Tax Write Off Donation Letter Template

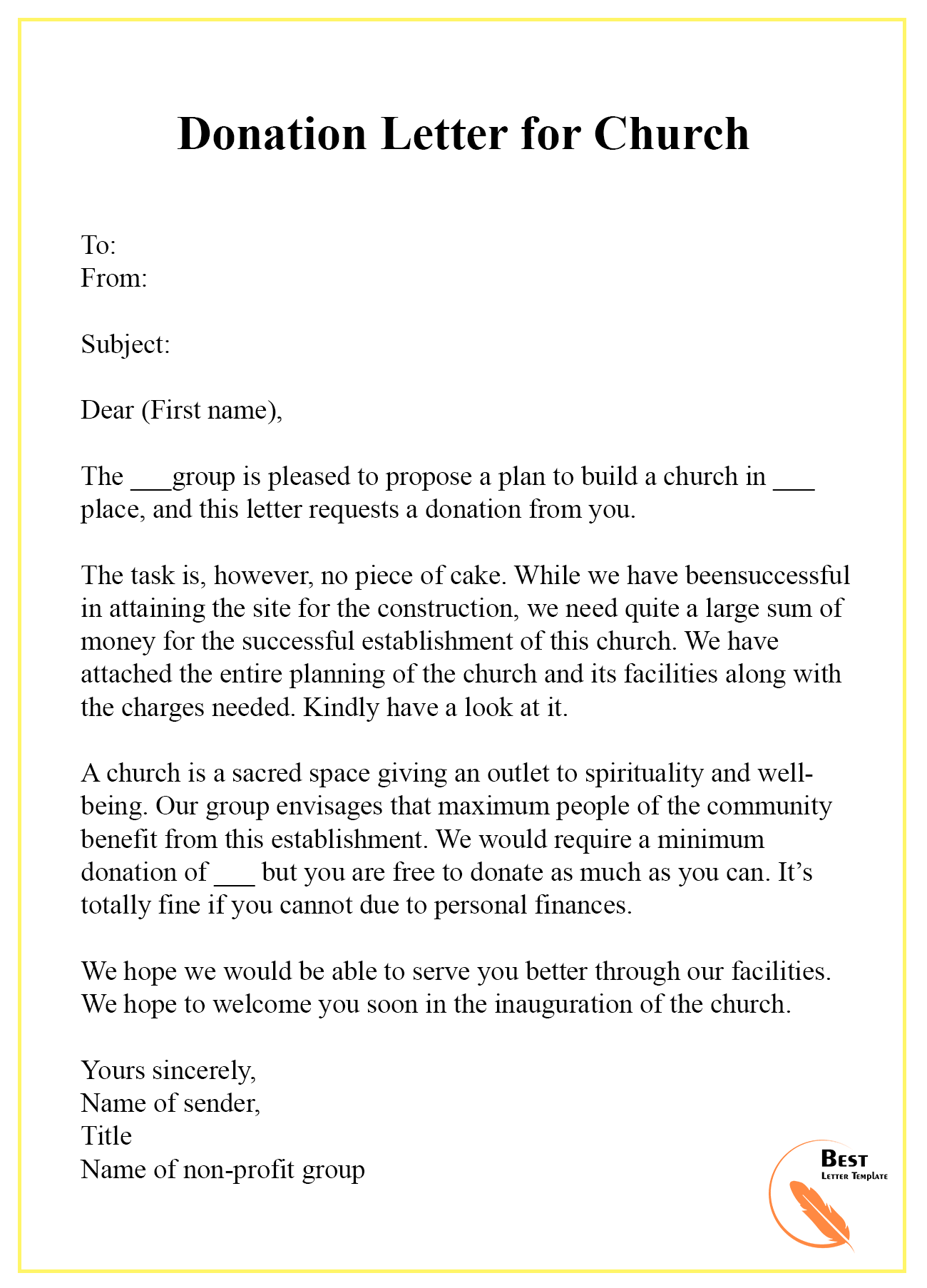

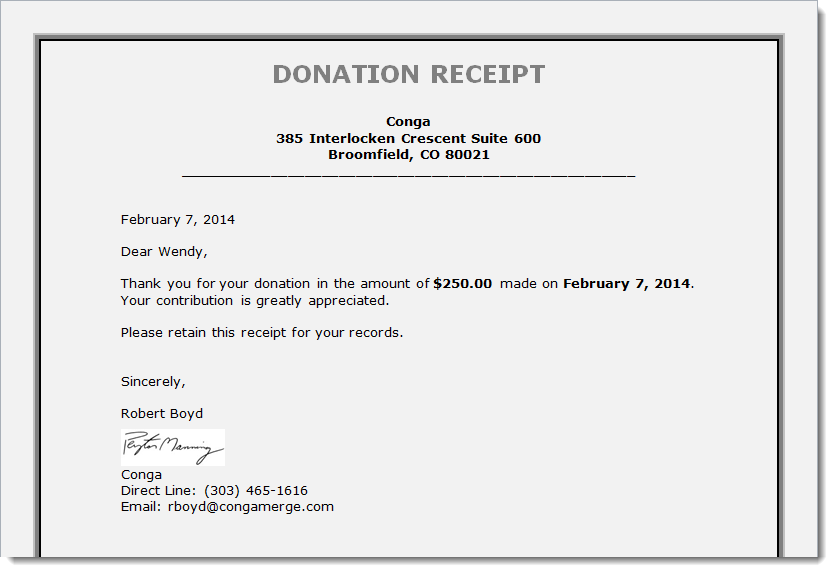

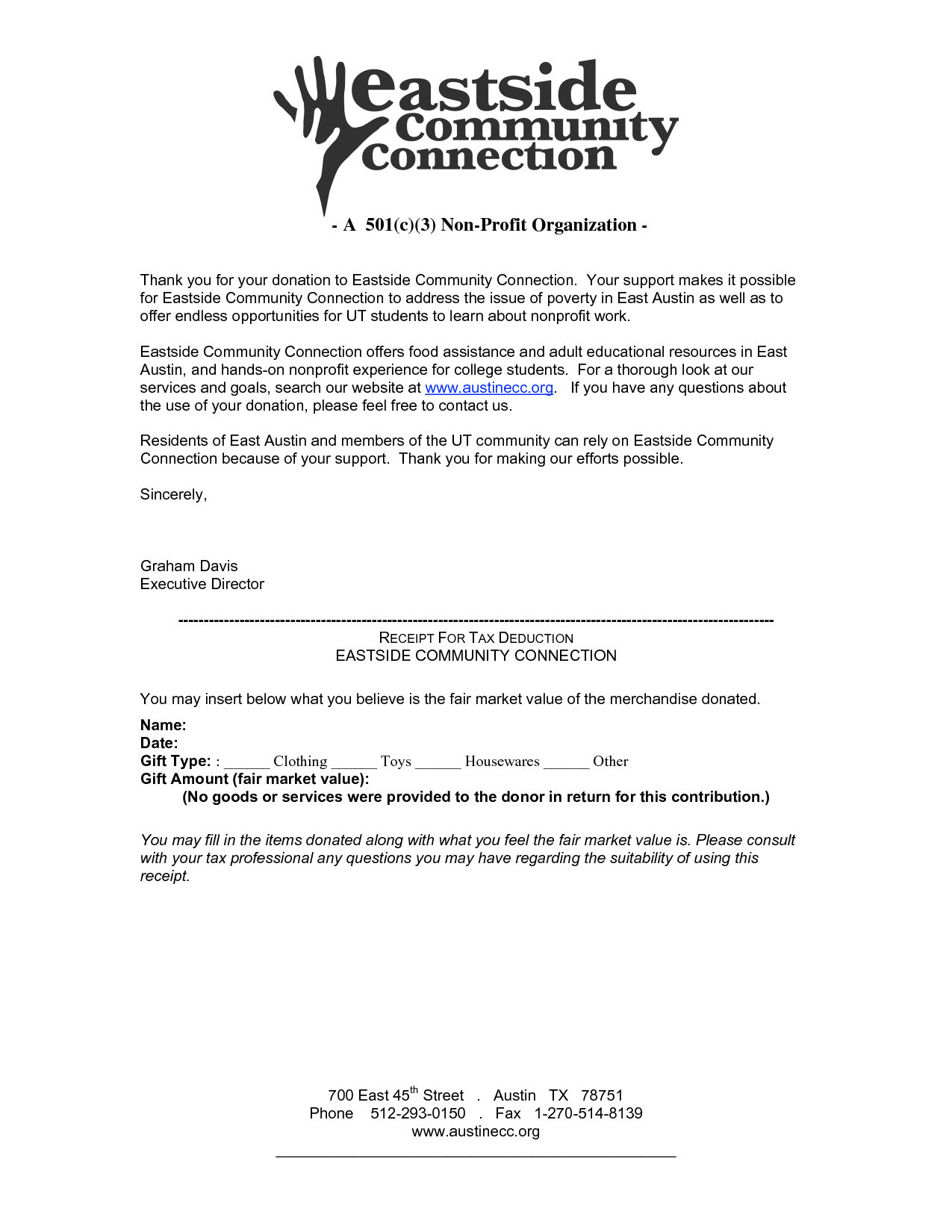

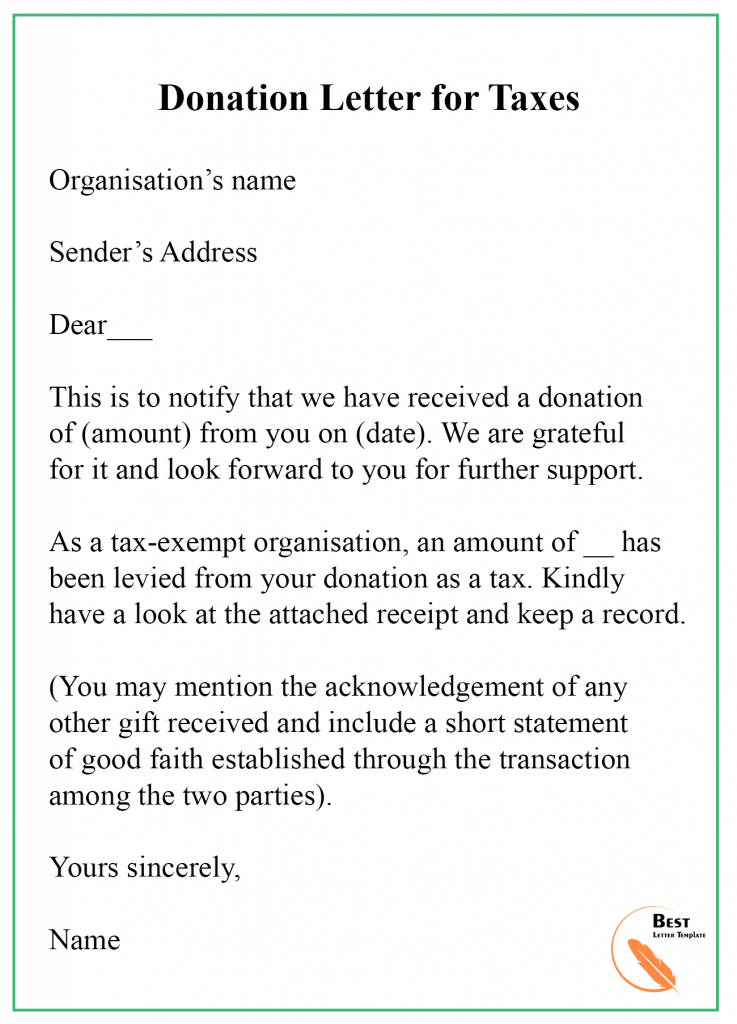

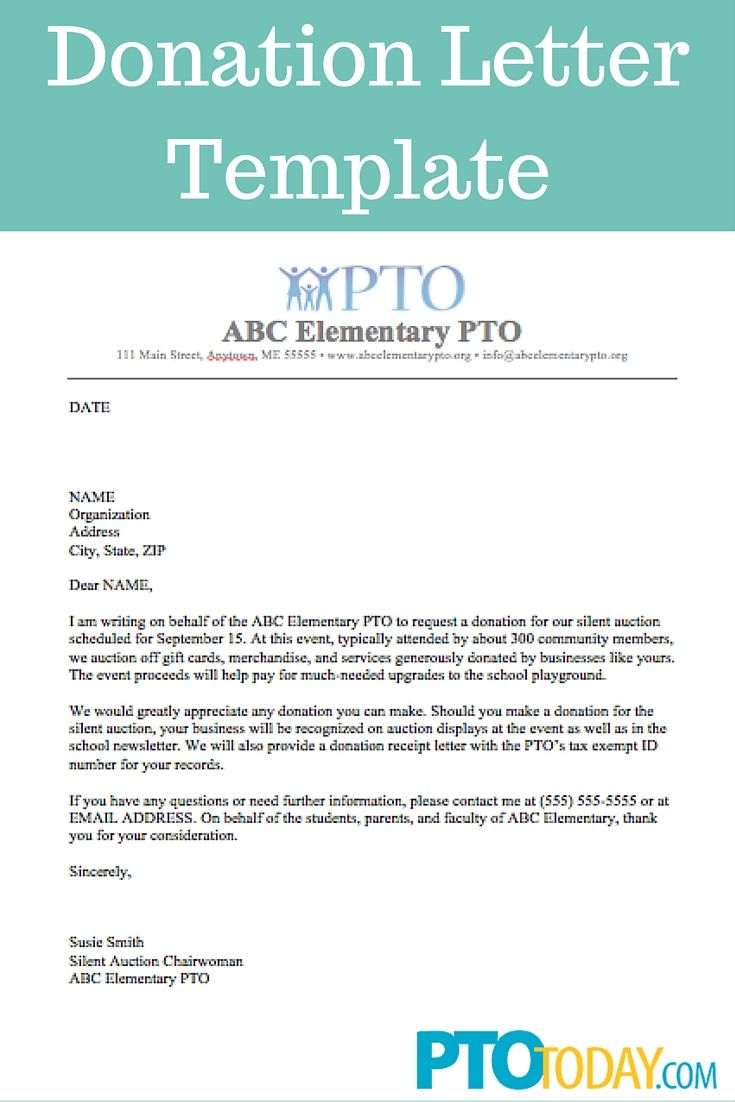

Tax Write Off Donation Letter Template - Web 501(c)(3) organization donation receipt. As always, if you have any questions or concerns, please reach out to us at [email address], call us at [phone number], or visit us at [church’s address]. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web please keep this letter for tax purposes. Web when your donor writes their letter, it should look similar to this: Web learn how to write the perfect donation letter by understanding the ins and outs of appeals, following simple best practices, and referencing these two stellar examples. Web fill out online for free. Donation receipts are important for a few reasons. Statement that no goods or services. Web what charitable donation tax forms do your donors need? Web a donor or donation acknowledgment letter is a letter nonprofits send to thank their donors for their gifts. We will populate it automatically with all the necessary donation details and organization info. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web tax deductible donation letter template. We will populate it automatically with all the necessary donation details and organization info. Benefits of an automated donation receipt process. Donors must receive these receipts by the time they file their taxes or the due. Web learn how to write the perfect donation letter by understanding the ins and outs of appeals, following simple best practices, and referencing these two stellar examples. Web when your donor writes their letter, it should look similar to this: We’ve included the following 2 samples to give you an idea of how you can personalize and include the required. Click here to download for free. Web what charitable donation tax forms do your donors need? Web updated april 24, 2024. The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Donors must receive these receipts by the time they file their taxes or the due date of their return. Benefits of a 501c3 donation receipt. Donors must receive these receipts by the time they file their taxes or the due date of their return. Web please keep this letter for tax purposes. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Web when. __________________ (find on the irs website) The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Use our free tax deductible donation letter to help you get started. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income. We’ve included the following 2 samples to give you an idea of how you can personalize and include the required tax information. Content marketing manager, neon one. Web fill out online for free. Web what charitable donation tax forms do your donors need? A donation receipt is used to claim a tax deduction for clothing and household property itemized on. As always, if you have any questions or concerns, please reach out to us at [email address], call us at [phone number], or visit us at [church’s address]. Web fill out online for free. Web 501(c)(3) organization donation receipt. Web please keep this letter for tax purposes. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers. Donation receipts are important for a few reasons. Use our free tax deductible donation letter to help you get started. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. These letters are already formatted to be used with a standard #10 envelope (or the option. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the irs to donors who have given a. Web please keep this letter for tax purposes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web what charitable donation tax forms do. Benefits of a 501c3 donation receipt. Use our free tax deductible donation letter to help you get started. We’ve included the following 2 samples to give you an idea of how you can personalize and include the required tax information. Click here to download for free. Without registration or credit card. Web please keep this letter for tax purposes. Each donation type requires different information. Web fill out online for free. You will be able to write off your donation at the end of the year. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It allows you to create and customize the draft of your receipt contents. Web when your donor writes their letter, it should look similar to this: The donor will use this letter as proof of his or her donation to claim a tax deduction. Web tax deductible donation letter template. The acknowledgment to the donor should include the following: Shared by davidmjuarez in letter.

Donor Request Letter Template For Your Needs

Tax Donation Letter Template

Donation Receipt Letter levelings

Tax Write Off Donation Letter Template Samples Letter Template Collection

Request for Donations Letter Beautiful Sample Letters asking for

Tax Write Off Donation Letter Template Samples Letter Template Collection

Donation Acknowledgement Letter Template Word

Tax Write Off Donation Letter Template Examples Letter Templates

Tax Write Off Donation Letter Template Samples Letter Template Collection

Printable to The Team Letter Archives Template DIY

We Will Populate It Automatically With All The Necessary Donation Details And Organization Info.

Web From There, Here Are Eight Short And Easy Steps To Print And Mail Out Your Tax Summaries.

At The End Of The Year, We’ll Also Send You An Annual Recap With How Much You’ve Given To The Church.

__________________ (Find On The Irs Website)

Related Post: