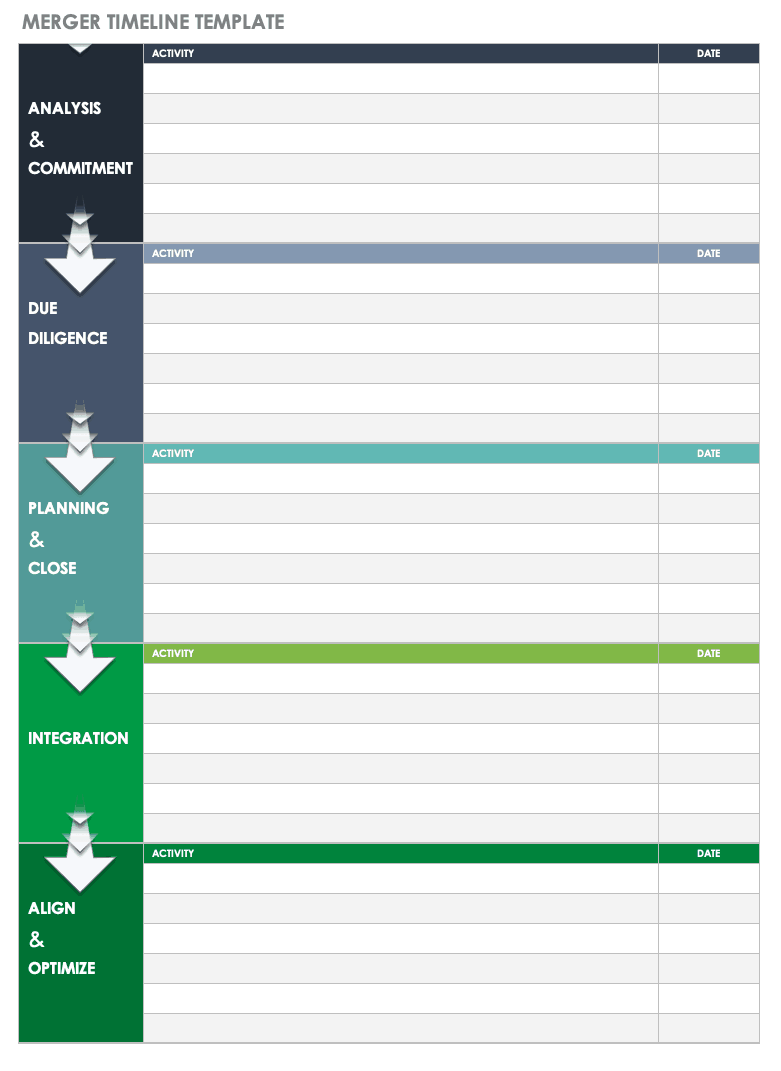

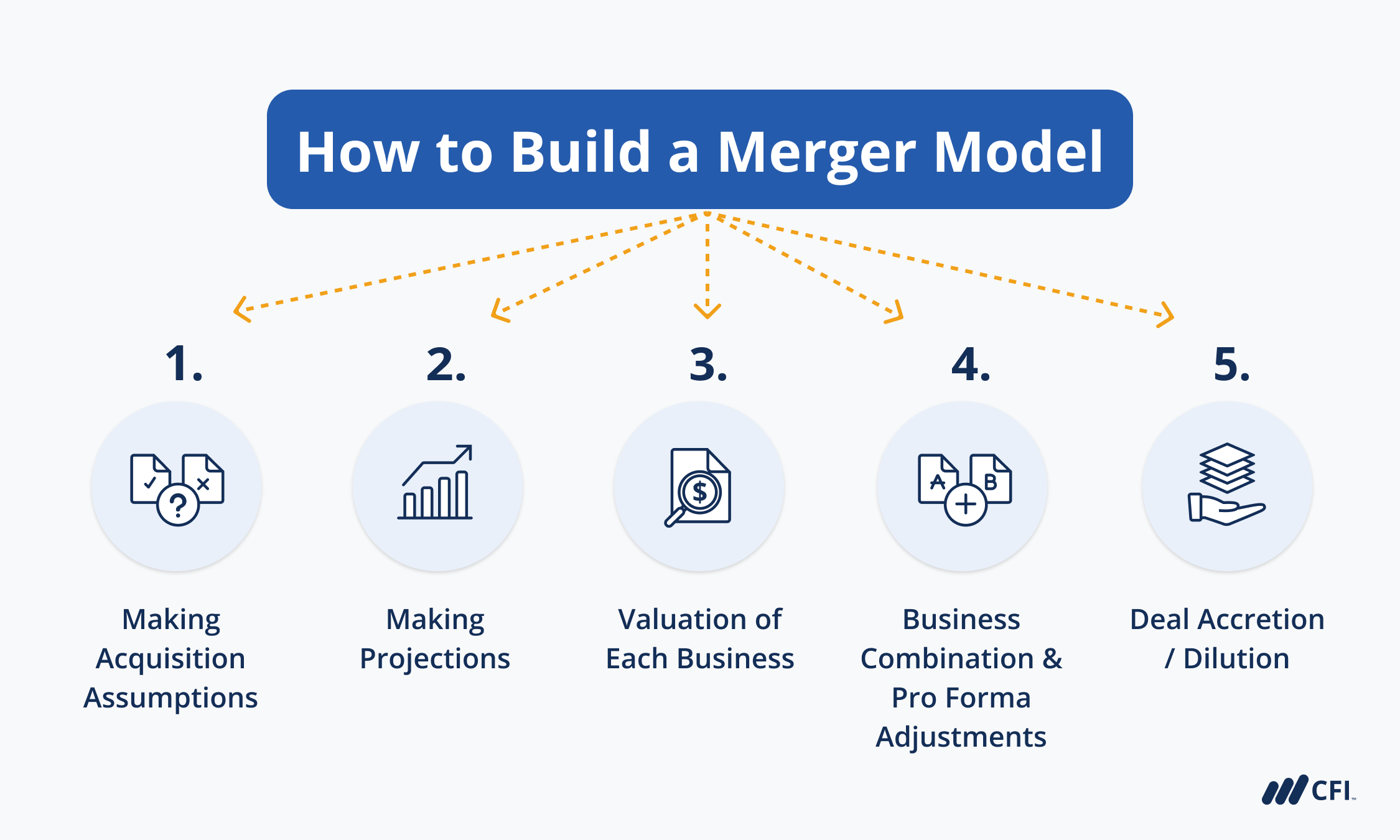

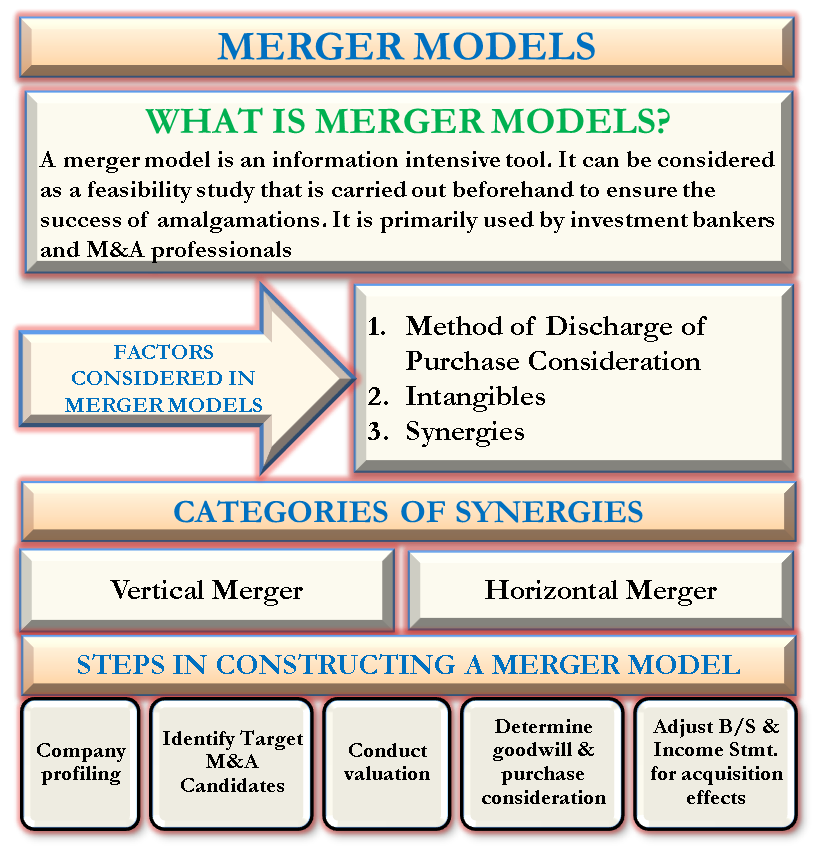

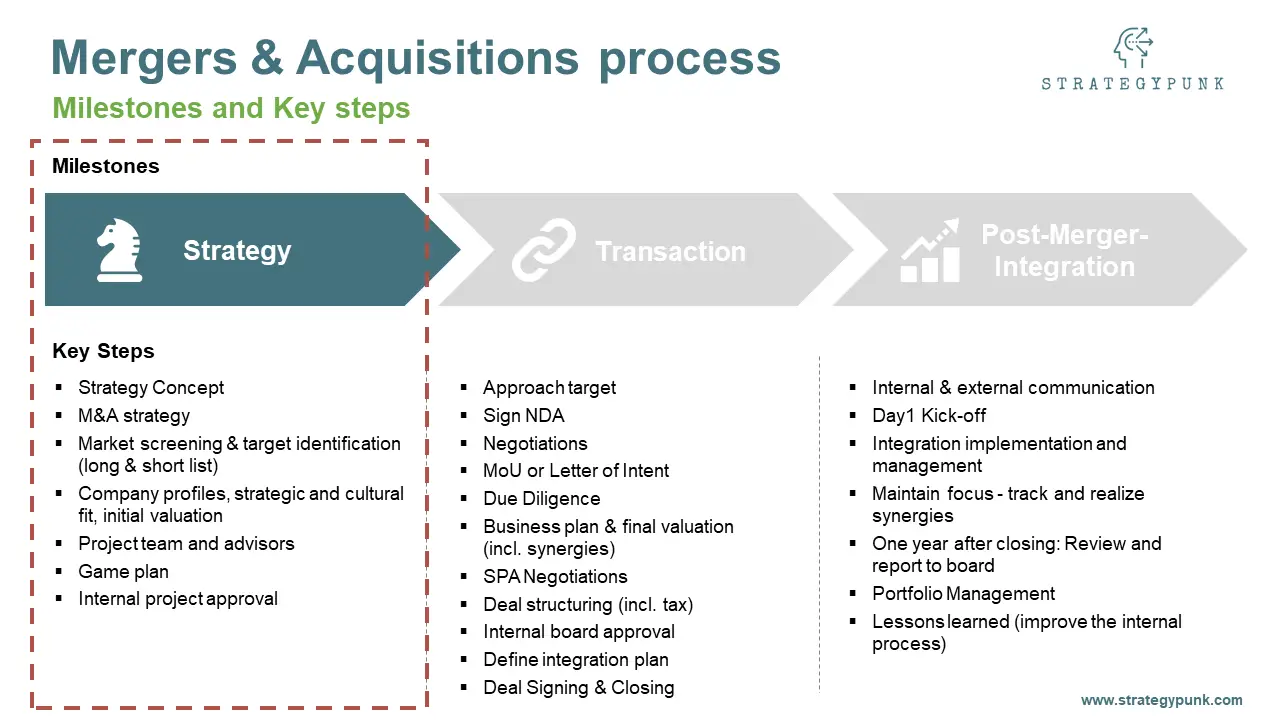

Merger Model Template

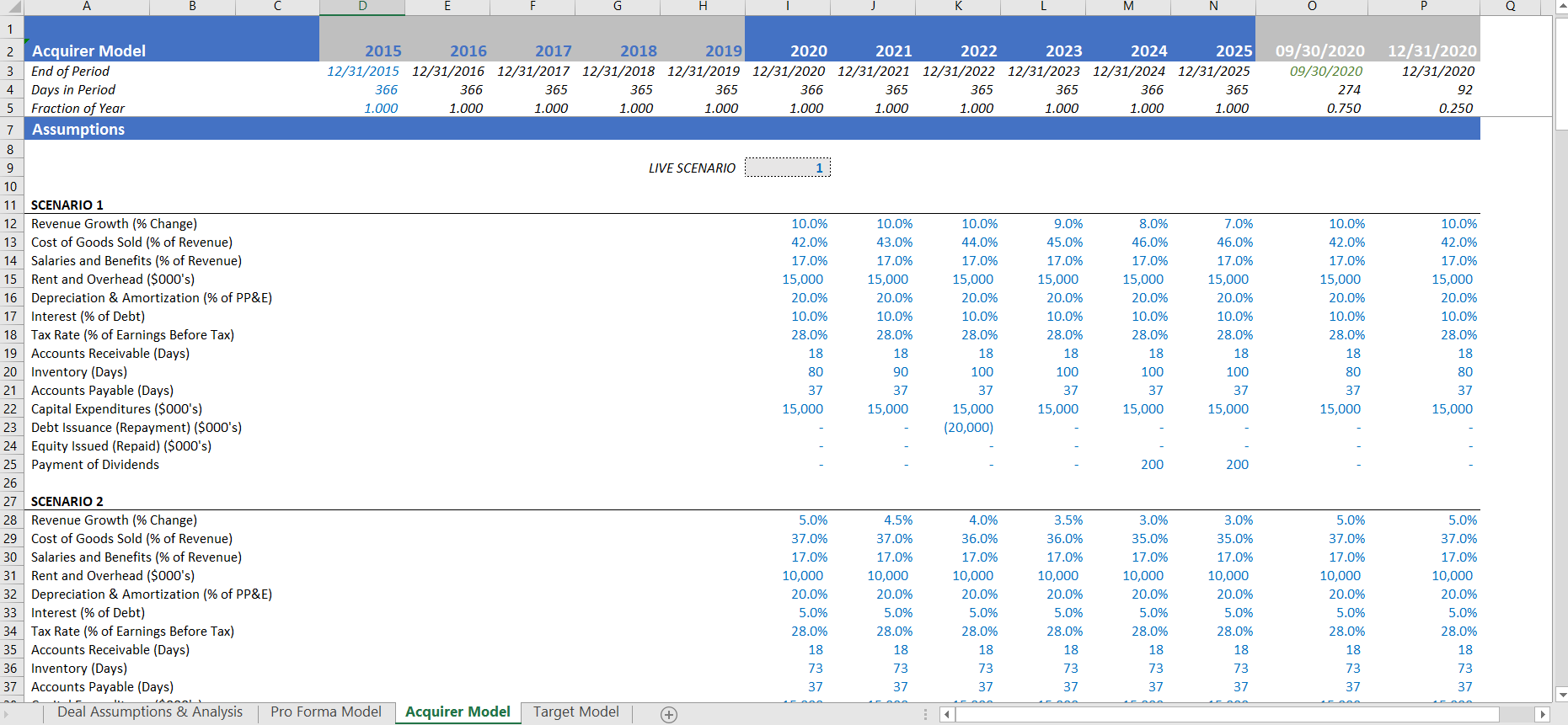

Merger Model Template - Conduct scenario analysis, calculate synergies, and streamline your m&a valuations. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. The merger model can allow analysts to look at different scenarios for a potential deal, such as varying the purchase price, or looking at the best funding option for the deal (equity or debt) Web this class is perfect for anyone who wants to learn how to build a financial model for mergers and acquisitions from the bottom up. Learn finance > merger model > modeling synergies. Let’s see how we incorporate synergies into the pro forma income statement. Merger models (also known as m&a models or accretion/dilution models) category #4: Web mergers & acquisitions model. An important part of investment banking is understanding mergers and acquisitions (. Assessing accretion and dilution helps evaluate shareholder value. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Here’s an overview of its key components: Then, it looks into the combined performance after the acquisition. It starts with analysing the cash flows of the target and the acquiring company. Web this tutorial shows how to create a merger and acquisition financial model in microsoft excel, including synergies, debt, and valuation calculations. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their synergies. Each topic contains a spreadsheet with which. We begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Leveraged buyout models (slight variations include the growth equity models and “investment models”) Conduct scenario analysis, calculate synergies, and streamline your m&a valuations. Web in this merger model walkthrough you will learn how to calculate the. Leveraged buyout models (slight variations include the growth equity models and “investment models”) Doesn't need to be the model to end all models, just looking for good. Web merger models analyze the financial impact of a merger or acquisition. Web merger model template | wall street oasis. Web download our free merger model template for excel. Here’s an overview of its key components: Anyone got a good free merger model template they'd feel comfortable sharing? A merger model is an analysis representing the combination of two companies that come together through an m&a process. Web download our free operating model excel template. Web download our free merger model template for excel. Web download our free operating model excel template. It computes the perpetuity growth. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. The modeling process involves assumptions, projections, and valuation techniques. Learn finance > merger model > modeling synergies. Web download our free merger model template for excel. A merger model measures the estimated accretion or dilution to an acquirer’s earnings per share (eps) from the impact of an m&a transaction. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Short description full description table of contents review (0) Web what is. We begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). In this section, we demonstrate how to model a merger of two public companies in excel. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. All industries, financial model,. Leveraged buyout models (slight variations include the growth equity models and “investment models”) Assessing accretion and dilution helps evaluate shareholder value. Web in this merger model walkthrough you will learn how to calculate the acquisition effects, combine income statements, and calculate eps accretion / dilution. Web mergers & acquisitions model. The modeling process involves assumptions, projections, and valuation techniques. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. It is equipped with a wide range of features and functionalities to provide a holistic view of merger scenarios. It starts with analysing the cash flows of the target and the acquiring company. We begin our m&a model by plugging into the spreadsheet some. Leveraged buyout models (slight variations include the growth equity models and “investment models”) Web download our free operating model excel template. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Web in this merger model lesson, you'll learn how a company might decide what mix of cash, debt, and stock it might use to fund. Assessing accretion and dilution helps evaluate shareholder value. All industries, financial model, general excel financial models. Short description full description table of contents review (0) Web what is a merger model? A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. Web the key steps involved in building a merger model are: We begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Let’s see how we incorporate synergies into the pro forma income statement. Web download our free merger model template for excel. Web merger models analyze the financial impact of a merger or acquisition. The goal of a merger is to create synergies and improve productivity. Merger models (also known as m&a models or accretion/dilution models) category #4:

Merger Model Template

How To Build A Merger Model

Merger and Acquisition Model Excel Tutorial & Template

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Mergers & Acquisitions Process Guide and free template

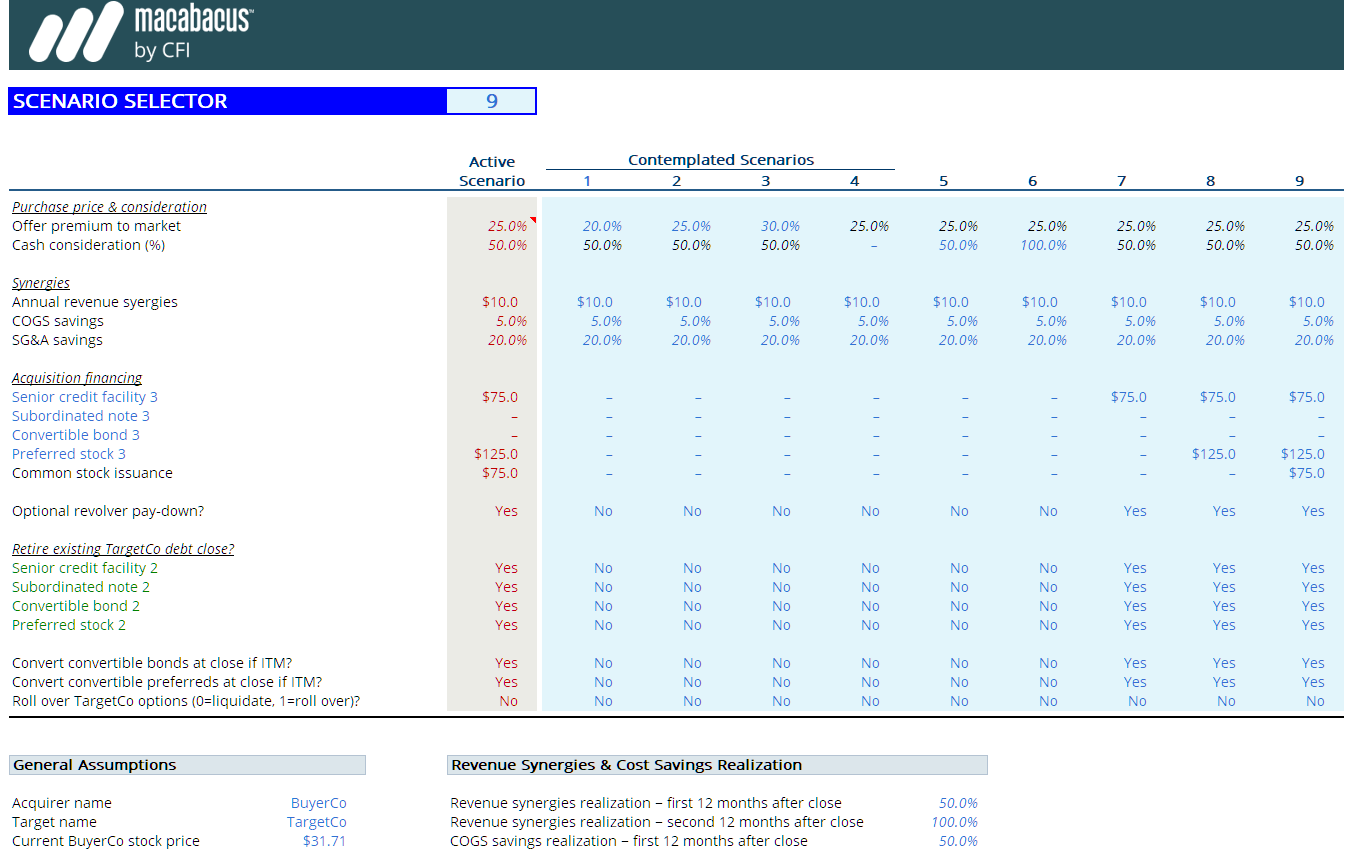

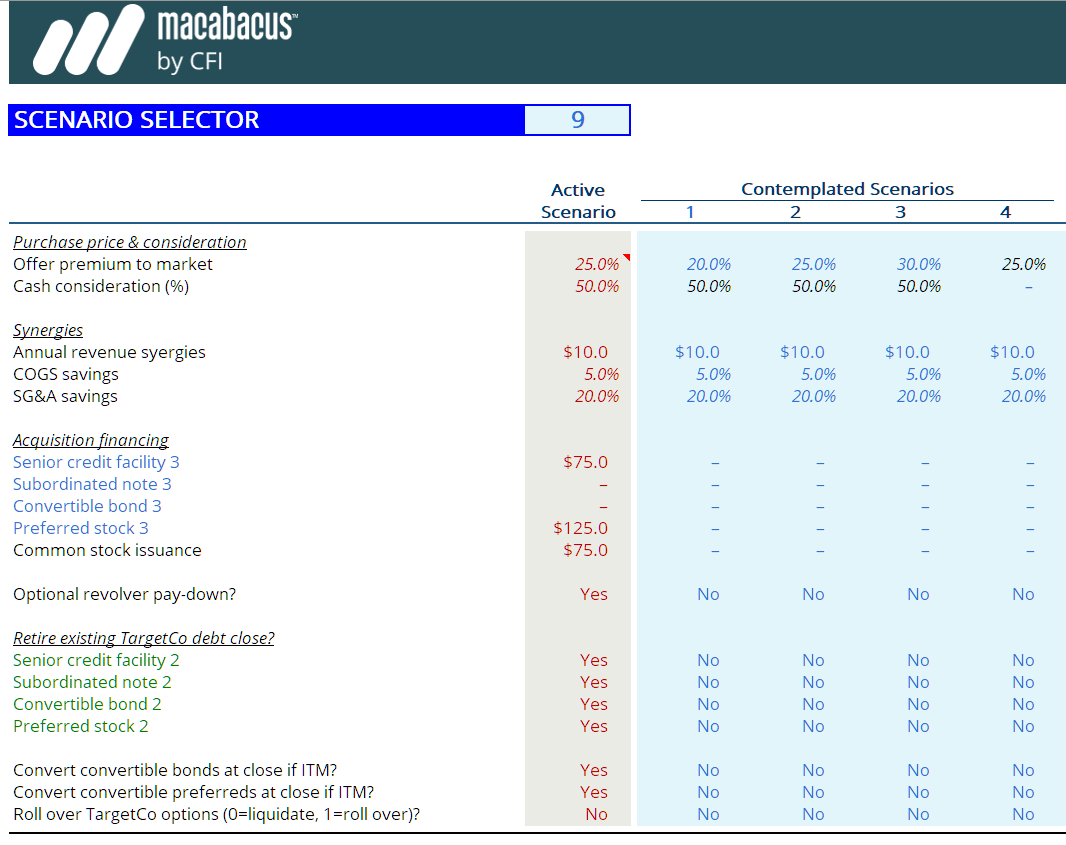

Merger Model Templates Download Excel Template for M&A Macabacus

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://s3.amazonaws.com/biwsuploads-assest/biws/wp-content/uploads/2019/04/22172725/EPS-Accretion-Dilution-1024x549.jpg)

Merger Model StepByStep Walkthrough [Video Tutorial]

Merger and Acquisition Excel Model Template Icrest Models

Merger Model M&A Training Tutorial + Excel Template

Merger Model Templates Download Excel Template for M&A Macabacus

Web Merger Model Template | Wall Street Oasis.

Web This Class Is Perfect For Anyone Who Wants To Learn How To Build A Financial Model For Mergers And Acquisitions From The Bottom Up.

A Merger Model Measures The Estimated Accretion Or Dilution To An Acquirer’s Earnings Per Share (Eps) From The Impact Of An M&A Transaction.

This Model Runs Through Different Scenarios And Synergies To Forecast Future Value After The Transaction.

Related Post: