Printable Form 940

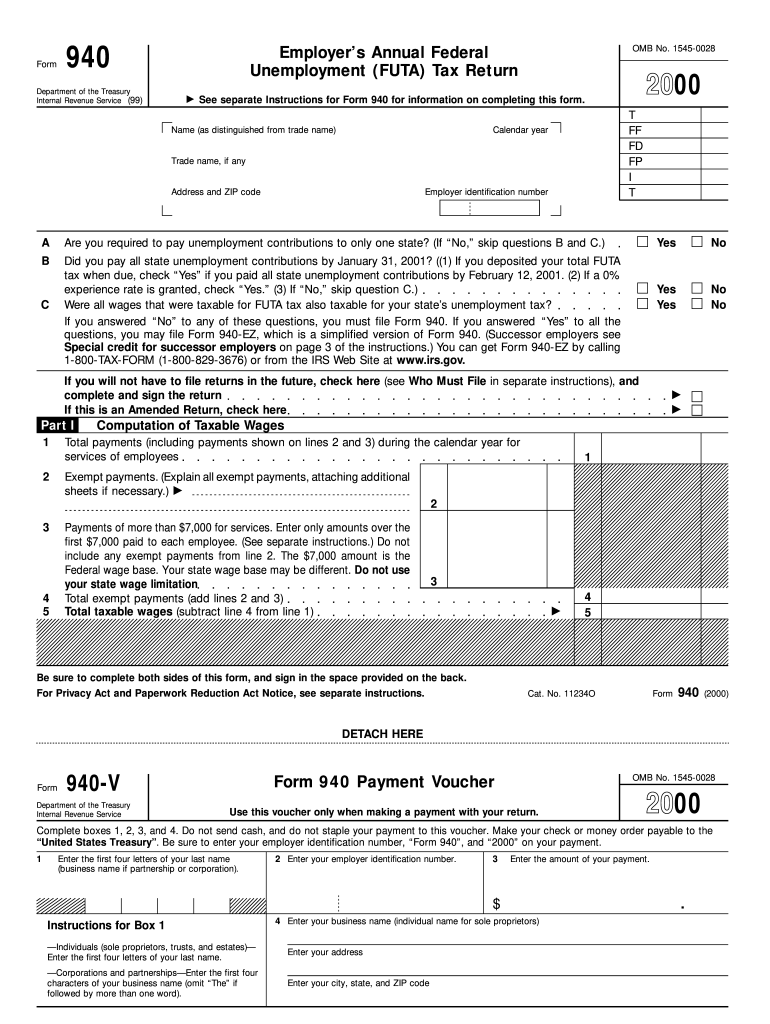

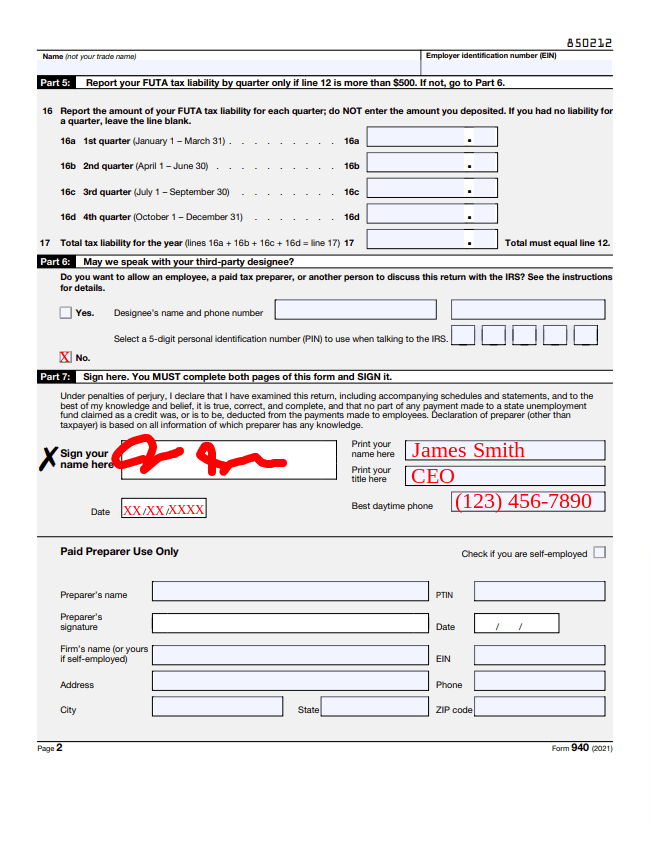

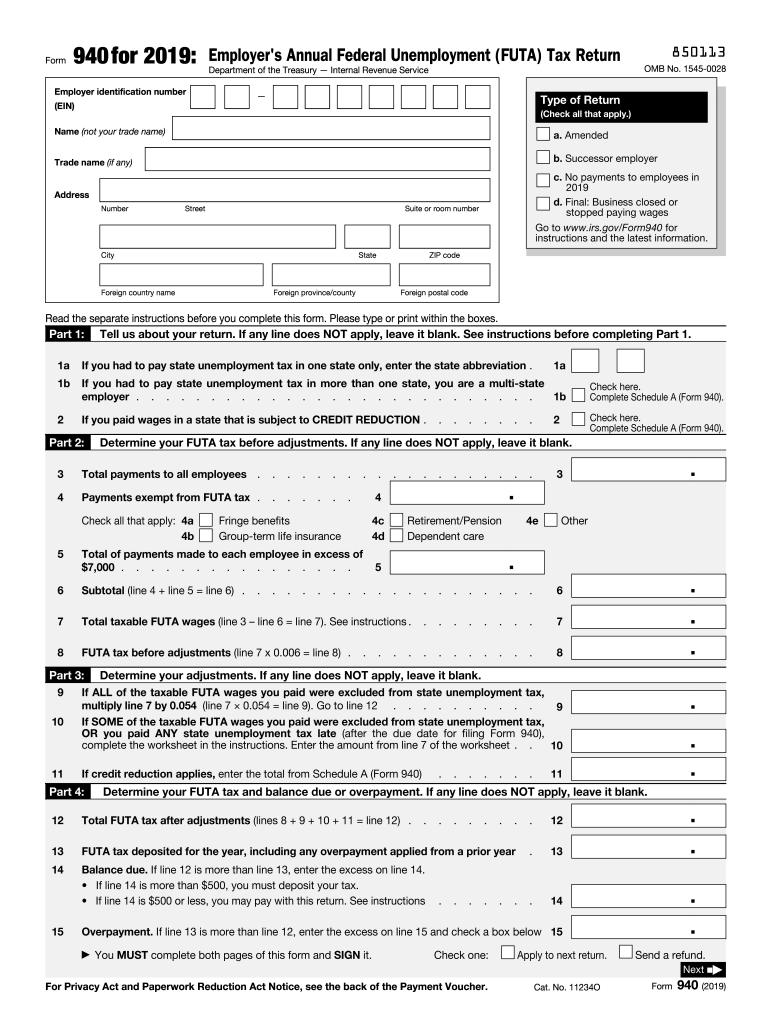

Printable Form 940 - February 04, 2020 06:38 pm. Unlike other federal payroll taxes — such as medicare and social security — futa taxes are only paid by the employer and not deducted from employees’ wages. More about the federal form 940 other tax credit ty 2023. Form 941, employer's quarterly federal tax return. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Don’t want to fill out form 940 yourself? Futa taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. Any business owner with one or more employees will need to complete this form. Web small businesses with employees are required by the irs to file form 940. You paid wages of at least $1,500 to any employee during the standard calendar year. Futa tax is the federal payroll tax business owners pay to finance the federal unemployment benefits program. Don’t want to fill out form 940 yourself? For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. While you can fill out the form by hand, the pdf form has editable. While you can fill out the form by hand, the pdf form has editable fields you can fill. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Employer identification number (ein) — name (not your trade name) trade name (if any) address. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. This. Don’t want to fill out form 940 yourself? Employer's annual federal unemployment (futa) tax return. This money is then pooled to use to help support unemployed people at a federal level. Web irs form 940 is an essential document for us employers, specifically for reporting annual federal unemployment tax act (futa) taxes. Futa taxes are used to fund unemployment benefits. Quickbooks online doesn't allow us to print the 940 tax form if we have pending dues for that certain tax. Futa taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web form 940 is. Virgin islands, have the option to file new form 940 (sp) for tax year 2023. Don’t want to fill out form 940 yourself? You paid wages of at least $1,500 to any employee during the standard calendar year. Web form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax. And now, here’s how to fill out futa tax forms. Web irs form 940 is an annual tax form used by employers to report their federal unemployment taxes. Futa taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. Web irs form 940 is used to report. This form is distinct from other tax forms because it focuses solely on unemployment taxes. Department of the treasury — internal revenue service. Any business owner with one or more employees will need to complete this form. We last updated the employer's annual federal unemployment (futa) tax return in january 2024, so this is the latest version of form 940,. Web use form 940 to report your annual federal unemployment tax act (futa) tax. February 04, 2020 06:38 pm. This money is then pooled to use to help support unemployed people at a federal level. You paid wages of at least $1,500 to any employee during the standard calendar year. Form 941, employer's quarterly federal tax return. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. An employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Web in short, form 940 is the form employers fill out to. Try patriot’s full service payroll! Web irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web irs form 940 is the employer’s annual federal unemployment tax return, filed separately from the form 941 employer’s quarterly tax returns. An employer's annual. Web to complete and file form 940, download the current pdf version of the form from the irs website. Web form 940 (2021) employer's annual federal unemployment (futa) tax return. Don’t want to fill out form 940 yourself? Web form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Virgin islands, have the option to file new form 940 (sp) for tax year 2023. I'm here to help you with printing your 940 tax form, rhondanwcc. You must file a 940 tax form if either of the following is true: While you can fill out the form by hand, the pdf form has editable fields you can fill. This application is used to report the number of wages paid to employees throughout the year, the amount of federal unemployment taxes withheld from their wages, and the amount of taxes paid to the government. An employer's annual federal unemployment tax return, the irs’ form 940, is an annual form filed with the irs by businesses with one or more employees. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Web use form 940 to report your annual federal unemployment tax act (futa) tax. This form is distinct from other tax forms because it focuses solely on unemployment taxes. Web irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web form 940, employer’s annual federal unemployment (futa) tax return, is a form employers file with the irs to report their yearly futa tax liability. Understand how to complete this tax form, when it is due, and how to avoid penalties.

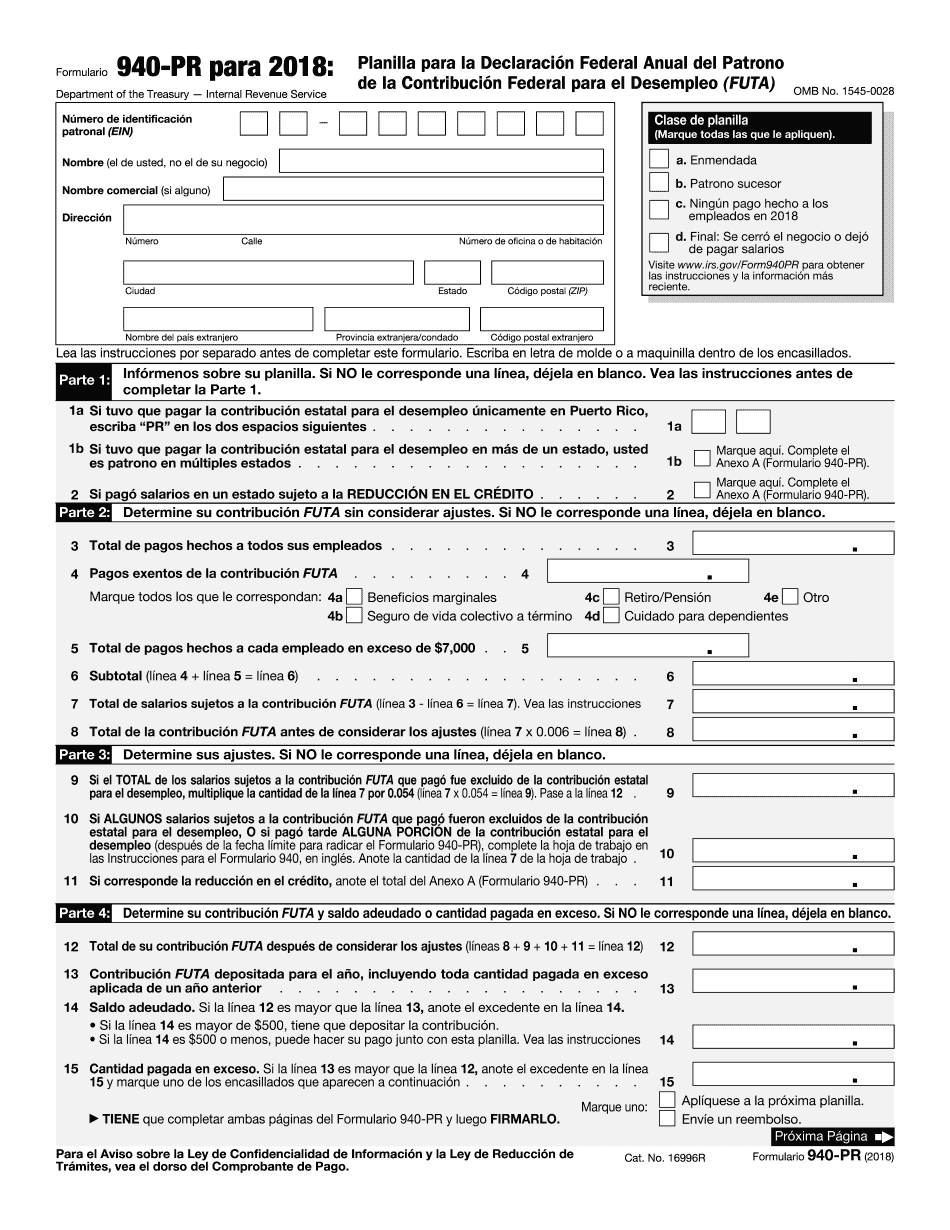

IRS Form 940 PR 2018 2019 Fill Out And Edit Online Printable Form 2021

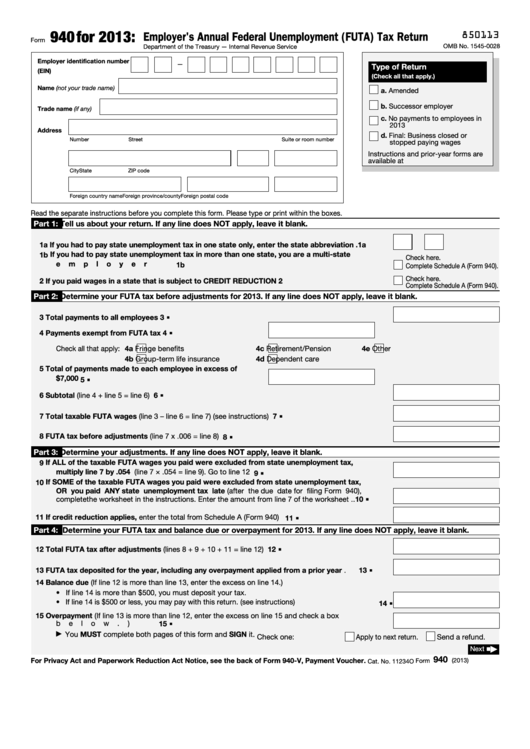

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)

What Is IRS Form 940?

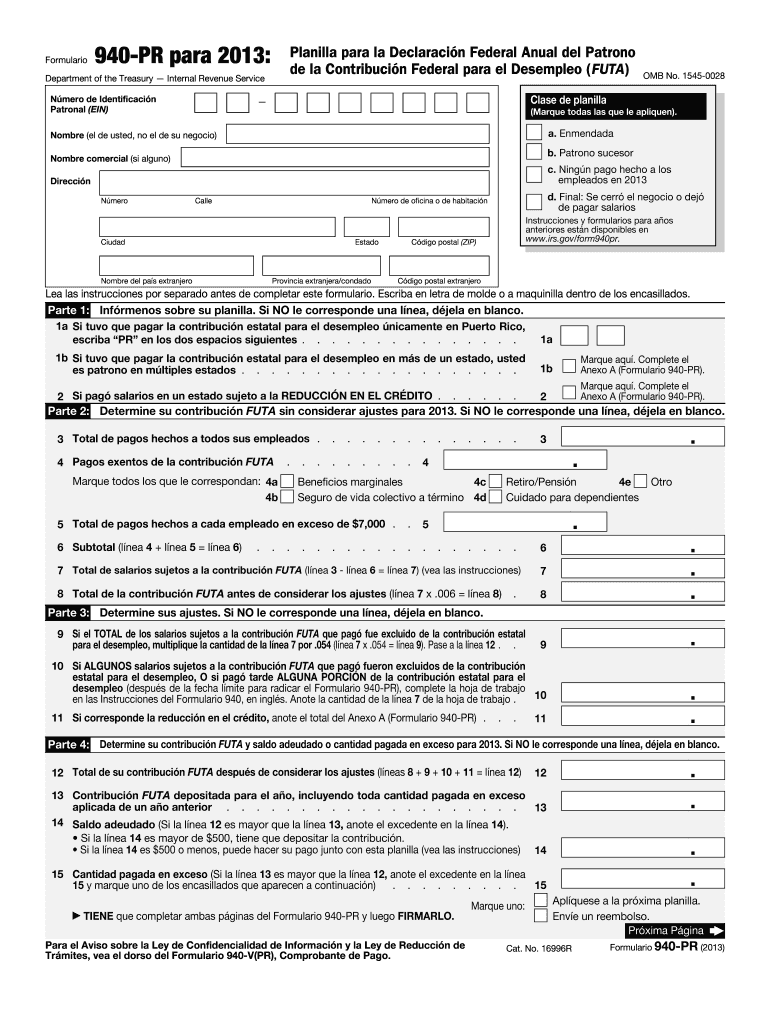

Printable 940 Form 2021 Printable Form 2023

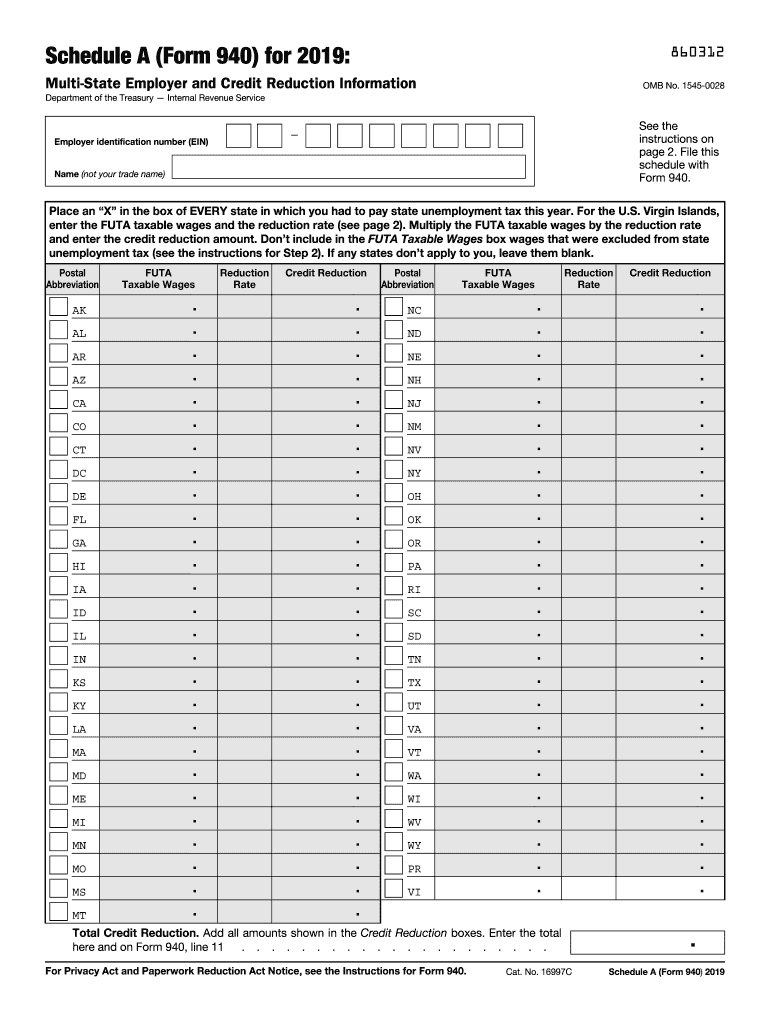

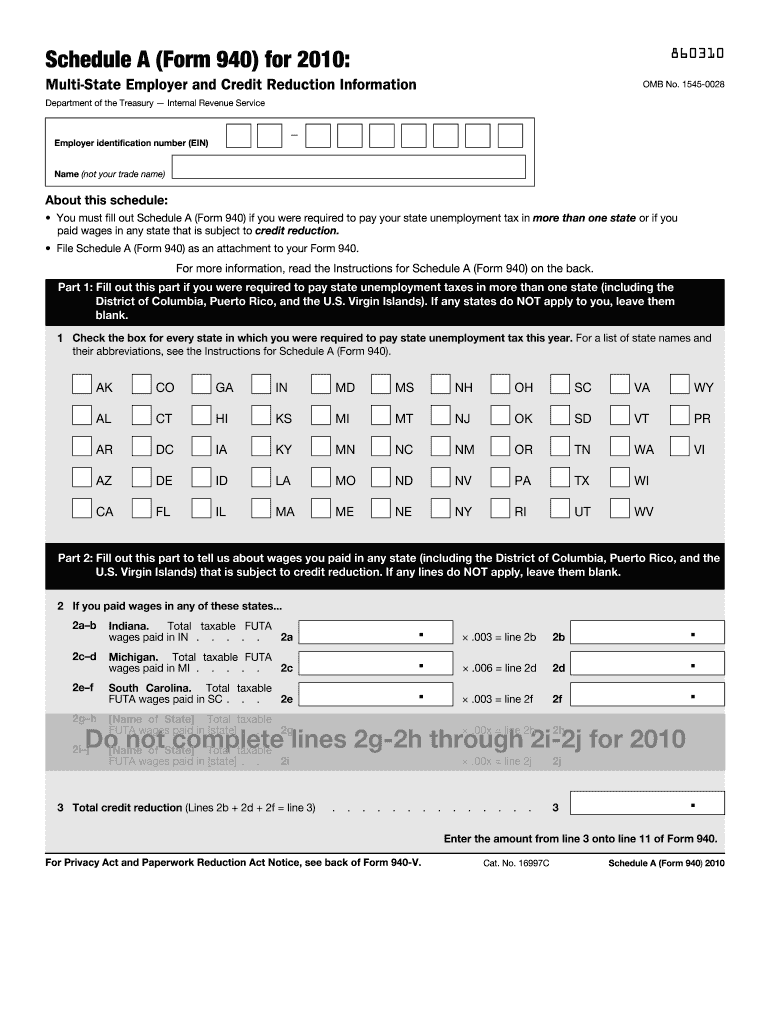

2019 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

940 Form Fill Out and Sign Printable PDF Template airSlate SignNow

How to Fill Out Form 940 Instructions, Example, & More

Form 940 2019 Fill out & sign online DocHub

Fillable Form 940 Schedule A Printable Forms Free Online

940 Schedule a Form Fill Out and Sign Printable PDF Template

Employers Must Submit The Form To The Irs By January 31 Of Each Year If They Qualify.

Web Learn How To Complete The Irs Form 940 To Report Federal Unemployment Tax Payments And Taxes Owed, As Well As Information About State Unemployment Taxes.

Web Form 940 Is An Irs Document Filed By Employers Once A Year To Report Their Federal Unemployment Tax Act (Futa) Tax Liability.

Web Form 940 Is An Internal Revenue Service (Irs) Document That Lets Employers Report Any Federal Unemployment Tax Act (Futa) Tax Payments They’ve Made Over The Calendar Year.

Related Post: