Substantial Presence Test For The Calendar Year

Substantial Presence Test For The Calendar Year - Using the substantial presence test, we calculate her days as follows: Web irs substantial presence test. Web to meet the substantial presence test, you must be physically present in the united states on at least: The individual must use the following calculation to satisfy the substantial. In the current calendar year? Under the internal revenue code, even. Web the individual must be present in the u.s. What is the green card test?. 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30. Web the person must be physically present in the united states on at least: Web the person must be physically present in the united states on at least: 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30. Web if you meet the substantial presence test for a calendar year, your residency starting date is generally the first day you are present in the united. Web the person must be physically present in the united states on at least: Web the substantial presence test is a criterion set by the united states internal revenue service (irs) to determine an individual’s tax residency status in the u.s. Web generally, the substantial presence test counts any day that you are physically present in the united states during. Web you meet the substantial presence test (which is a numerical formula which measures days of presence in the united states). Web irs substantial presence test. The substantial presence test for the. Web generally, the substantial presence test counts any day that you are physically present in the united states during the calendar year, no matter the time of day.. Web the person must be physically present in the united states on at least: To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and 20 days in 2021 (1/6 of 120). Web the individual must be present in the u.s. Citizen, and. You qualify as a resident alien of the united states for tax purposes if you meet either of these: On 120 days in each of the years 2021, 2022 and 2023. 31 days during the current tax year you are asking about, and 183. Citizen, and you were physically present in the. What is the green card test?. Using the substantial presence test, we calculate her days as follows: You can work out your tax residency status with our. How many days did you spend in the u.s. The individual must use the following calculation to satisfy the substantial. How many days will you spend in the u.s. If you are not a u.s. Under the internal revenue code, even. 31 days during the current calendar year, and a minimum of 183 days during the applicable three year. You can work out your tax residency status with our. 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30. You qualify as a resident alien of the united states for tax purposes if you meet either of these: Web generally, the substantial presence test counts any day that you are physically present in the united states during the calendar year, no matter the time of day. You can work out your tax residency status with our. 120 days (current. Web to meet the substantial presence test, you must be physically present in the united states on at least: You can work out your tax residency status with our. How many days will you spend in the u.s. Web you meet the substantial presence test (which is a numerical formula which measures days of presence in the united states). To. You were physically present in the u.s. Web the individual must be present in the u.s. How many days will you spend in the u.s. If you are not a u.s. 31 days during the current tax year you are asking about, and 183. 31 days during the current calendar year, and a minimum of 183 days during the applicable three year. How many days will you spend in the u.s. Web if you meet the substantial presence test for a calendar year, your residency starting date is generally the first day you are present in the united states during that calendar year. Using the substantial presence test, we calculate her days as follows: Web to meet the substantial presence test, you must be physically present in the united states on at least: Web an individual must meet one of the following tests to be considered a resident alien for tax purposes: Web the substantial presence test looks at the number of days that an individual has spent in the u.s. For at least 31 days during the current calendar year. You qualify as a resident alien of the united states for tax purposes if you meet either of these: You can work out your tax residency status with our. What is the green card test?. You were physically present in the u.s. Web generally, the substantial presence test counts any day that you are physically present in the united states during the calendar year, no matter the time of day. Web the individual must be present in the u.s. Under the internal revenue code, even. In the tax year in which the.

Substantial Presence Test Finance and Treasury

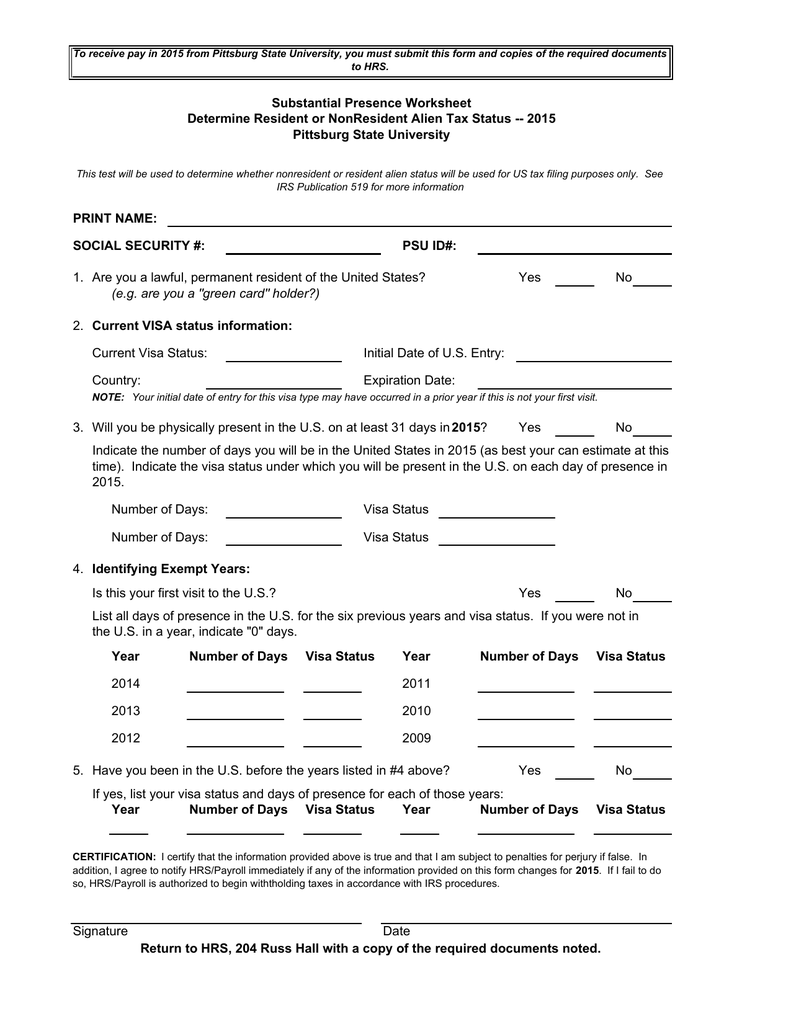

Substantial Presence Worksheet

Substantial Presence Test Finance and Treasury

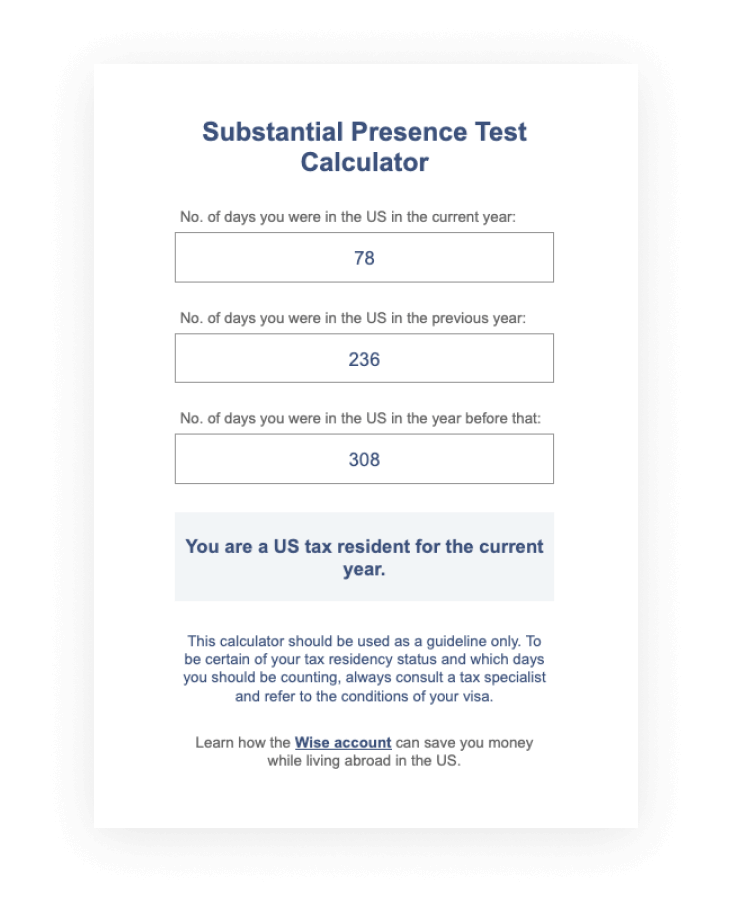

Substantial Presence Test Calculator Wise

Easy Substantial presence test calculator

Substantial Presence Test for U.S. Tax Purposes What Are the Basics

The Substantial Presence Test

Easy Substantial presence test calculator

How to use substantial presence test calculator YouTube

Substantial Presence Test How to Calculate YouTube

Web Irs Substantial Presence Test.

If You Are Not A U.s.

How Many Days Did You Spend In The U.s.

In The Current Calendar Year?

Related Post: