Irrevocable Living Trust Template

Irrevocable Living Trust Template - Web an advantage of a living trust, also known as revocable living trust, is that it does not have to go through the standard probate process, so funds can be distributed to cover your death expenses or to care for minors or disabled family members. As the name suggests, these trusts can be changed or revoked at any time. Web updated february 27, 2024. This agreement made and entered into the ___ day of __ , __ , by. The trustee of a revocable trust retains control of the trust property during their lifetime. A living trust form is an official document used by an individual (grantor) to transfer the benefits generated by or from their assets to another person (beneficiary) in the event that they pass away or become incapacitated. This irrevocable living trust agreement, (hereinafter “trust”), is being made this _____ day of _____, 20 _____, by and between _____ of _____, _____ county, _____, as the trustor, and serving as trustee. What type of property do you want to put in your living trust? The purpose of an irrevocable trust is to move the assets from the. You'll give up control over the trust property with an irrevocable living trust, but you determine the uses of the trust assets. Yes, an irrevocable trust can be used for assisted living to protect assets for seniors claiming public funding. What is a revocable living trust? Content on this site is for general information purposes, should not be relied upon as legal advice, and does not constitute a contract or an attorney client relationship. You can add more property types later. It. You'll give up control over the trust property with an irrevocable living trust, but you determine the uses of the trust assets. Web irrevocable trust template. Web an advantage of a living trust, also known as revocable living trust, is that it does not have to go through the standard probate process, so funds can be distributed to cover your. You will need a pdf viewer to open this document. However, the trust can’t be used to pay for assisted living. It is a legal document you create that allows you to separate the ownership of your property from the control of your property. Web revocable trusts and irrevocable trusts are created through contracts in which a person is appointed. Web irrevocable trust template. Web irrevocable living trust. Click the link below to download pdf viewing software. As the name suggests, these trusts can be changed or revoked at any time. A living trust, or inter vivos trust, is a legal arrangement that is created while you are alive. The settlor of the trust is usually named the trustee of a revocable trust. To confuse things further, a testamentary is a trust that is made during a grantor's life, but does not go into effect until the grantor's death. A testamentary trust is a trust that is created and funded at your death. Web irrevocable living trust agreement. What. However, the trust can’t be used to pay for assisted living. Web updated february 27, 2024. W i t n e s s e t h: This article will explain irrevocable trusts and their application to illinois estate planning. Web irrevocable trust template. The purpose of an irrevocable trust is to move the assets from the. These terms can get confusing; You will need a pdf viewer to open this document. Web an advantage of a living trust, also known as revocable living trust, is that it does not have to go through the standard probate process, so funds can be distributed to. Web an irrevocable trust is a trust that you create during your lifetime but that you relinquish the power to modify. Web irrevocable trust template. What is a living trust? A living trust form is an official document used by an individual (grantor) to transfer the benefits generated by or from their assets to another person (beneficiary) in the event. Establishes the terms and conditions of an irrevocable trust. W i t n e s s e t h: These terms can get confusing; Web free revocable living trust template | lawdepot (us) answer a few simple questions print and download instantly it takes just 5 minutes. Content on this site is for general information purposes, should not be relied. And between _____ , an adult resident of ___ , county, __ _____ (hereafter referred to as “grantor”) and _ (hereafter referred to as “trustees”). Web updated february 27, 2024. Web an irrevocable trust is a trust that you create during your lifetime but that you relinquish the power to modify. Whereas, the grantor desires to create an irrevocable trust. A revocable living trust gives the grantor (the person creating the trust) flexibility in what assets they want to hold in their trust. It outlines the assets in the trust, the beneficiaries, and the conditions under. Web revocable trusts and irrevocable trusts are created through contracts in which a person is appointed as “trustee” to hold title to property, with an obligation to use the property for the. Web a revocable trust is also called a living trust. A trust is a legal entity that can own property separate from its creator, known as the grantor. Click the link below to download pdf viewing software. Web an advantage of a living trust, also known as revocable living trust, is that it does not have to go through the standard probate process, so funds can be distributed to cover your death expenses or to care for minors or disabled family members. Whereas, the grantor desires to create an irrevocable trust of the property described in schedule a hereto, together with such monies, securities and other assets as the trustees hereafter may hold or acquire hereunder (said property, monies, securities and other assets, together with any additions thereto received pursuant. Web irrevocable trust template. As the name suggests, these trusts can be changed or revoked at any time. Web irrevocable living trust. You will need a pdf viewer to open this document. Web jane doe irrevocable trust. It can be changed or revoked at any point during your lifetime. Content on this site is for general information purposes, should not be relied upon as legal advice, and does not constitute a contract or an attorney client relationship. Who controls the assets of a trust?

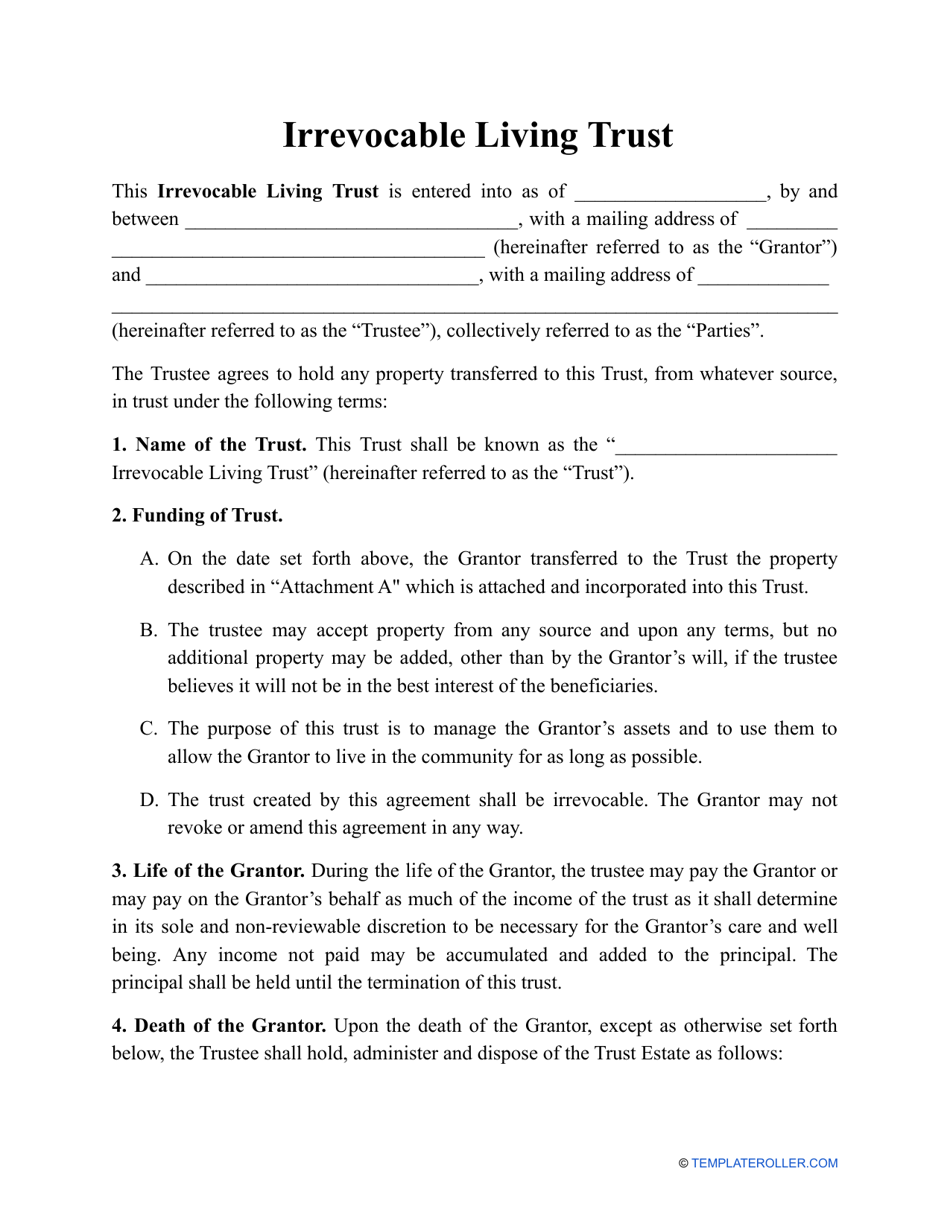

Irrevocable Living Trust Template Download Printable PDF Templateroller

Irrevocable Living Trust Template Fill Out, Sign Online and Download

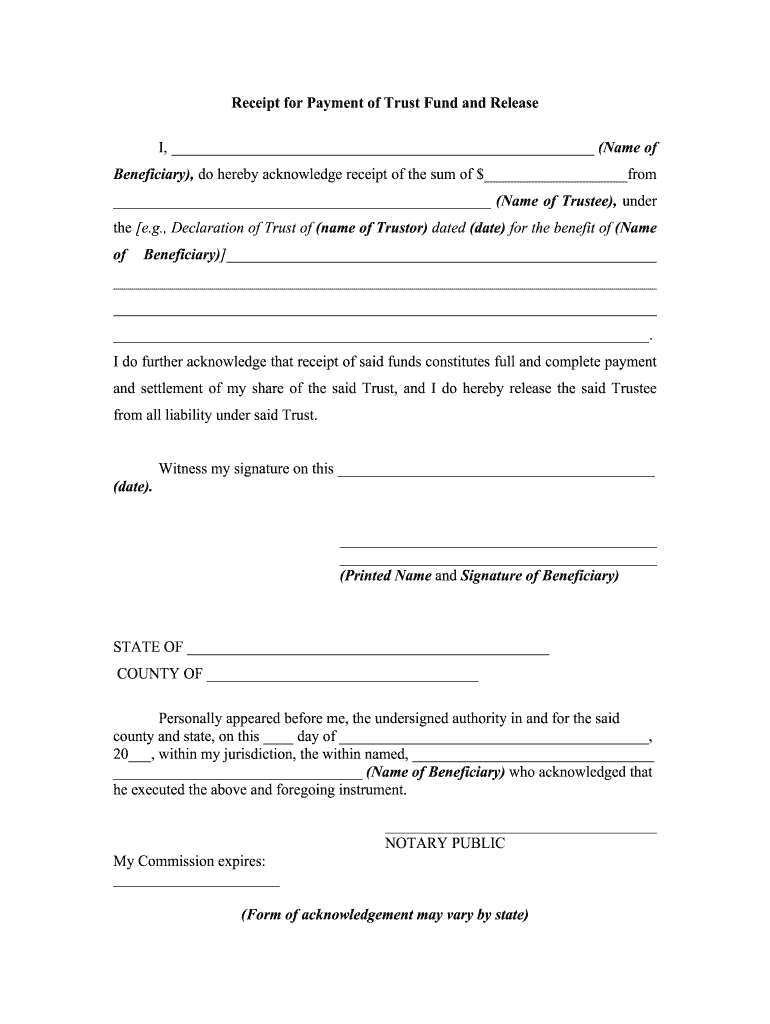

FREE 10+ Sample Living Trust Form Templates in PDF Word

FREE 10+ Sample Living Trust Form Templates in PDF Word

living trust irrevocable Doc Template pdfFiller

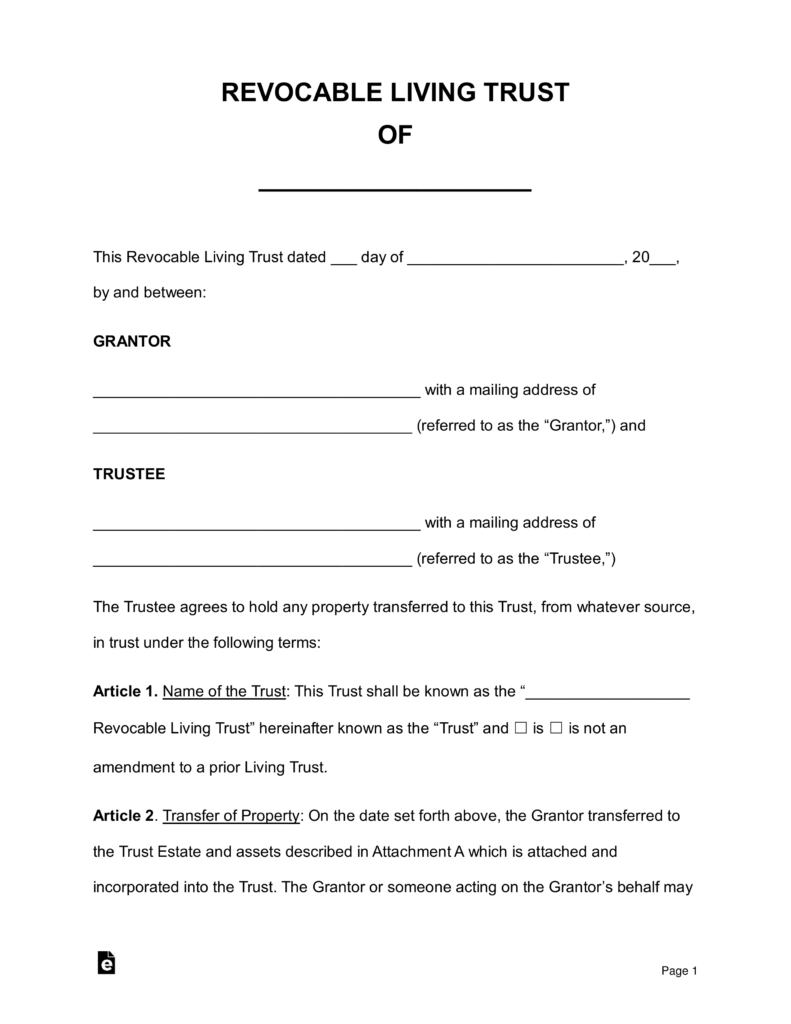

Free Revocable Living Trust Forms PDF Word EForms Living Will Forms

Revocable Living Trust Form Create a Revocable Living Trust

FREE 8+ Sample Living Trust Forms in PDF MS Word

Free Printable Irrevocable Trust Form Printable World Holiday

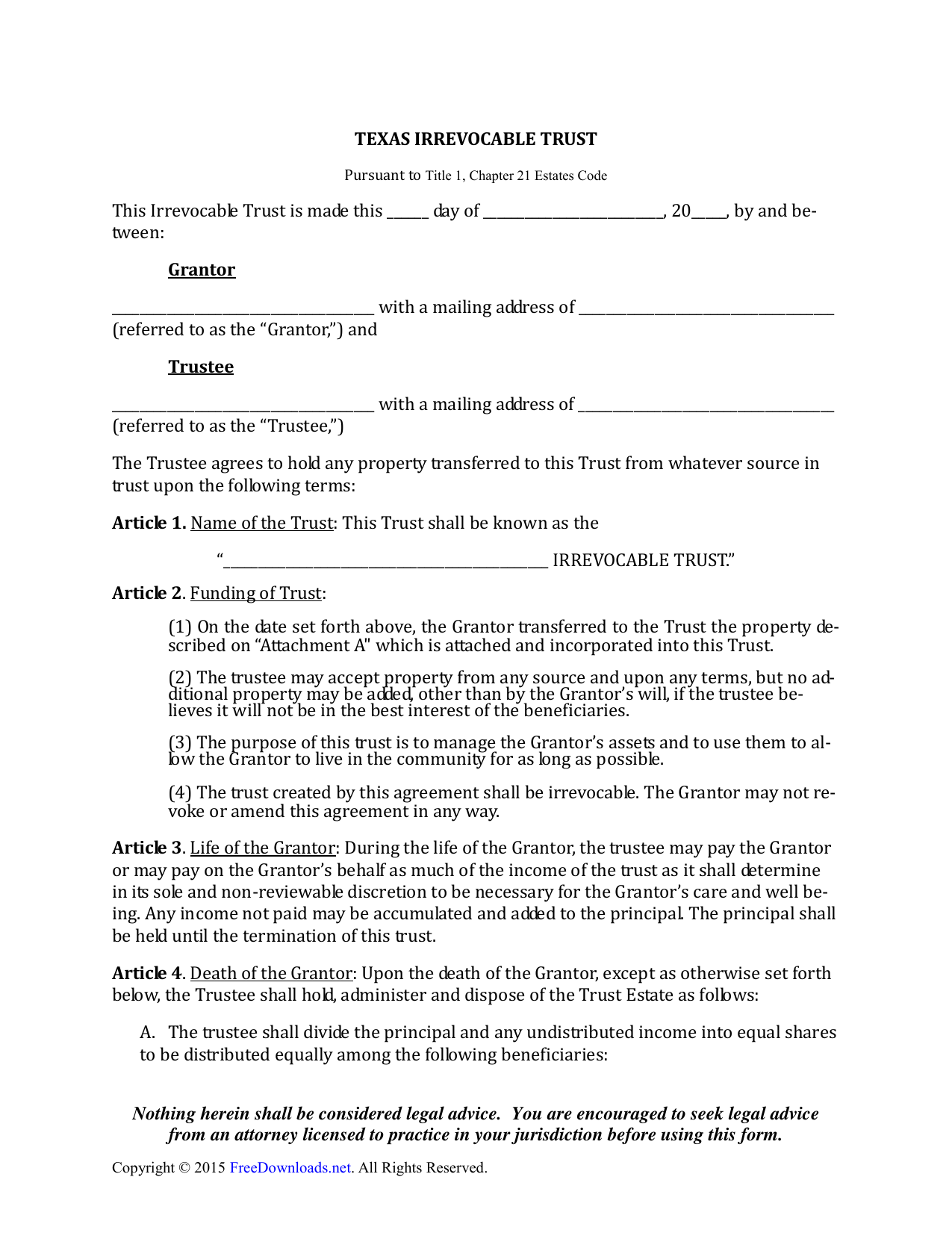

Download Texas Irrevocable Living Trust Form PDF RTF Word

Web Free Revocable Living Trust Template | Lawdepot (Us) Answer A Few Simple Questions Print And Download Instantly It Takes Just 5 Minutes.

Irrevocable Living Trust Template Is Often Used In Trust Form Templates, Family Trust, Revocable Trust, Fiduciary Duty, Asset Protection,.

And Between _____ , An Adult Resident Of ___ , County, __ _____ (Hereafter Referred To As “Grantor”) And _ (Hereafter Referred To As “Trustees”).

Web Download, Fill In And Print Irrevocable Living Trust Template Pdf Online Here For Free.

Related Post: