Pay Off Debt Template

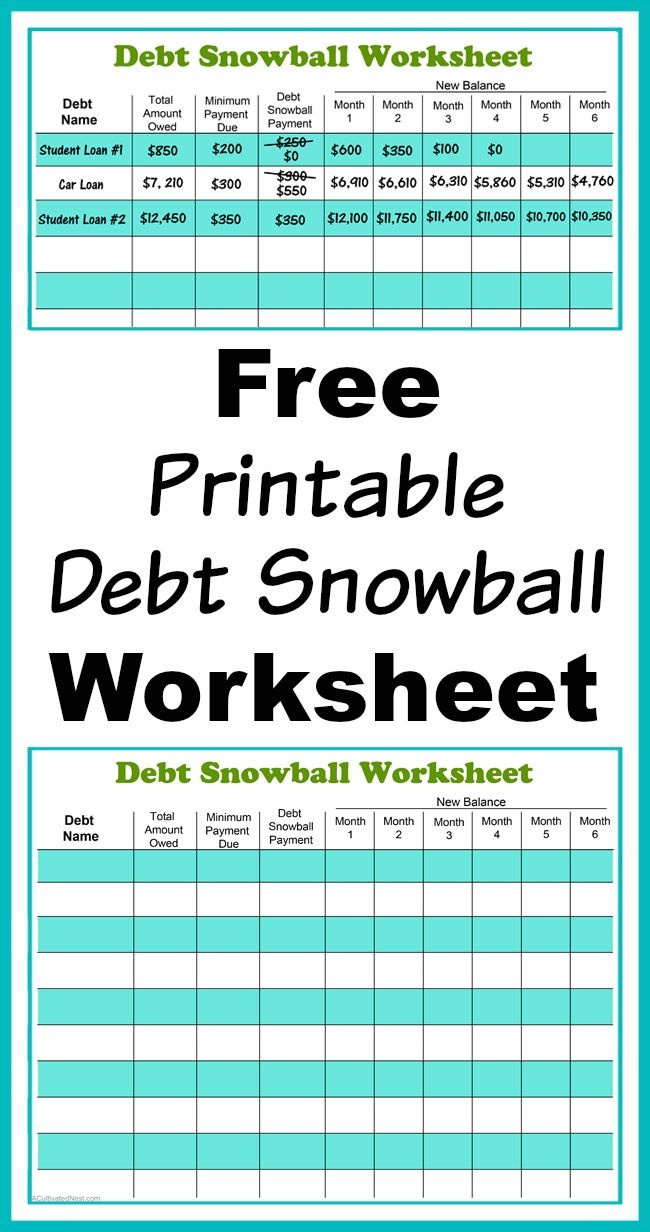

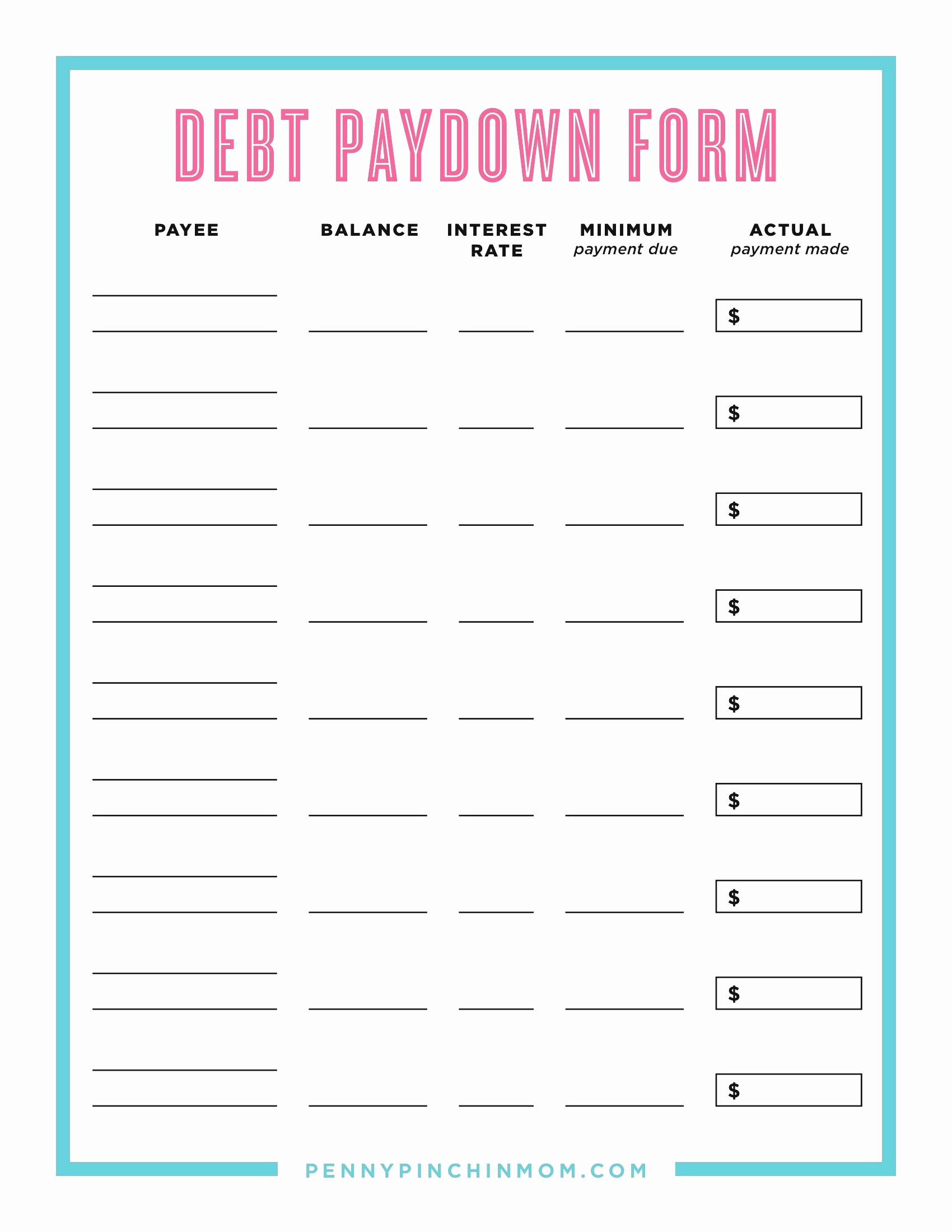

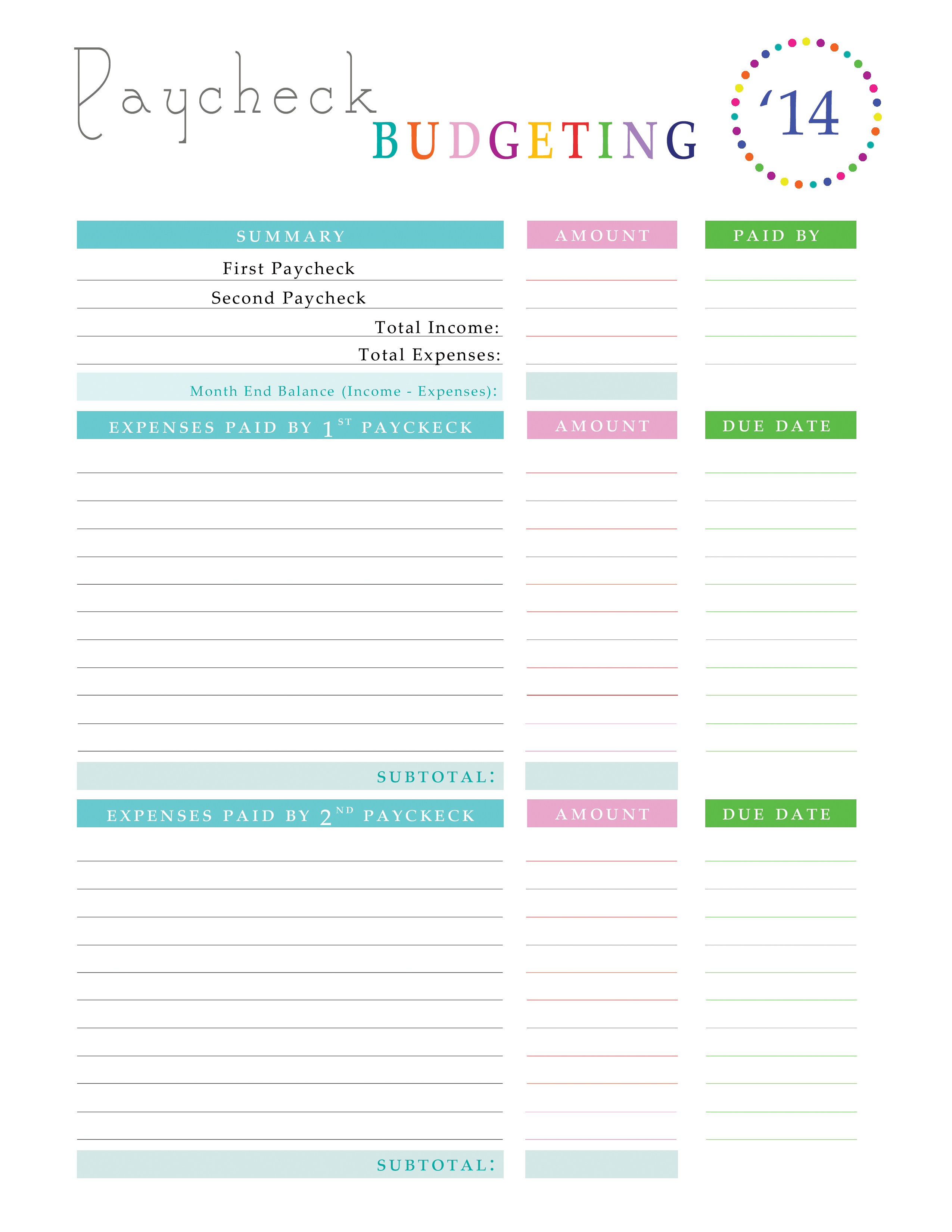

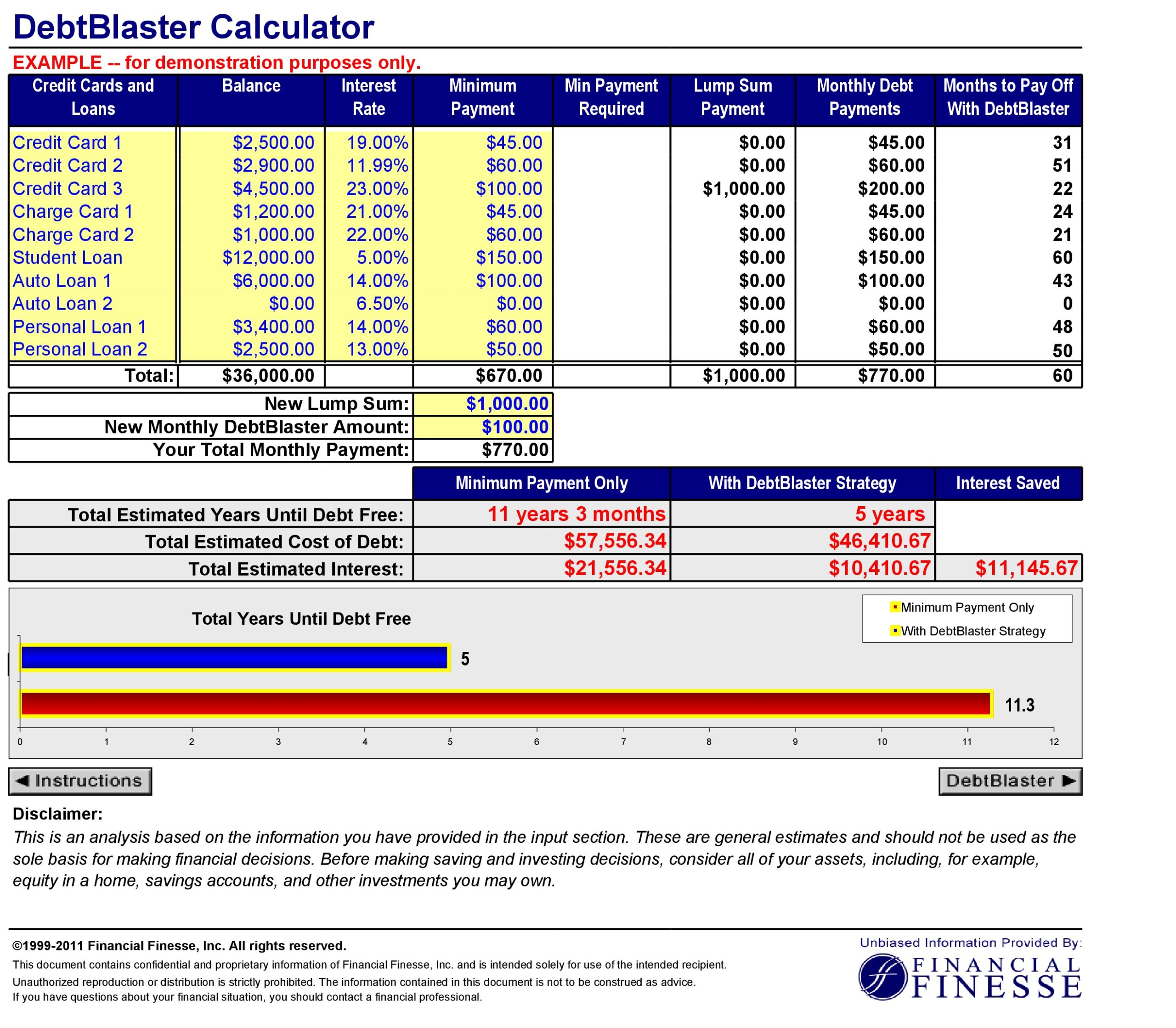

Pay Off Debt Template - The most important part is having a list of all your debts and creditors that you want to keep track of. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take. Web free printable debt payoff planner template. Web this template is built for google sheets, and it gives you the perfect space to list your debts and track your progress. July 26, 2022 by printabulls team 18 comments. $4,000, $1,000, $3,000 and $2,000. I usually don’t count the mortgage, but you certainly can. Creating a budget is the first step towards financial freedom. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Tiller money offers several types of spreadsheets including a debt. Tiller money offers several types of spreadsheets including a debt. How do you figure out which one to focus on paying off first? Web let's say you have four credit card balances: Collect all of your current outstanding debt that charges interest. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless. Web keep in mind that you can pay more if you have the money. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Tiller money offers several types of spreadsheets including a debt. When working on paying off debt, you can use all the help you can get.. Web download free debt payoff trackers for excel® and pdf | updated 8/18/2021. Web here are 7 free debt snowball spreadsheets to help you save money, reduce stress, and avoid paying higher interest rates in 2023 with a plan to pay debt off. Track your debt free journey using a column chart that gradually reveals a debt free image as. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Check it out here for a free download. For example, if you have a $3,000 loan with an interest rate of 19% and a $1,500. How do you figure out which one to focus on paying off first? If. Download free credit card payoff and debt reduction calculators for excel. If you’ve been trying to get out of debt then you know how important it is to keep track of your payments and progress. Track your debt free journey using a column chart that gradually reveals a debt free image as you pay off your debt. Web table of. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web download free debt payoff trackers for excel® and pdf | updated 8/18/2021. Web create your free budget. The debt payoff template from medium for google sheets is a payment plan that’ll help you settle smaller debt amounts. The most important part is having a list of all your debts and creditors that you want to keep track of. $1,000 ($50 minimum payment) 2nd debt: In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take. Rise credit official blog offers tips and tools for financial wellness. This debt planner will. Free monthly budget + money bundle templates. Check it out here for a free download. Web the goal of the debt snowball method is to pay off debts systematically by focusing on one debt at a time while making minimum payments on the others. Web here are 7 free debt snowball spreadsheets to help you save money, reduce stress, and. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. Rise credit official blog offers tips and tools for financial wellness. If you committed to paying $500 per month, but you have an extra $200, you can certainly add that. $1,000 ($50 minimum payment) 2nd debt: If you’ve been trying to get out. Check it out here for a free download. $4,000, $1,000, $3,000 and $2,000. You need to work out how much you can put towards this first debt while covering the minimum payments. To use the debt avalanche method, list your debts according to their interest rates, with the highest rates at the top of the list and the lowest rates. If you’ve been trying to get out of debt then you know how important it is to keep track of your payments and progress. So whether you wish to use the snowball or the avalanche method, just download the template you need! On top of that, it comes with instructions to guide you through the process. There are a couple of ways you can do this. What is the debt snowball? $4,000, $1,000, $3,000 and $2,000. This debt planner will allow you to see the big picture of what your debt looks like and help you manage your finances better. Web 1 / 11. This arrangement can be successful, but you should proceed with caution. Web free printable debt payoff planner template. 15 free printable monthly budget templates help you manage money in 2022. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Debt payoff template from medium for google sheets. Web by heather phillips. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. You need to work out how much you can put towards this first debt while covering the minimum payments.

Pdf Debt Tracker Printable Printable World Holiday

Debt Payoff Sheet Tutlin.psstech.co Free Printable Debt Payoff

Paying off Debt Worksheets

Credit Card Debt Payoff Tracker Printable Credit Card Payoff Etsy

Paying off Debt Worksheets

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Get Out Of Debt Budget Spreadsheet Spreadsheet Softwar get out of debt

How To Create A Spreadsheet To Pay Off Debt Spreadsheet Downloa how to

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Paying off all your debts using debt snowball progress charts The

Web Table Of Contents.

$1,000 ($50 Minimum Payment) 2Nd Debt:

How Do You Figure Out Which One To Focus On Paying Off First?

The Main Principles Of Debt Snowball Spreadsheets Include The Following:

Related Post: