Sifma Settlement Calendar

Sifma Settlement Calendar - With t+1 set for may 28,. Previous dates may be found in the file linked below the table. • the assignor may only assign sell. Web subsequently, canada and mexico announced their transition to t+1 settlement to occur on may 27, 2024. ¬g¬ak›ž â¿÷¬\b b hôeíöžïrú~ë?.ë*y@@ãl&®ó®hàæn ;íäçøµs. Web mbs notification settlement dates (updated for 2025) cpr claims prices. Web mbsd’s combined tba trade, do not allocate, and pool netting services reduce customers’ overall settlement obligations in two ways: See pool settlement dates on the : At any given time, sifma publishes notification day/settlement day calendar for each. Web sifma, ici and dtcc formally initiated the effort to accelerate the settlement cycle to t+1 following a february 2021 dtcc whitepaper outlining the benefits that such. Web pk !&€ ˆ [content_types].xml ¢ ( ìu[oâ0 ~7ñ?,}5¬ˆæ ãðá룒€? ¬g¬ak›ž â¿÷¬\b b hôeíöžïrú~ë?.ë*y@@ãl&®ó®hàæn ;íäçøµs. With t+1 set for may 28,. Web pk !õv õ} [content_types].xml ¢ ( äténâ0 ½wê?d¾väࡪ* ‡.ç ú & ‹ä¶.¿ïä,ª* e õ’(±çmöì`´®«d ³™è¥]‘€í 6¶èä×ô½ó. Web lender submissions must align to the eligible settlement dates as published on the applicable pool settlement calendar for the issue month. Previous dates may be found in the file linked below the table. Web lender submissions must align to the eligible settlement dates as published on the applicable pool settlement calendar for the issue month of the submission. First, mbsd nets eligible tba trades to. • the assignor may only assign sell. The schedule is currently called “mbs. • the assignor may only assign sell. With t+1 set for may 28,. Web pk !õv õ} [content_types].xml ¢ ( äténâ0 ½wê?d¾väࡪ* ‡.ç ú & ‹ä¶.¿ïä,ª* e õ’(±çmöì`´®«d ³™è¥]‘€í 6¶èä×ô½ó. Web for each tba class, sifma sets one notification day/settlement day pair for each month. O the last day to transmit for given issue. Securities settlement cycle to t+1, collaborating with the industry on next steps. At any given time, sifma publishes notification day/settlement day calendar for each. See pool settlement dates on the : Web subsequently, canada and mexico announced their transition to t+1 settlement to occur on may 27, 2024. Web sifma, ici and dtcc formally initiated the effort to accelerate the. Previous dates may be found in the file linked below the table. With t+1 set for may 28,. Sifma, ici and dtcc leading effort to shorten u.s. Web lender submissions must align to the eligible settlement dates as published on the applicable pool settlement calendar for the issue month of the submission. Web mbs notification settlement dates (updated for 2025). With t+1 set for may 28,. This topic provides information concerning buying an mbs from or selling the mbs to the sales desk,. Web subsequently, canada and mexico announced their transition to t+1 settlement to occur on may 27, 2024. At any given time, sifma publishes notification day/settlement day calendar for each. First, mbsd nets eligible tba trades to. ¬g¬ak›ž â¿÷¬\b b hôeíöžïrú~ë?.ë*y@@ãl&®ó®hàæn ;íäçøµs. Web mbs notification settlement dates (updated for 2025) cpr claims prices. Web lender submissions must align to the eligible settlement dates as published on the applicable pool settlement calendar for the issue month of the submission. Web subsequently, canada and mexico announced their transition to t+1 settlement to occur on may 27, 2024. Web for. See pool settlement dates on the : Web sifma, ici and dtcc formally initiated the effort to accelerate the settlement cycle to t+1 following a february 2021 dtcc whitepaper outlining the benefits that such. Web pool settlement calendars, visit the additional resources section on the loan deliverypage. Web mbs notification settlement dates (updated for 2025) cpr claims prices. The sifma. Previous dates may be found in the file linked below the table. • the assignor may only assign sell. First, mbsd nets eligible tba trades to. O the last day to transmit for given issue. Web mbs notification settlement dates (updated for 2025) cpr claims prices. Web lender submissions must align to the eligible settlement dates as published on the applicable pool settlement calendar for the issue month of the submission. First, mbsd nets eligible tba trades to. Challenges & opportunities of the accelerated settlement cycle and future proofing for t+0. Web sifma, ici and dtcc formally initiated the effort to accelerate the settlement cycle to. Web mbsd’s combined tba trade, do not allocate, and pool netting services reduce customers’ overall settlement obligations in two ways: Web sifma, ici and dtcc formally initiated the effort to accelerate the settlement cycle to t+1 following a february 2021 dtcc whitepaper outlining the benefits that such. Web pool settlement calendars, visit the additional resources section on the loan deliverypage. The schedule is currently called “mbs. The sifma maintains a settlement schedule that shows the settlement dates for each class of security. At any given time, sifma publishes notification day/settlement day calendar for each. Web mbs notification settlement dates (updated for 2025) cpr claims prices. Securities settlement cycle to t+1, collaborating with the industry on next steps. First, mbsd nets eligible tba trades to. O the last day to transmit for given issue. Web this calendar, also known as the settlement date calendar, is based on settlement date information released by the securities industry and financial markets association. Challenges & opportunities of the accelerated settlement cycle and future proofing for t+0. Web when a trade is settled on a “regular” settlement date, it will occur on a date that is predetermined by sifma, based on a schedule that changes periodically. Web subsequently, canada and mexico announced their transition to t+1 settlement to occur on may 27, 2024. Sifma, ici and dtcc leading effort to shorten u.s. This topic provides information concerning buying an mbs from or selling the mbs to the sales desk,.

FAQ subpage Settlement calendar Livex

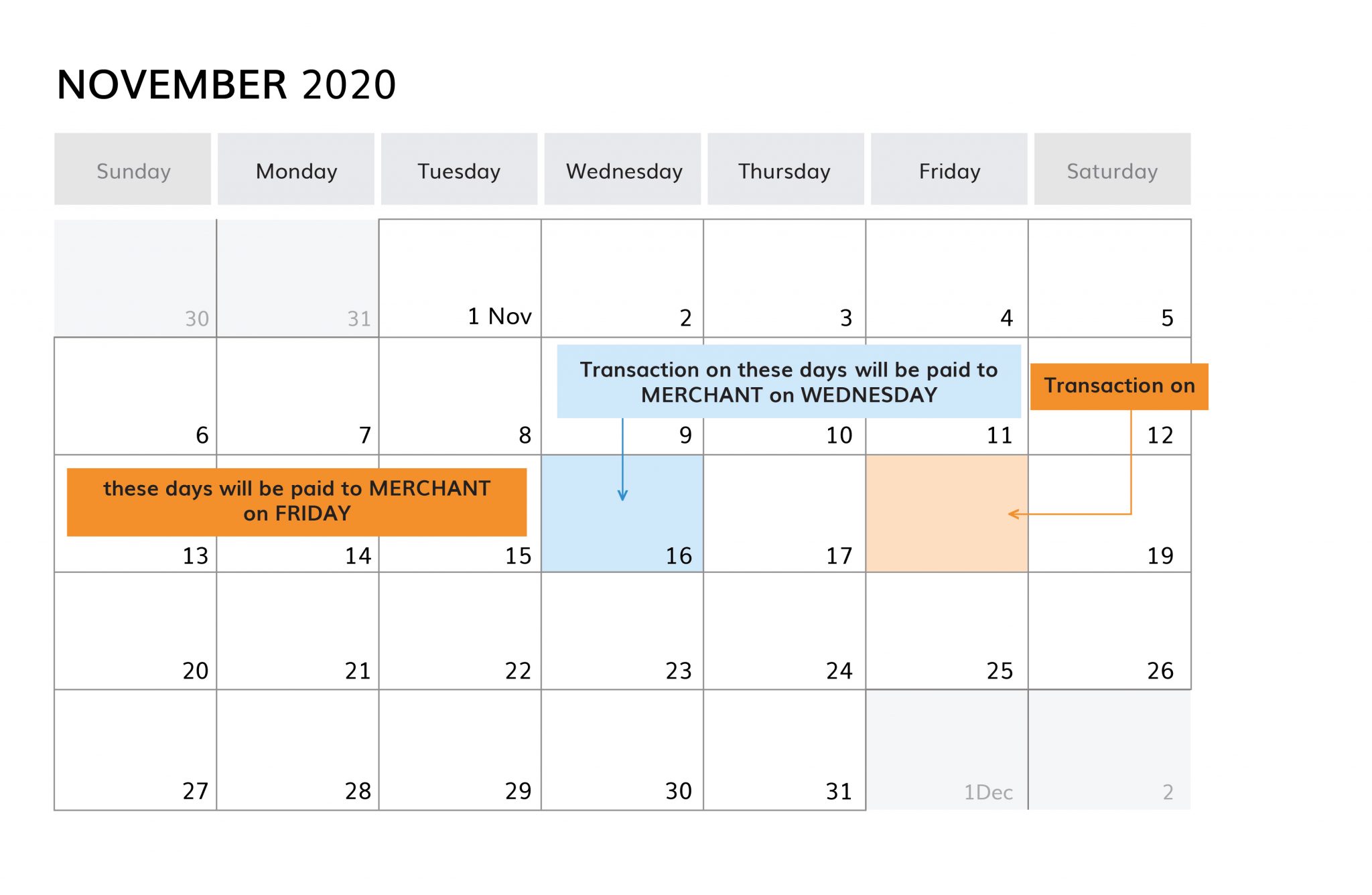

Settlement Schedule senangGuide

Shortening the Settlement Cycle SIFMA SIFMA

SIFMA, ICI and DTCC Lay Out Path to Shorten U.S. Securities Settlement

A Shorter Settlement Cycle T+1 Will Benefit Investors and Market

Ten Years Later What's Changed? SIFMA Ten Years Later What’s

A Shorter Settlement Cycle One Step at A Time SIFMA A Shorter

Settlement Calendar Jan 2022 Calendar Example And Ideas

Resolution Planning for Large International Banks Considerations for

SEC Rulemaking Agenda SIFMA SIFMA

Web Pk !Õv Õ} [Content_Types].Xml ¢ ( Äténâ0 ½Wê?D¾Väࡪ* ‡.Ç Ú & ‹Ä¶.¿Ïä,ª* E Õ’(±Çmöì`´®«D ³™È¥]‘€Í 6¶Èä×Ô½Ó.

Further Information On The Sec’s Final Rule Can Be Found Here.

• The Assignor May Only Assign Sell.

Web Apr 28, 2021 • Press Releases.

Related Post: