Tax Donation Receipt Template

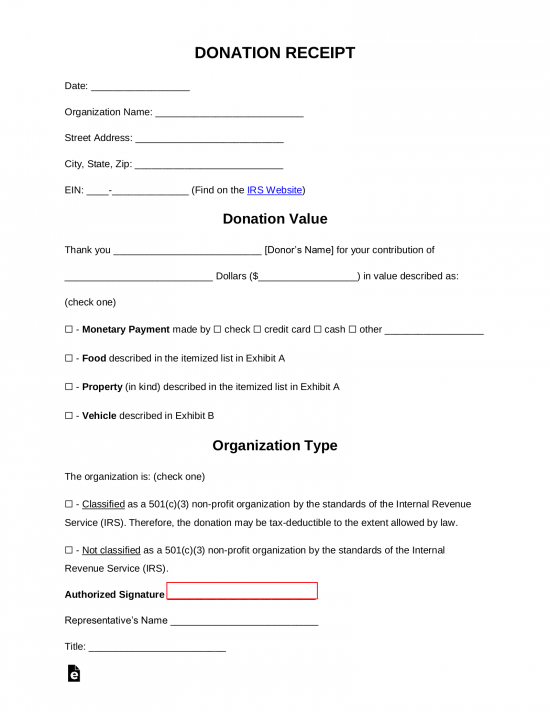

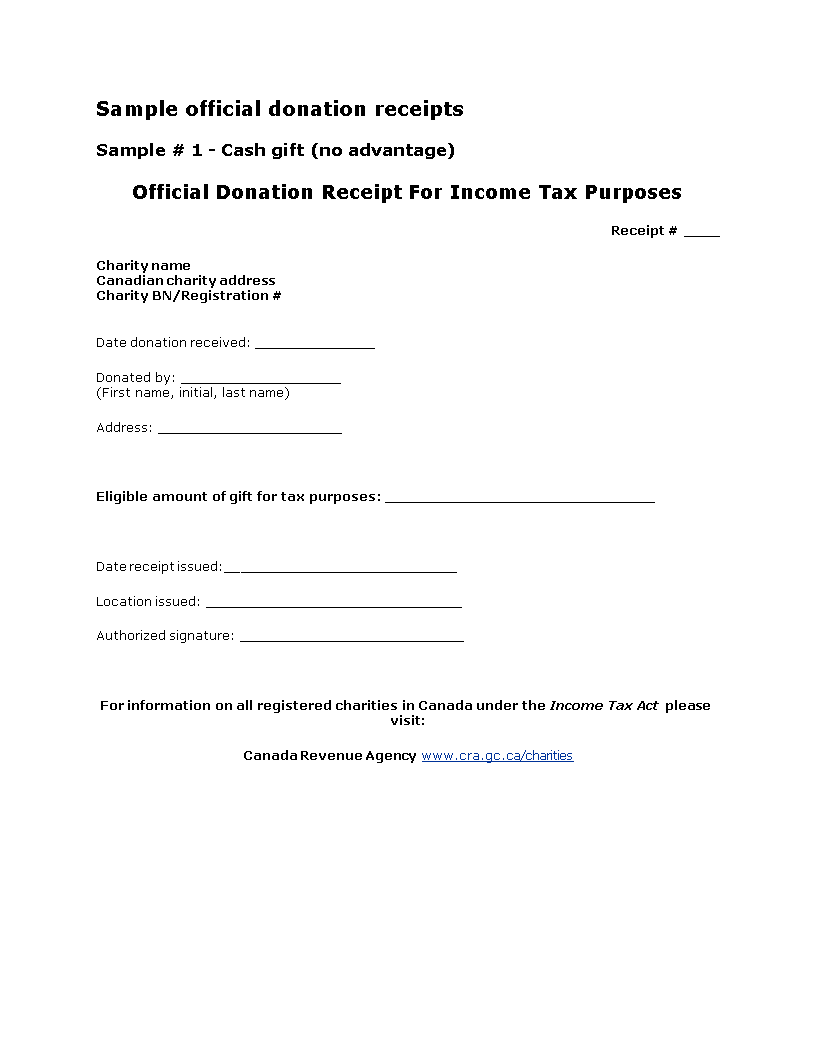

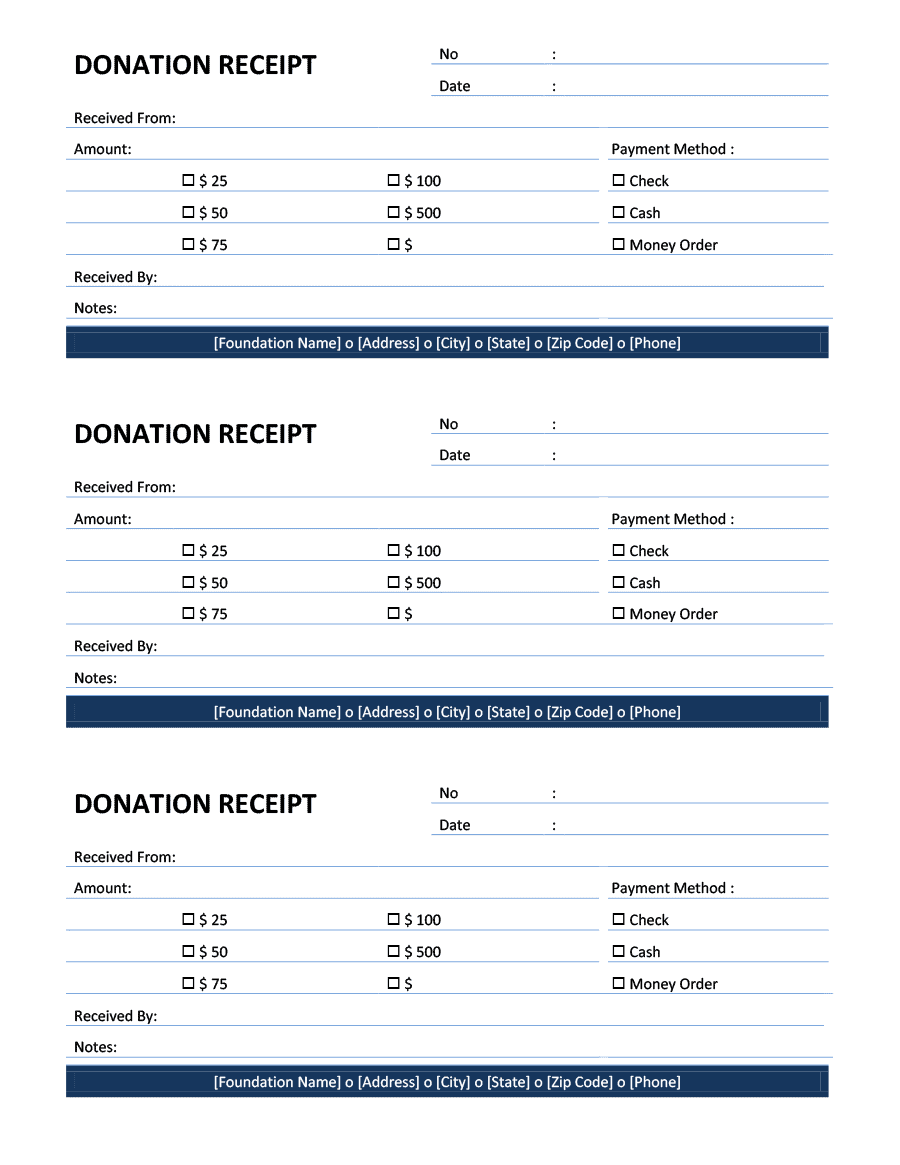

Tax Donation Receipt Template - Feel free to download, modify and use any you like. Use this donation receipt template for donors who have not received any merchandise in exchange for a donation. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Content marketing manager, neon one. This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! The date of the donation. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Use our receipt maker to create the perfect template for your charity. Here’s an example of a donation receipt that our nonprofit user sent out to their donor. Date * location * description & quantity * add. Web one of the ways your nonprofit can ensure that you’re staying compliant is by issuing donation receipts and acknowledgement letters to your donors. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Feel free to download, modify and use any you like. Statement that no goods or services. Content marketing manager, neon one. This can include cash donations, personal property, or a vehicle. Web cash donation receipt template. It acknowledges that a gift was made to you, and that the receipt contains the information required under the income tax regulations. If a donor receives goods or services in exchange for a donation over $75 ( calculate your donation. Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more. 5) * email * phone * download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. For more templates, refer to our main receipt. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Date * location * description & quantity * add. It acknowledges that a gift was made to you, and that the receipt contains the information required under the income tax regulations. Create your first invoice. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Anna blazhuk / moment via getty images. Web one of the ways your nonprofit can ensure that you’re staying compliant is by issuing donation receipts and acknowledgement letters to your donors. The date of the donation. Web updated november 14, 2023. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. 5 types of donation receipts. Use our receipt maker to create the perfect template for your charity. Goods or services were. Part of running most successful nonprofit organizations includes fundraising and handling donations. Here’s an example of a donation receipt that our nonprofit user sent out to their donor. If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. * indicates required fields. Primarily, the receipt is used by organizations. Date * location * description & quantity * add. Web updated december 18, 2023. Goods or services were not provided in exchange for the donation. It acknowledges that a gift was made to you, and that the receipt contains the information required under the income tax regulations. Statement that no goods or services were provided by the organization, if. Create your first invoice free with our online invoice generator. Web a statement that identifies the form as an official donation receipt for income tax purposes. Here’s our collection of donation receipt templates. Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more. Date * location * description. 5 types of donation receipts. 5) * email * phone * download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501 (c) (3) of the internal revenue code. Anna blazhuk / moment via getty images. If a donor receives goods or services in exchange for a donation over $75 ( calculate your donation. Web nonprofits must send a receipt for any single donation of $250 or more. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Here’s our collection of donation receipt templates. If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. If a donor specifically requests for a donation receipt. Web updated may 27, 2021. Donation receipts are important for a few reasons. Use this donation receipt template for donors who have not received any merchandise in exchange for a donation. Date * location * description & quantity * add. Use a cash donation receipt template for anyone who’d like to donate in cash. Web updated december 18, 2023. Part of running most successful nonprofit organizations includes fundraising and handling donations. The irs requires a donation receipt in the following cases: This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! A donation tax receipt is essential for your organization and donors, and they ensure you’re maintaining good relationships with your donors. Web these are examples of tax donation receipts that a 501c3 organization should provide to its donors.

Free Donation Receipt Templates Samples PDF Word eForms

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Tax Donation receipt Templates at

FREE 7+ Tax Receipts for Donation in MS Word PDF

6+ Free Donation Receipt Templates

FREE 12+ Donation Receipt Forms in PDF MS Word Excel

Tax Deductible Donation Form Template HQ Printable Documents

Getting Started With Tax Donation Receipt Templates Free Sample

FREE 9+ Donation Receipt Templates in Google Docs Google Sheets

FREE 7+ Tax Receipts for Donation in MS Word PDF

Web Updated November 14, 2023.

Web When Creating Your Donation Receipt Template, Be Sure To Abide By Irs Requirements By Including The Following Information:

If A Donor Receives Goods Or Services In Exchange For A Donation Over $75 ( Calculate Your Donation Receipt Value For Such Transactions Here)

Feel Free To Download, Modify And Use Any You Like.

Related Post: