Irrevocable Trust Template

Irrevocable Trust Template - Web whereas, the grantor desires to create an irrevocable trust of the property described in schedule a hereto, together with such monies, securities and other assets as the trustees hereafter may hold or acquire hereunder (said property, monies, securities and other assets, Living trust vs irrevocable trust. Web an irrevocable trust agreement is a legal document that allows the transfer of assets into a trust. The main difference between irrevocable trusts and revocable or living trusts is who has control of the assets in the trust. Find out how two types of trusts differ and decide which is more appropriate and beneficial for your current financial standing and your beneficiaries: Web an irrevocable trust cannot be changed or modified without the beneficiary's permission. Web irrevocable trust template. It cannot be revoked once a party has signed an irrevocable trust agreement. Web the said beneficiaries shall not have any power to sell, assign, transfer, encumber or in any manner to anticipate or dispose of their interest in the trust funds, or any part of same, or the income produced from said funds, or any part of same. Us legal form's irrevocable trust forms are professionally drafted and affordable. Find out how two types of trusts differ and decide which is more appropriate and beneficial for your current financial standing and your beneficiaries: Therefore, it is imperative to understand what can and cannot be done with assets once they are placed in the trust. Web irrevocable living trust agreement. Web you may download an irrevocable living trust template via. Therefore, it is imperative to understand what can and cannot be done with assets once they are placed in the trust. Essentially, an irrevocable trust removes certain assets from a grantor’s taxable estate, and these. Web an irrevocable trust involves three parties (you, the person managing the trust, and the people who will ultimately receive the assets placed into the. Essentially, an irrevocable trust removes certain assets from a grantor’s taxable estate, and these. You will be permanently transferring control of any assets placed into the trust to the person managing the trust—referred to as the trustee. Therefore, it is imperative to understand what can and cannot be done with assets once they are placed in the trust. Web utilizing. Web utilizing irrevocable trust forms, you can give real estate, private property like a motorcycle, jewelry, boats, stocks and bonds, and things without a title such as a stamp collection. It outlines the assets in the trust, the beneficiaries, and the conditions under. This irrevocable living trust agreement, (hereinafter “trust”), is being made this _______ day of _______________, 20 _____,. Web you may download an irrevocable living trust template via the link below. It cannot be revoked once a party has signed an irrevocable trust agreement. Us legal form's irrevocable trust forms are professionally drafted and affordable. Web irrevocable living trust agreement. Web an irrevocable trust involves three parties (you, the person managing the trust, and the people who will. Web irrevocable trust template. Essentially, an irrevocable trust removes certain assets from a grantor’s taxable estate, and these. It outlines the assets in the trust, the beneficiaries, and the conditions under. The main difference between irrevocable trusts and revocable or living trusts is who has control of the assets in the trust. Web an irrevocable trust cannot be changed or. Therefore, it is imperative to understand what can and cannot be done with assets once they are placed in the trust. This irrevocable living trust agreement, (hereinafter “trust”), is being made this _______ day of _______________, 20 _____, by and between _________________ of _______________, _____________ county, __________________, as the trustor, and serving as trustee. An irrevocable trust form is a. Web an irrevocable trust involves three parties (you, the person managing the trust, and the people who will ultimately receive the assets placed into the trust). This irrevocable living trust agreement, (hereinafter “trust”), is being made this _______ day of _______________, 20 _____, by and between _________________ of _______________, _____________ county, __________________, as the trustor, and serving as trustee. Web. Web an irrevocable trust involves three parties (you, the person managing the trust, and the people who will ultimately receive the assets placed into the trust). Find out how two types of trusts differ and decide which is more appropriate and beneficial for your current financial standing and your beneficiaries: It cannot be revoked once a party has signed an. It outlines the assets in the trust, the beneficiaries, and the conditions under. Web the said beneficiaries shall not have any power to sell, assign, transfer, encumber or in any manner to anticipate or dispose of their interest in the trust funds, or any part of same, or the income produced from said funds, or any part of same. Web. It cannot be revoked once a party has signed an irrevocable trust agreement. Web an irrevocable trust cannot be changed or modified without the beneficiary's permission. Web whereas, the grantor desires to create an irrevocable trust of the property described in schedule a hereto, together with such monies, securities and other assets as the trustees hereafter may hold or acquire hereunder (said property, monies, securities and other assets, The main difference between irrevocable trusts and revocable or living trusts is who has control of the assets in the trust. Web irrevocable living trust agreement. Web utilizing irrevocable trust forms, you can give real estate, private property like a motorcycle, jewelry, boats, stocks and bonds, and things without a title such as a stamp collection. Web irrevocable trust template. Therefore, it is imperative to understand what can and cannot be done with assets once they are placed in the trust. This irrevocable living trust agreement, (hereinafter “trust”), is being made this _______ day of _______________, 20 _____, by and between _________________ of _______________, _____________ county, __________________, as the trustor, and serving as trustee. Living trust vs irrevocable trust. Web you may download an irrevocable living trust template via the link below. An irrevocable trust form is a legal document that establishes the terms and conditions of an irrevocable trust. Web the said beneficiaries shall not have any power to sell, assign, transfer, encumber or in any manner to anticipate or dispose of their interest in the trust funds, or any part of same, or the income produced from said funds, or any part of same. Web an irrevocable trust involves three parties (you, the person managing the trust, and the people who will ultimately receive the assets placed into the trust). It outlines the assets in the trust, the beneficiaries, and the conditions under. Web an irrevocable trust agreement is a legal document that allows the transfer of assets into a trust.

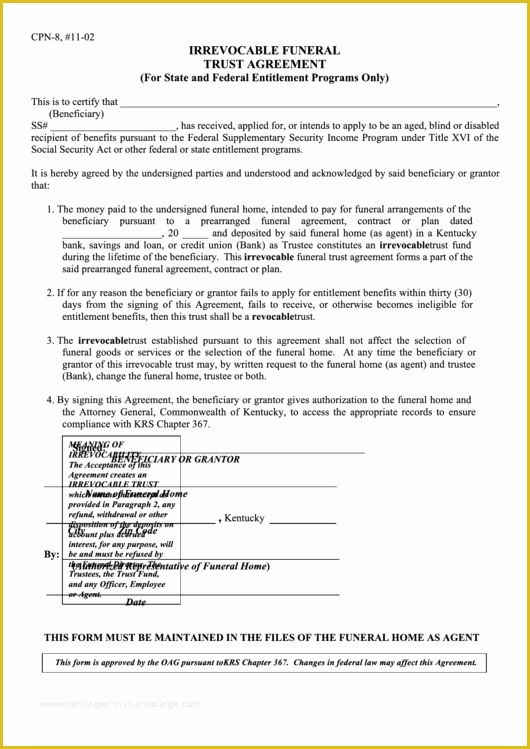

Irrevocable Trust Form Fill Out and Sign Printable PDF Template signNow

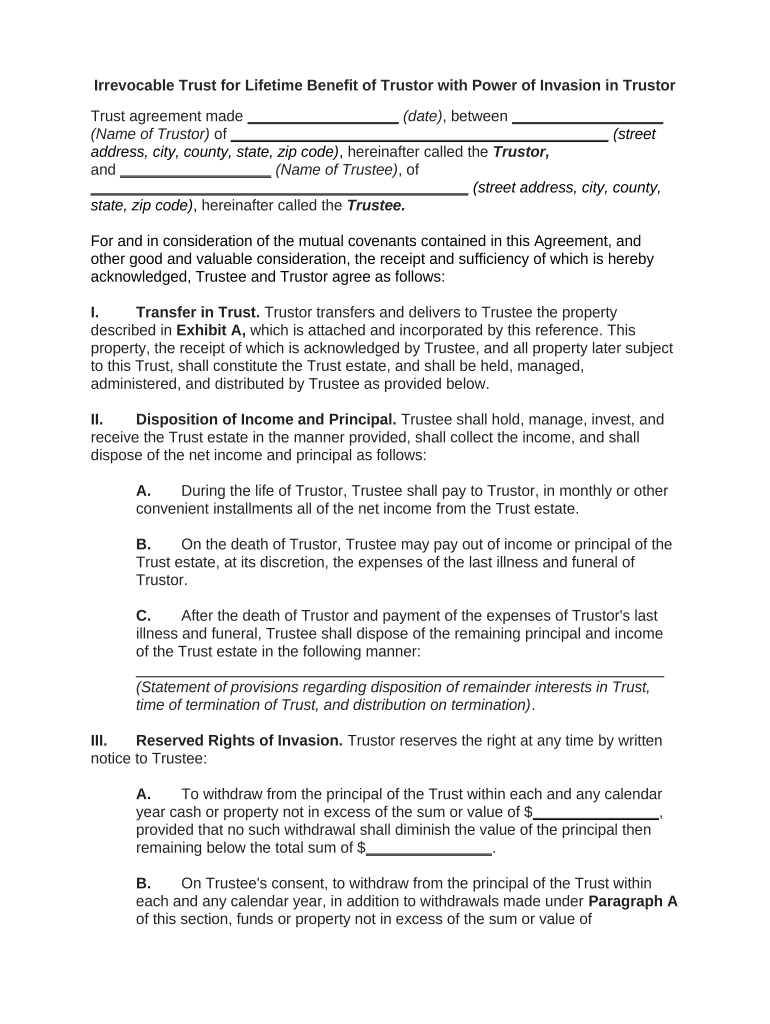

Printable Trust Forms Fill Out and Sign Printable PDF Template

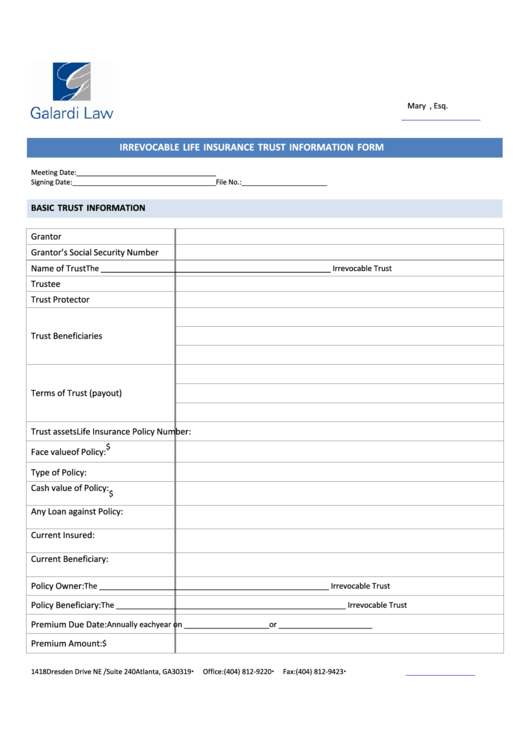

Irrevocable Trust Fill Online, Printable, Fillable, Blank pdfFiller

Living Trust Irrevocable Trust Irrevocable Form US Legal Forms

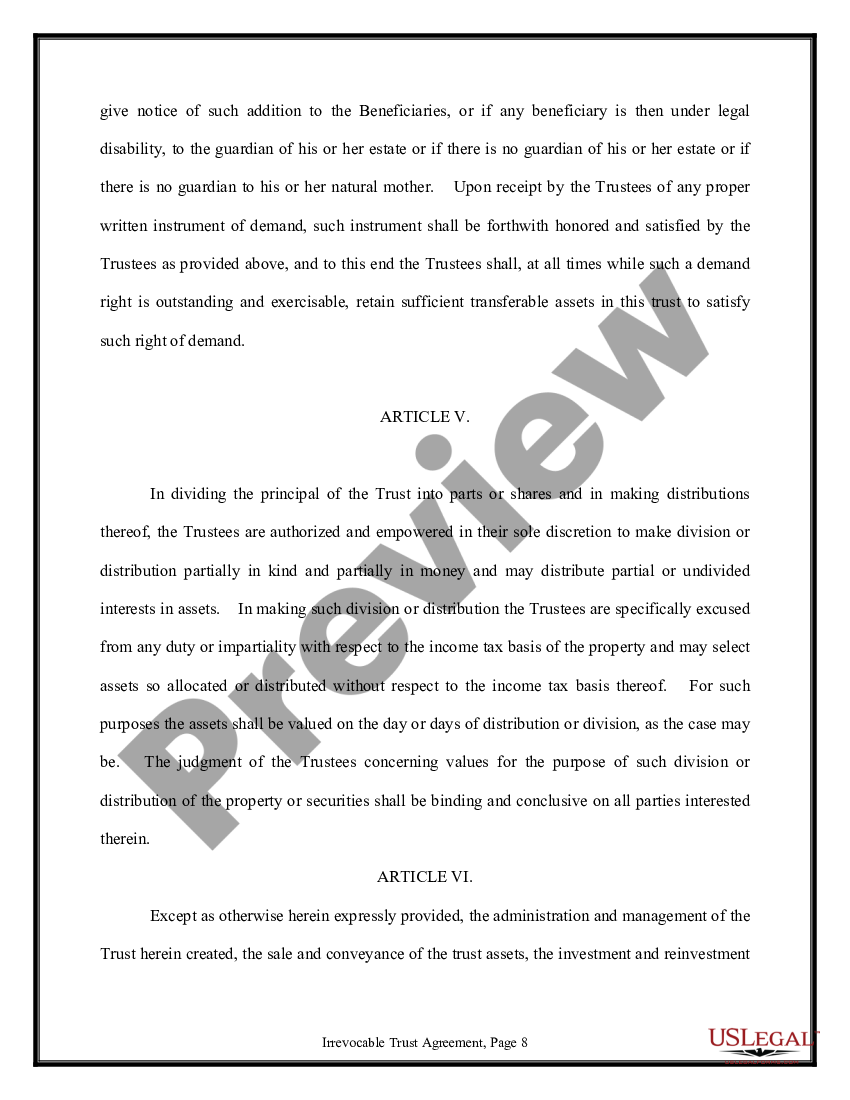

Trust Agreement Irrevocable Irrevocable Agreement US Legal Forms

Declaration Of Trust Template

Irrevocable Trustors Fill Online, Printable, Fillable, Blank pdfFiller

Irrevocable Trust Sample Form Fill Out and Sign Printable PDF

Top 5 Irrevocable Trust Form Templates free to download in PDF format

Free Printable Irrevocable Trust Form

You Will Be Permanently Transferring Control Of Any Assets Placed Into The Trust To The Person Managing The Trust—Referred To As The Trustee.

Us Legal Form's Irrevocable Trust Forms Are Professionally Drafted And Affordable.

Find Out How Two Types Of Trusts Differ And Decide Which Is More Appropriate And Beneficial For Your Current Financial Standing And Your Beneficiaries:

Essentially, An Irrevocable Trust Removes Certain Assets From A Grantor’s Taxable Estate, And These.

Related Post: