Template For Charitable Donation Receipt

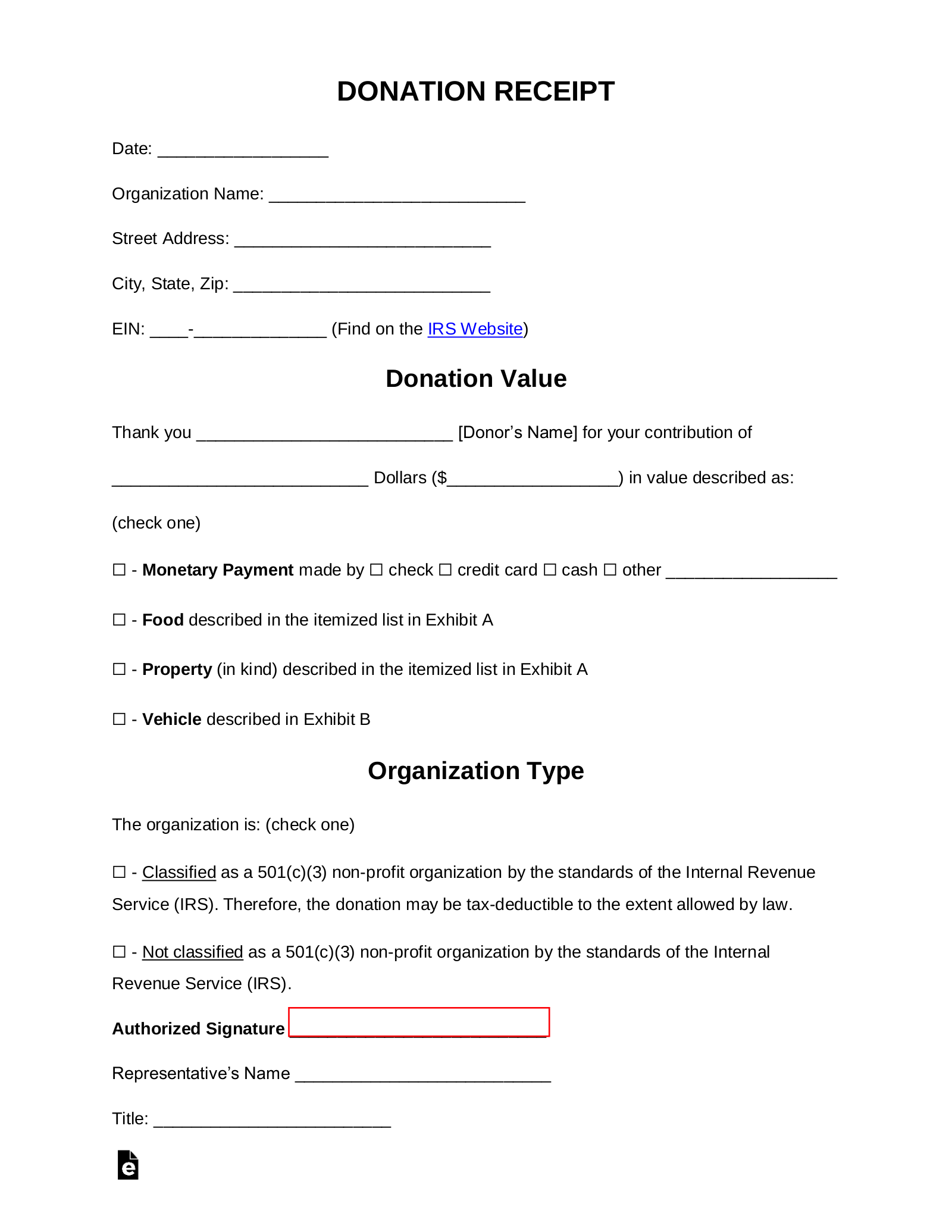

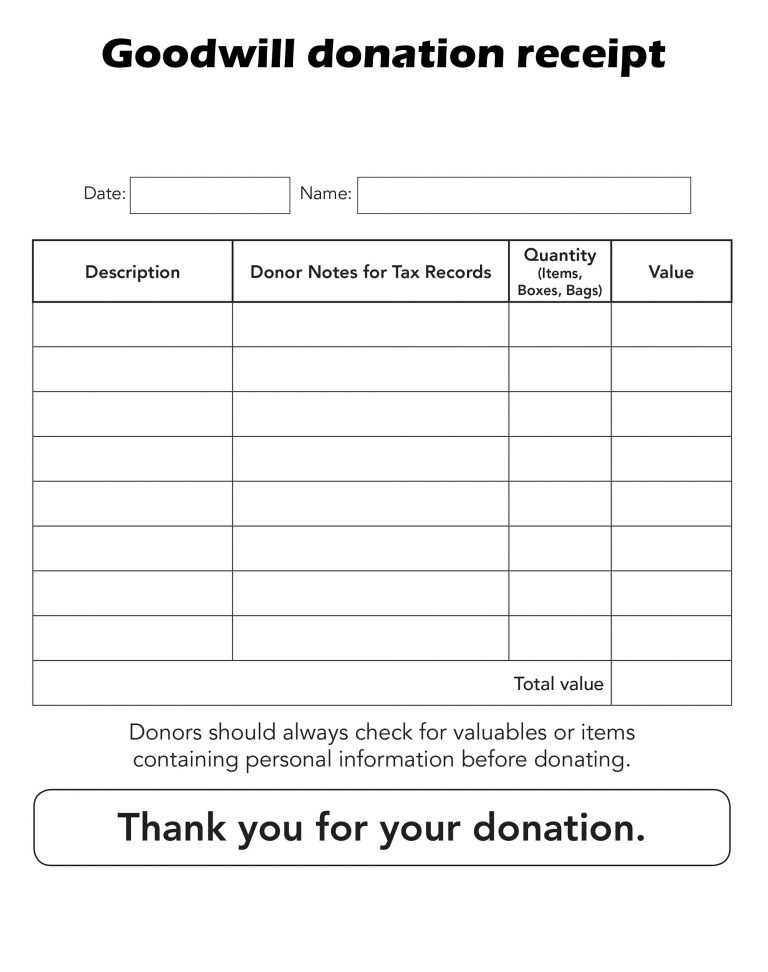

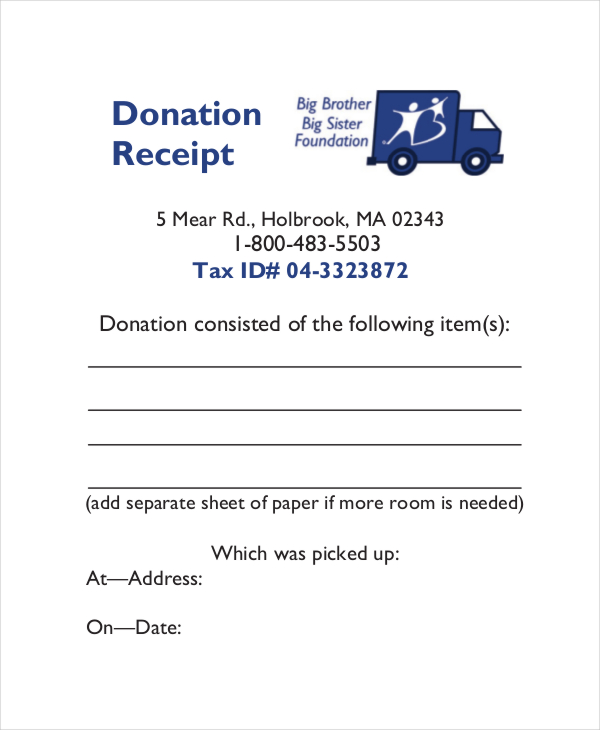

Template For Charitable Donation Receipt - Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Here’s an example of a donation receipt that our nonprofit user sent out to their donor. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Nonprofit donation receipts make donors happy and are useful for your nonprofit. Why do you need a donation receipt? In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable organization keep good internal records of gifts. Donors use them as a confirmation that their gift was received; A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web here are the main benefits of these helpful forms: They’re important for anyone who wants to itemize their charitable giving when tax season rolls. Take the stress out of acknowledgment with this guide to writing and sending the perfect donation receipt. Why do you need a donation receipt? Feel free to download, modify and use any you like. When should you send a donation receipt? Benefits of an automated donation receipt process. Use this donation receipt template for donors who have not received any merchandise in exchange for a donation. Take the stress out of acknowledgment with this guide to writing and sending the perfect donation receipt. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web official donation receipts must include the name. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: 5 types of donation receipts. Orphan charity foundation donation receipt; A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Web delight donors with this free donation receipt template. They’re important for anyone who wants to itemize their charitable giving when tax season rolls. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. It will also be helpful to give to potential donors, so they know that their donation was received and will be used for charitable purposes. By type (8). 5 types of donation receipts. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Cash donation receipt template canada. Web delight donors with this free donation receipt template. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Use our donation receipt template to automatically generate receipts. Web charitable donation receipt templates. They promote transparency and give donors a clear record of their contributions, including the date, amount, and purpose of the. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act and its regulations. Web official donation receipts must include the name and website address of the canada revenue agency (cra). By type (8) 501 (c) (3) charity donation. Web donation receipt templates. Use our donation receipt. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web charitable donation receipt templates. Web what qualifies as a charitable donation? These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Web here are the main benefits. Use formstack documents as a donation receipt generator for your organization. Samples (3) how to write a donation receipt. It’s especially important to make sure this is recorded to have proof of donation and prevent misuse. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: What to include. Feel free to download, modify and use any you like. Samples (3) how to write a donation receipt. The cash donation receipt assists in proving the authenticity of the transaction to the government should the donor wish to deduct the contribution from their. You can fill in the details for your organization and the type of charitable donation. A donation. Orphan charity foundation donation receipt; Use our donation receipt template to automatically generate receipts. By type (8) 501 (c) (3) charity donation. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. It will also be helpful to give to potential donors, so they know that their donation was received and will be used for charitable purposes. Benefits of a 501c3 donation receipt. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act and its regulations. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web official donation receipts must include the name and website address of the canada revenue agency (cra). It’s especially important to make sure this is recorded to have proof of donation and prevent misuse. Samples (3) how to write a donation receipt. A written donation receipt can be used to track your organization’s revenue and accounting purposes for the irs. Web delight donors with this free donation receipt template. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Donation receipts help organizations comply with legal and tax regulations. Why do you need a donation receipt?

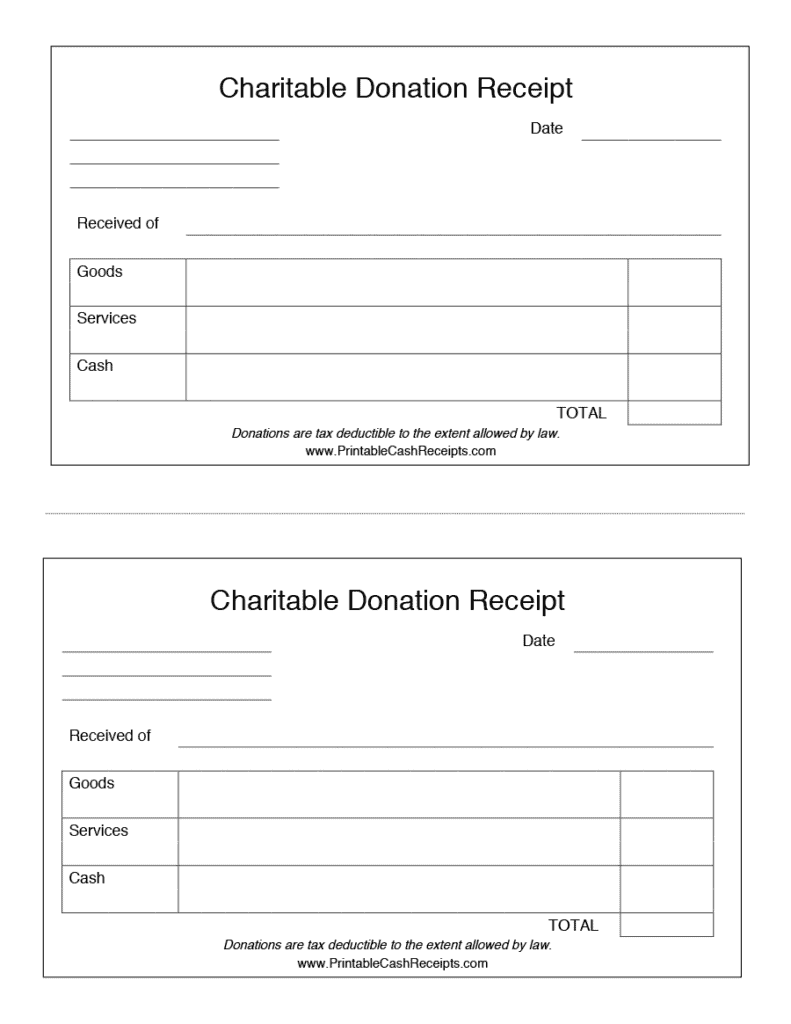

Donation Receipt Template Excel Templates

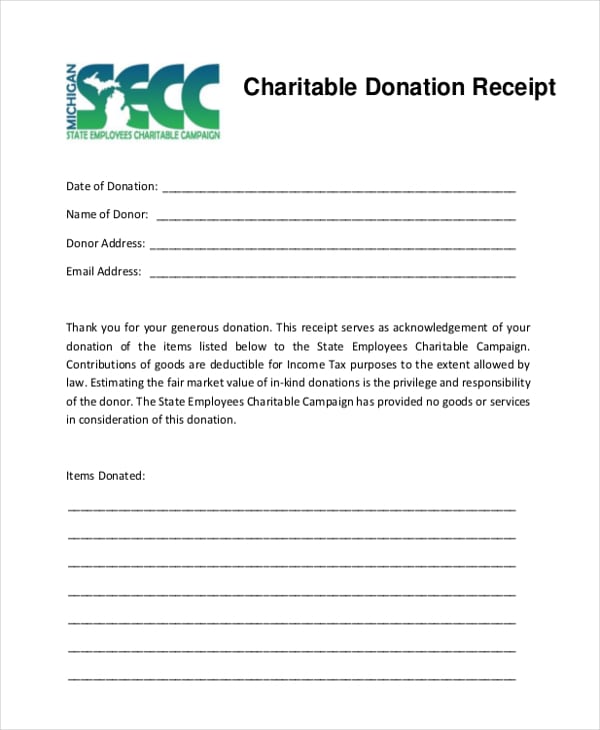

5 Charitable Donation Receipt Templates Free Sample Templates

FREE 12+ Donation Receipt Forms in PDF MS Word Excel

Free Donation Receipt Templates Samples PDF Word eForms

Free Sample Printable Donation Receipt Template Form

Donation Receipt Donation Receipt Forms , Donation Receipt Template Etsy

editable √ free tax receipt for donation templateral tax receipt for

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

6+ Free Donation Receipt Templates Word Excel Formats

Donation Receipt Template BestTemplatess BestTemplatess

Web Here Are The Main Benefits Of These Helpful Forms:

A 501 (C) (3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

Web Use A Cash Donation Receipt Template For Anyone Who’d Like To Donate In Cash.

Use This Donation Receipt Template For Donors Who Have Not Received Any Merchandise In Exchange For A Donation.

Related Post: