Irs Form 1310 Printable

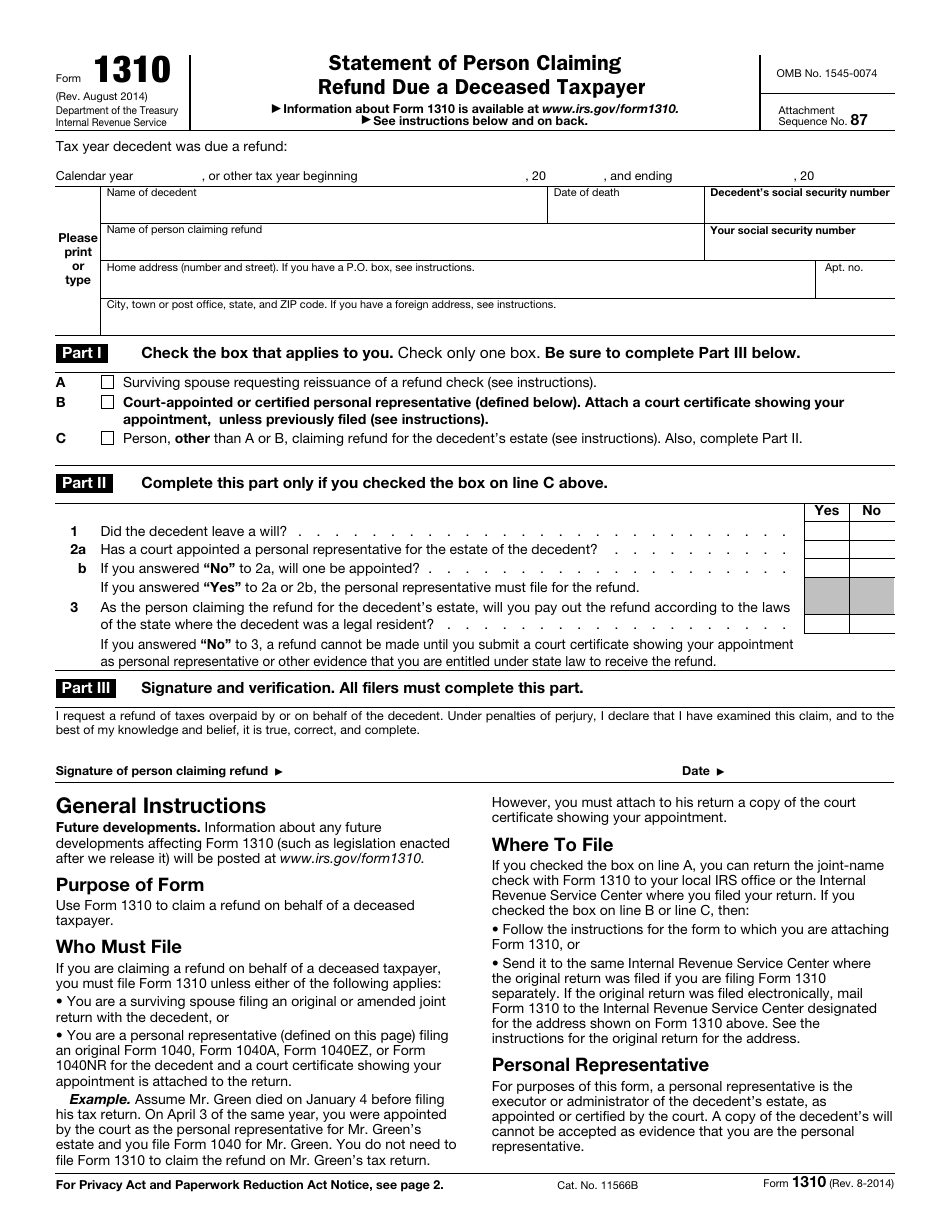

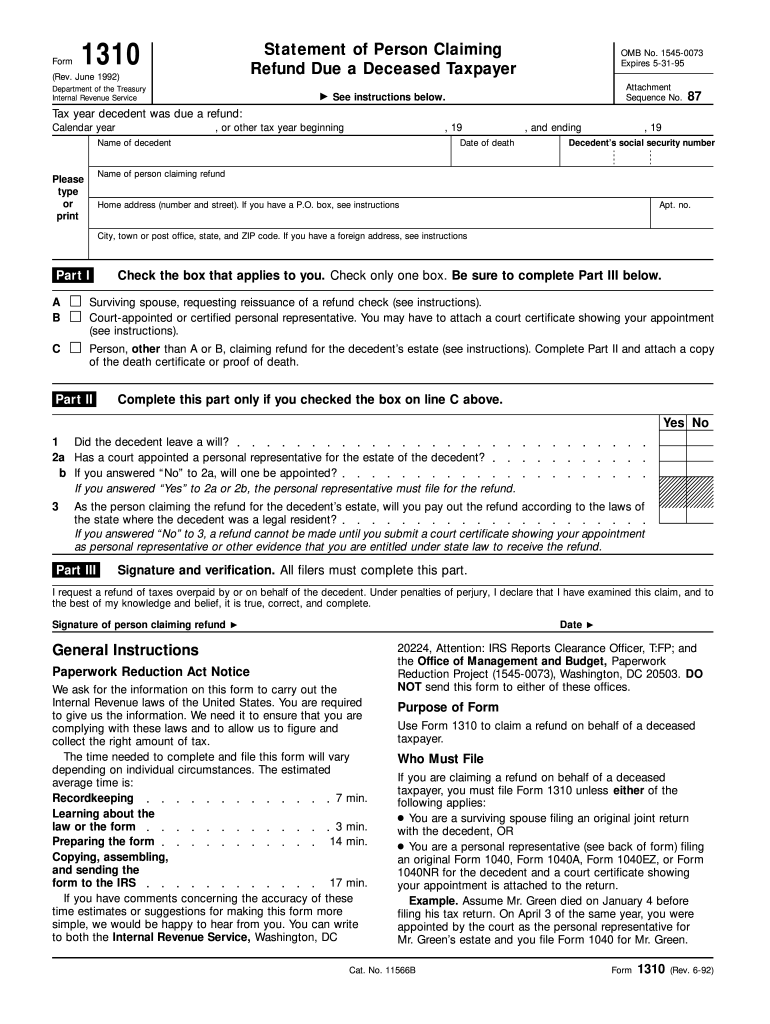

Irs Form 1310 Printable - How to resolve form 1310 critical diagnostic ref. Green died on january 4 before filing his tax return. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web a copy of the decedent’s will cannot be accepted as evidence that you are the personal representative. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security number, the death date, and the personal information for the person requesting the refund. In part i, you will simply check one of three boxes indicating whether. If filing a joint return and both taxpayers are deceased, complete a form 1310 for each. If the deceased taxpayer’s final return is not a joint return. Web a copy of the decedent’s will cannot be accepted as evidence that you are the personal representative. A tax form distributed by the internal revenue service (irs) and used by taxpayers looking to claim a refund on behalf of a. Web the following articles are the top questions referring form 1310. Irs form 1310 is used by an executor,. How to resolve form 1310 critical diagnostic ref. Send the written proof to the address where the. Web statement of person claiming refund due a deceased taxpayer (form 1310) unless: Web file form 1310 to claim the refund on mr. Web collect the right amount of tax. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security number, the death date, and the personal information for the person requesting the refund. Web the following articles are the top questions referring form 1310. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent. You are the personal representative (executor) filing the return on behalf of the estate. Web collect the right amount of tax. Use form 1310 to claim a refund on behalf of a deceased taxpayer. On april 3 of the same year, you were appointed Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent. Date of death decedent’s social security number Statement of person claiming refund due a deceased taxpayer: If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web the following articles are the top questions referring form 1310. 559, survivors, executors, and administrators. Form 1310 critical diagnostic ref. You are the surviving spouse filing a joint return, or. However, you must attach to his return a copy of the court certificate showing your appointment. Web collect the right amount of tax. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. 559, survivors, executors, and administrators. Statement of person claiming refund due a deceased taxpayer: Use form 1310 to claim a refund on behalf of a deceased taxpayer. Calendar year , or other tax year beginning. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security number, the death date, and the personal information for the person requesting the refund. Send the written proof to the address where the. Web file form 1310 to claim the refund on mr. How to resolve form 1310 critical diagnostic ref.. Web tax year decedent was due a refund: You are the surviving spouse filing a joint return, or. At the top of the form, you’ll provide identifying information such as the tax year, the decedent’s social security number, the death date, and the personal information for the person requesting the refund. Calendar year , or other tax year beginning ,. However, you must attach to his return a copy of the court certificate showing your appointment. Date of death decedent’s social security number If filing a joint return and both taxpayers are deceased, complete a form 1310 for each. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Calendar year , or other tax year beginning. Web file form 1310 to claim the refund on mr. Statement of person claiming refund due a deceased taxpayer: Calendar year , or other tax year beginning , 20 , and ending , 20 please print or type name of decedent. However, you must attach to his return a copy of the court certificate showing your appointment. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Send the written proof to the address where the. Green died on january 4 before filing his tax return. If filing a joint return and both taxpayers are deceased, complete a form 1310 for each. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Date of death decedent’s social security number Web a copy of the decedent’s will cannot be accepted as evidence that you are the personal representative. A tax form distributed by the internal revenue service (irs) and used by taxpayers looking to claim a refund on behalf of a. You must have written proof to file as the personal representative. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web fortunately, the form is very simple to complete. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

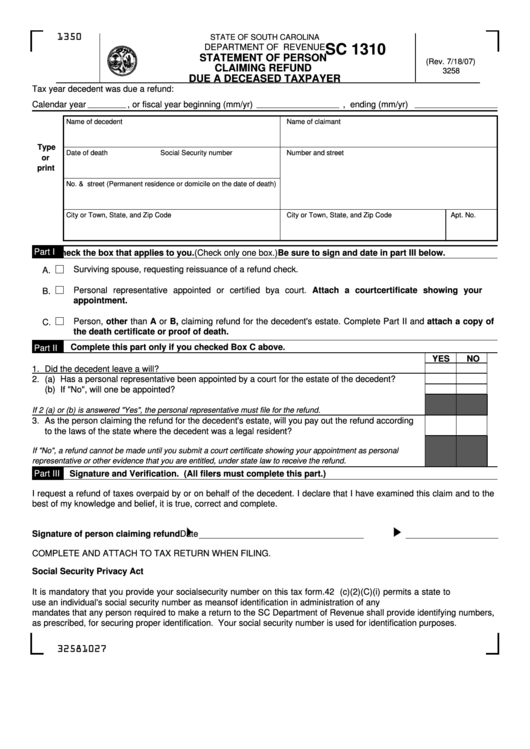

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

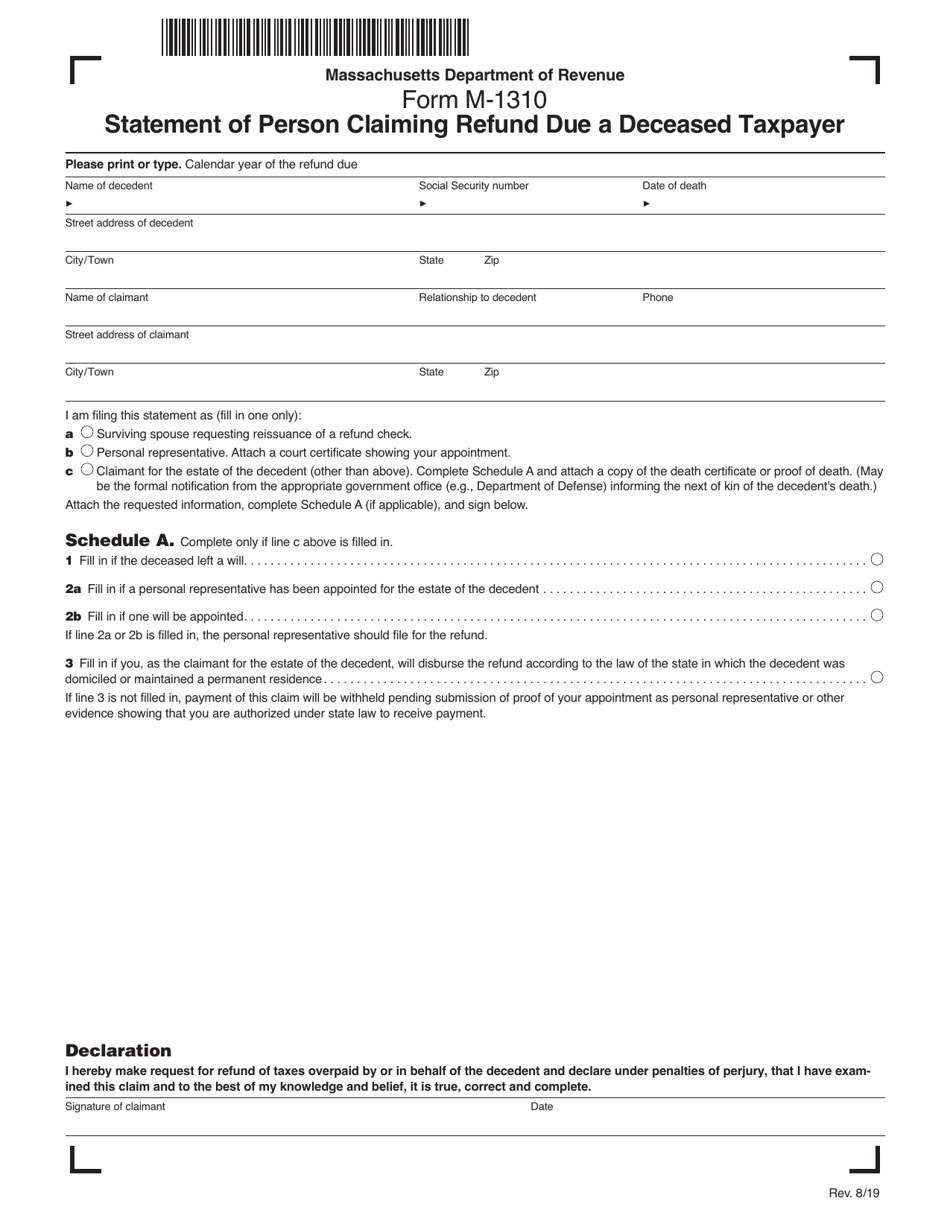

Form M1310 Download Printable PDF or Fill Online Statement of Person

IRS Form 1310 Fill Out, Sign Online and Download Fillable PDF

Manage Documents Using Our Editable Form For IRS Form 1310

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

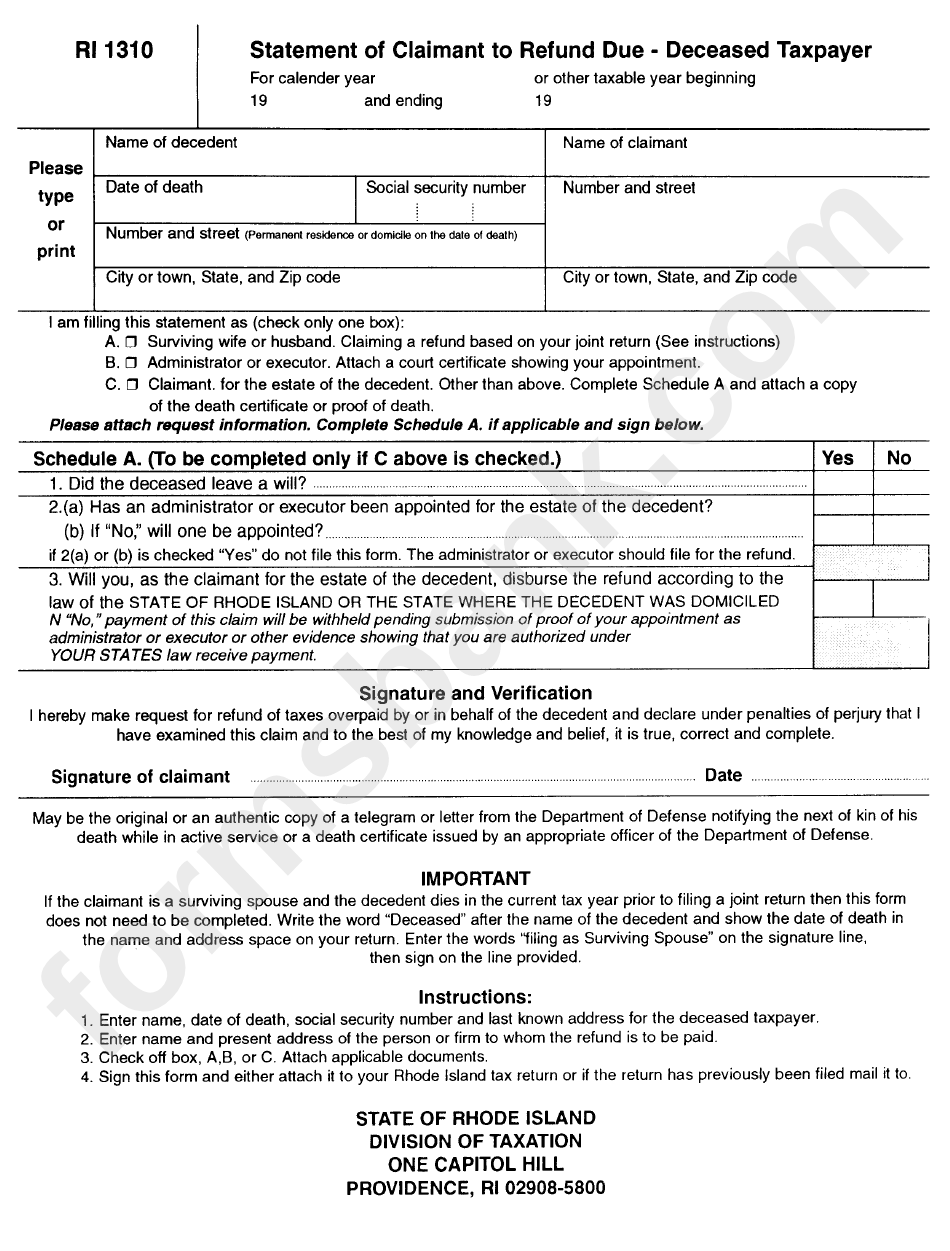

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Ir's Form 1310 Fill Out and Sign Printable PDF Template airSlate

Irs Form 1310 Printable Master of Documents

What is IRS Form 1310? Claiming Refund Due a Deceased Taxpayer

You Are The Surviving Spouse Filing A Joint Return, Or.

559, Survivors, Executors, And Administrators.

You Are The Personal Representative (Executor) Filing The Return On Behalf Of The Estate.

On April 3 Of The Same Year, You Were Appointed

Related Post: