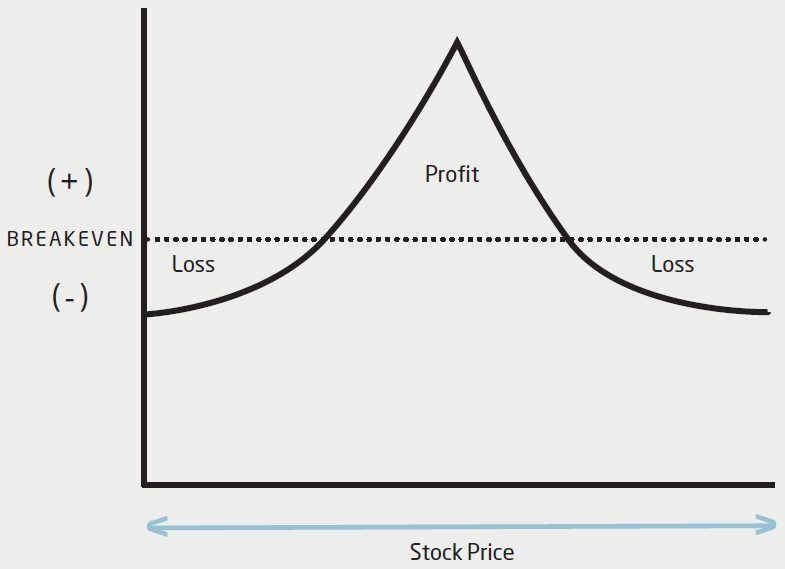

Long Calendar Spread

Long Calendar Spread - The options institute at cboe ®. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Long call calendar spread (call horizontal) long put calendar spread (put horizontal) short call calendar spread (short call time spread) Note the point of maximum profit is right at the strike price (as of the date the short options expire). Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type ( calls or puts) and strike price, but different expirations. Web the long calendar option spread can be entered by purchasing one contract and simultaneously selling another contract with a shorter expiration date. It’s created by simultaneously buying and selling two options of the same type (calls or puts) but with different expiration dates. Both calls have the same underlying stock and the same strike price. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. § long 1 xyz (month 2) 100 call. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the. In the first leg, a trader writes option contracts, and the second leg involves buying option contacts at the same strike price.. Web theoretical p&l graph for a long calendar spread. § long 1 xyz (month 2) 100 call. It’s created by simultaneously buying and selling two options of the same type (calls or puts) but with different expiration dates. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Original study notes from options industry council (oic) education. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility,. Note the point of maximum profit is right at the strike price (as of the date the short options expire). The options institute at cboe ®. § long 1 xyz (month 2) 100 call. Both calls have the same underlying stock and the same strike price. Maximum profit is realized if the underlying is equal to the strike at expiration. § short 1 xyz (month 1) 100 call. Long calendar spreads are great strategies for options traders who believe the stock price will trade near the short option price, allowing traders to profit from “pinning” the future stock price to this strike. Long call calendar spread (call horizontal) long put calendar spread (put horizontal) short call calendar spread (short call. Note the point of maximum profit is right at the strike price (as of the date the short options expire). To profit from neutral stock price action near the strike price of the calendar spread with limited risk in either direction. Profit increases with time) as well as from an increase in vega. § short 1 xyz (month 1) 100. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Both calls have the same underlying. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery. Web theoretical p&l graph for a long calendar spread. Web updated october 31, 2021. § long 1 xyz (month 2) 100 call. Web a long calendar spread—often referred to as a time. Web updated october 31, 2021. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. § short 1 xyz (month 1) 100 call. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web updated october 31, 2021. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. Option trading strategies offer traders and investors the opportunity to profit in ways not available to those. Original study notes from options industry council (oic) education. Typically, the. Both calls have the same underlying stock and the same strike price. To profit from neutral stock price action near the strike price of the calendar spread with limited risk in either direction. The strategy most commonly involves calls with the same strike (horizontal spread), but can also be done with different strikes (diagonal spread). Web updated october 31, 2021. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. The options institute at cboe ®. Web theoretical p&l graph for a long calendar spread. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike price but different expiration dates. Web long calendar spreads, also known as time spreads or horizontal spreads, are a versatile options trading strategy that can offer investors both income and growth potential. Note the point of maximum profit is right at the strike price (as of the date the short options expire). It’s created by simultaneously buying and selling two options of the same type (calls or puts) but with different expiration dates. Long call calendar spread (call horizontal) long put calendar spread (put horizontal) short call calendar spread (short call time spread) Original study notes from options industry council (oic) education.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

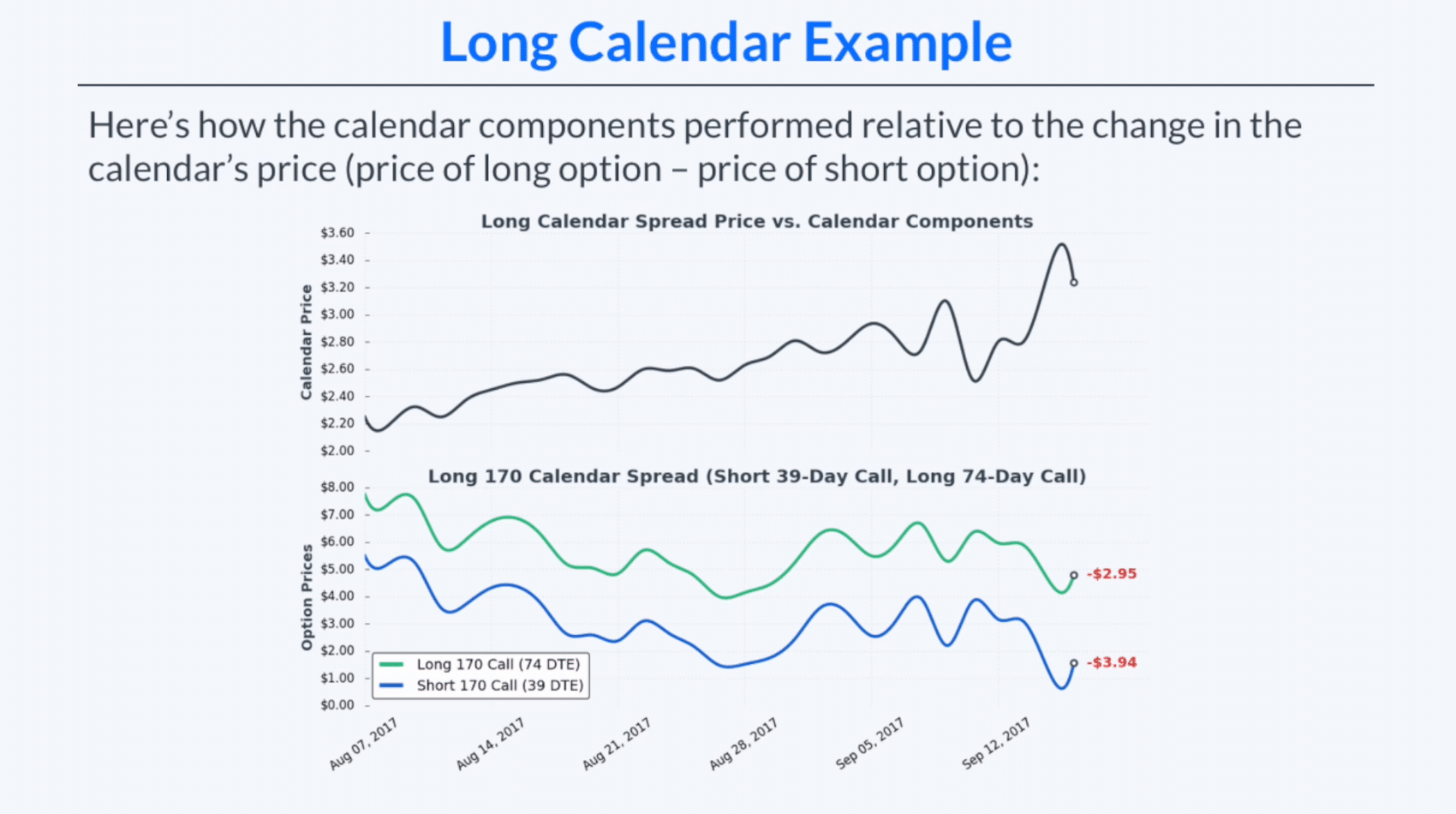

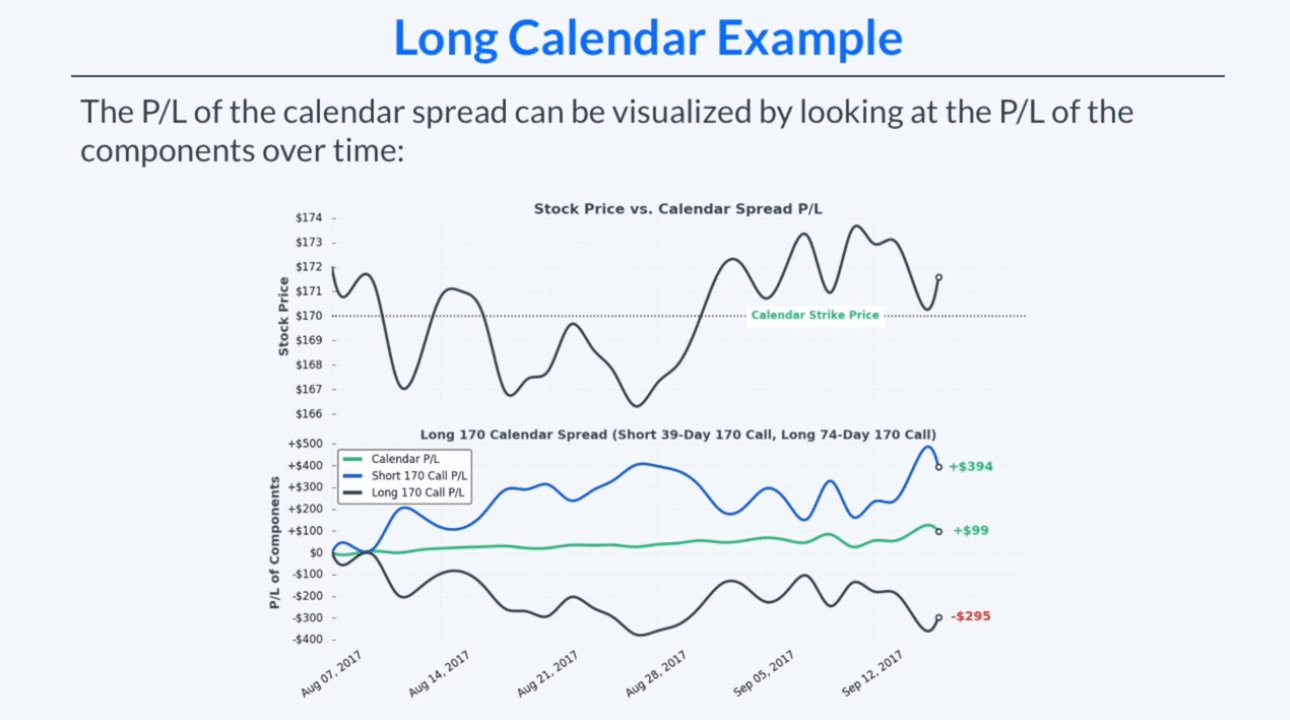

How Long Calendar Spreads Work (w/ Examples) Options Trading

How to Trade Options Calendar Spreads (Visuals and Examples)

Long Calendar Spread with Puts

The Long Calendar Spread Explained 1 Options Trading Software

Long Calendar Spread with Puts Strategy With Example

Printable Calendar Spreads on Behance

Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spreads for Beginner Options Traders projectfinance

Long Calendar Spreads Unofficed

Profit Increases With Time) As Well As From An Increase In Vega.

A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration Periods.

In The First Leg, A Trader Writes Option Contracts, And The Second Leg Involves Buying Option Contacts At The Same Strike Price.

A Long Calendar Spread Consists Of Two Options Of The Same Type And Strike Price, But With Different Expirations.

Related Post: