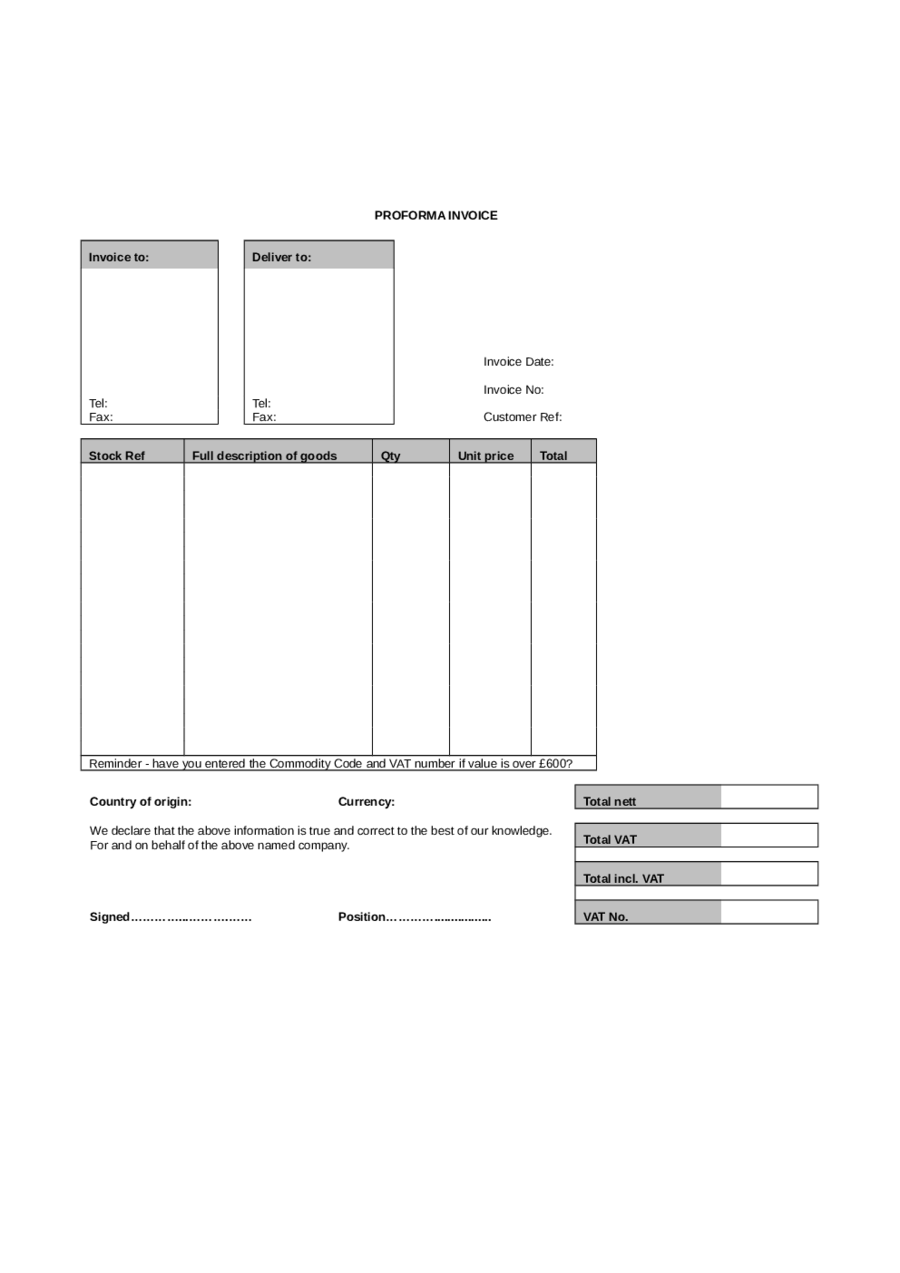

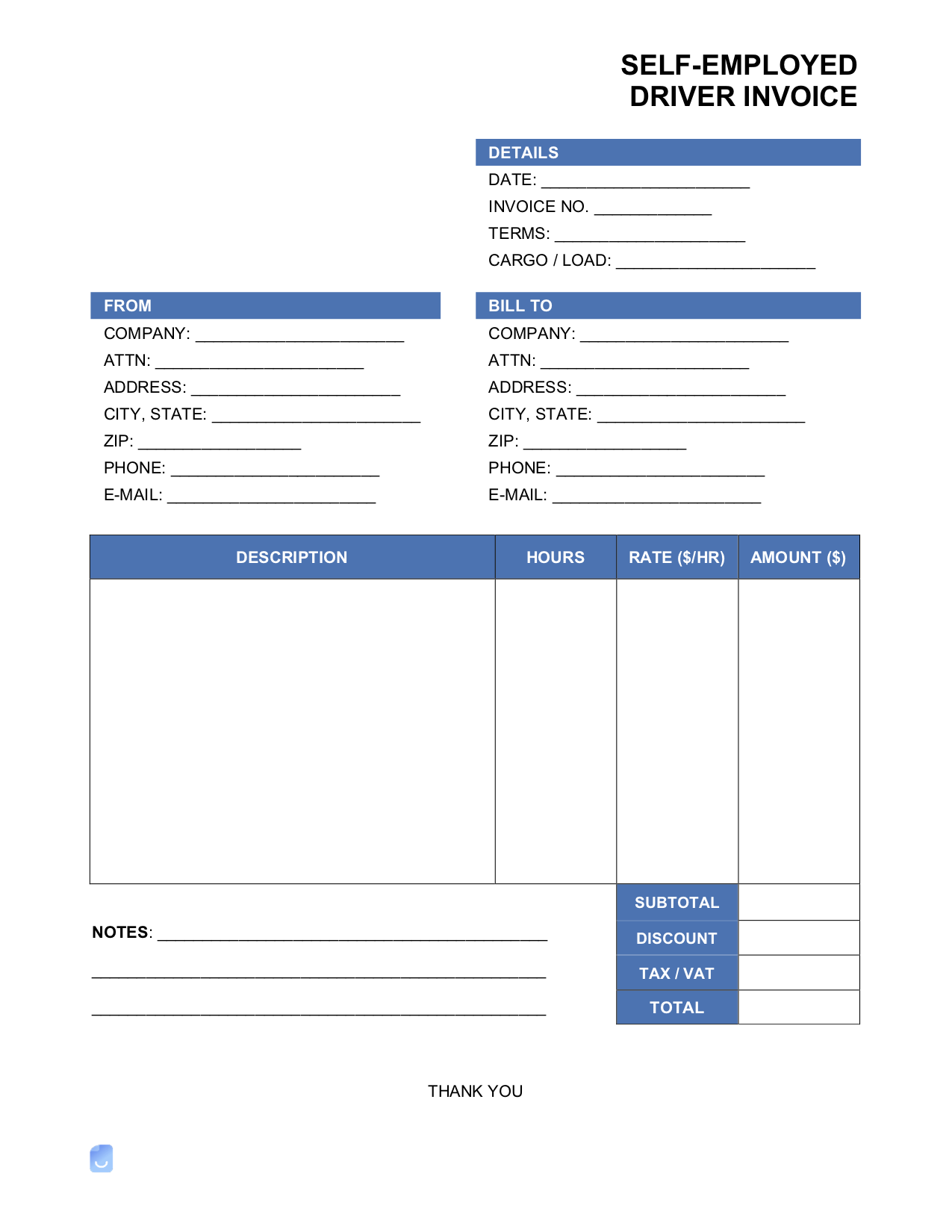

W9 Invoice Template - Under invoice templates, select manage. Web enter your ssn, ein or individual taxpayer identification as appropriate. Web independent contractor (1099) invoice template. Therefore, payments should be made in full. Definition and who fills it out. Contributions you made to an ira. If an account holder fails to provide its tin, then the withholding rate is 30%. Person (including a resident alien), to provide your correct tin. Acquisition or abandonment of secured property. Clients are not responsible for paying the contractor’s taxes; Person (including a resident alien), to provide your correct tin. Under invoice templates, select manage. Office of the controller accounts payable. Web you can create more invoice templates as follows: Definition and who fills it out. Web fill w9 invoice template, edit online. Web enter your ssn, ein or individual taxpayer identification as appropriate. Written by sara hostelley | reviewed by brooke davis. Web you can create more invoice templates as follows: This document will report all payments made to you within the tax year. See what is backup withholding, later. Web it's just $50. Office of the controller accounts payable. Web updated april 29, 2024. Web updated january 11, 2024. One of the most common situations is when someone works as. Web enter your ssn, ein or individual taxpayer identification as appropriate. Select save and continue to select the groups that will use this invoice template. Web for those of you who have traditionally earned most of your income as an employee, you may not have much of an idea. Clients are not responsible for paying the contractor’s taxes; Select save and continue to select the groups that will use this invoice template. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web updated january 11, 2024. Web it's just $50. Written by sara hostelley | reviewed by brooke davis. This document will report all payments made to you within the tax year. Failure to provide your social security number or ein may result in the delay of future payments or backup withholdings. It is commonly required when making a payment and withholding taxes are not being deducted. Select save and. Clients are not responsible for paying the contractor’s taxes; See what is backup withholding, later. Failure to provide your social security number or ein may result in the delay of future payments or backup withholdings. If an account holder fails to provide its tin, then the withholding rate is 30%. Web updated april 29, 2024. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Person (including a resident alien), to provide your correct tin. This document will report all payments made to you within the tax year. Definition and who fills it out. Sign, fax and printable from pc, ipad, tablet. This document will report all payments made to you within the tax year. See what is backup withholding, later. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Clients are not responsible for paying the contractor’s taxes; Definition and who fills it out. As an independent contractor, you’re required to pay taxes on the income you earn and you must file a tax return with the irs each year. One of the most common situations is when someone works as. Under invoice templates, select manage. Failure to provide your social security number or ein may result in the delay of future payments or. Web you can create more invoice templates as follows: Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. Acquisition or abandonment of secured property. Web for those of you who have traditionally earned most of your income as an employee, you may not have much of an idea what it is for or how to fill out a w9 form, or how to prepare for it with every invoice template you create and send for payment. This document will report all payments made to you within the tax year. An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Select business settings and under billing & shipping, select pay by invoice. Web fill w9 invoice template, edit online. See what is backup withholding, later. Web enter your ssn, ein or individual taxpayer identification as appropriate. Web updated january 11, 2024. Failure to provide your social security number or ein may result in the delay of future payments or backup withholdings. As an independent contractor, you’re required to pay taxes on the income you earn and you must file a tax return with the irs each year. Claim exemption from backup withholding if you are a u.s. Definition and who fills it out. Under invoice templates, select manage.

Form W9 Template. Create A Free Form W9 Form.

MA Substitute W9 2004 Fill out Tax Template Online US Legal Forms

W9 Invoice Template Fill Online, Printable, Fillable, Blank pdfFiller

2015 Irs W9 form 2015 W 9 form Fillable Wowkeyword Doctors note

Detail W9 Invoice Template Koleksi Nomer 6

Fillable Form W9 Printable Forms Free Online

W9 Federal Withholding Form Printable W9 Form 2023 (Updated Version)

Stanford Resume Template Word

2023 Invoice Template Fillable, Printable PDF & Forms Handypdf

Detail W9 Invoice Template Koleksi Nomer 4

Web Updated April 29, 2024.

Therefore, Payments Should Be Made In Full.

Web It's Just $50.

Select Save And Continue To Select The Groups That Will Use This Invoice Template.

Related Post: