Irr Template

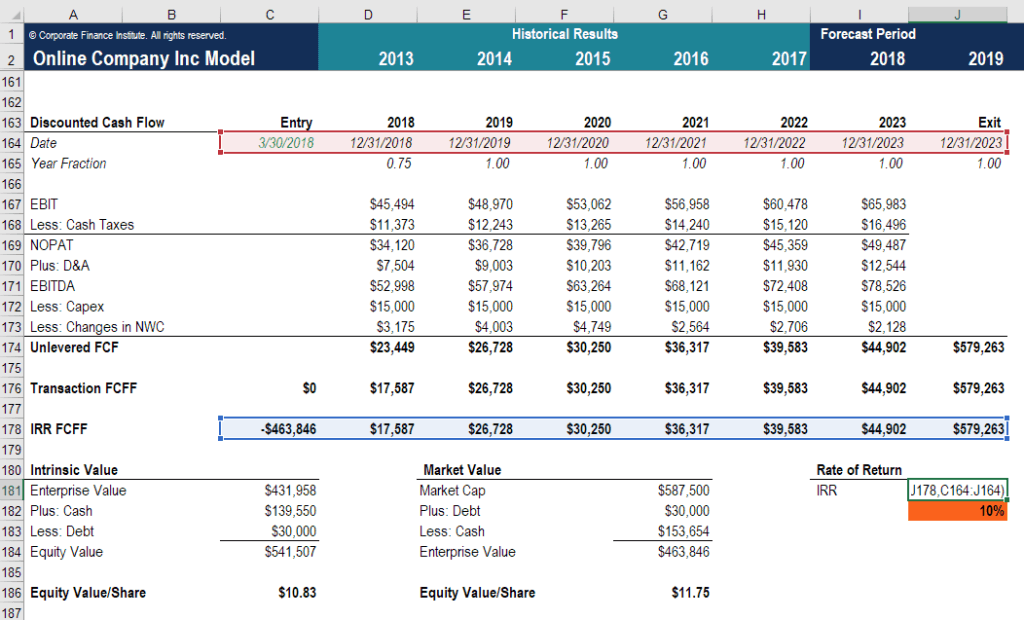

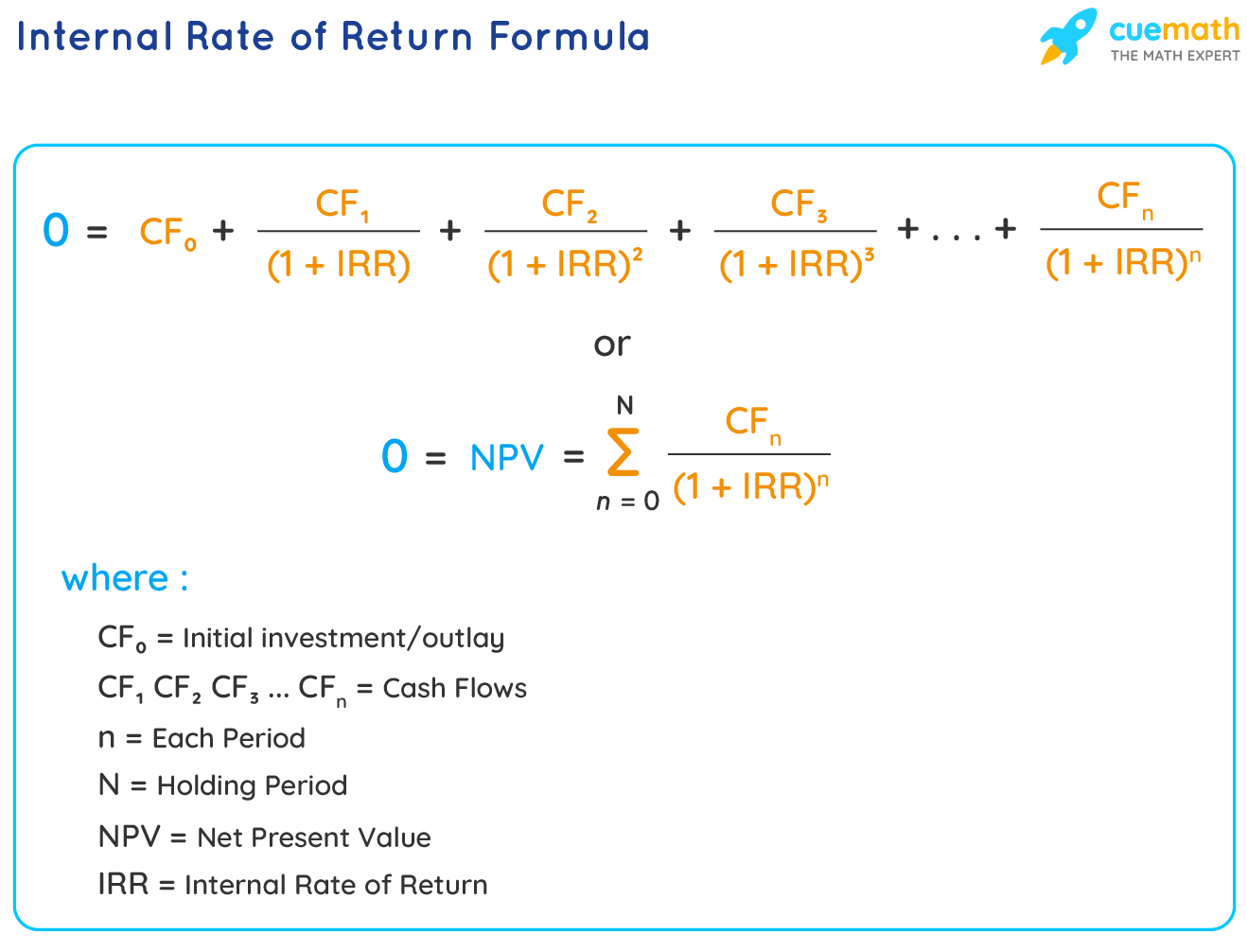

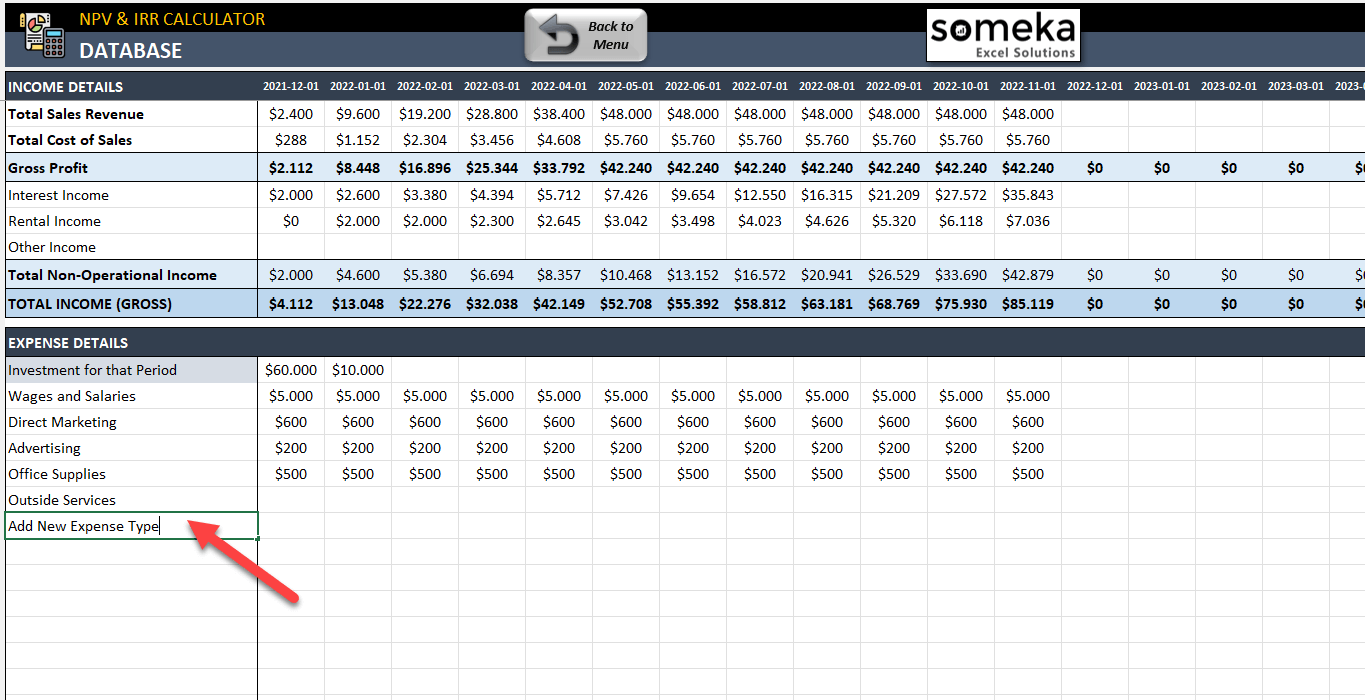

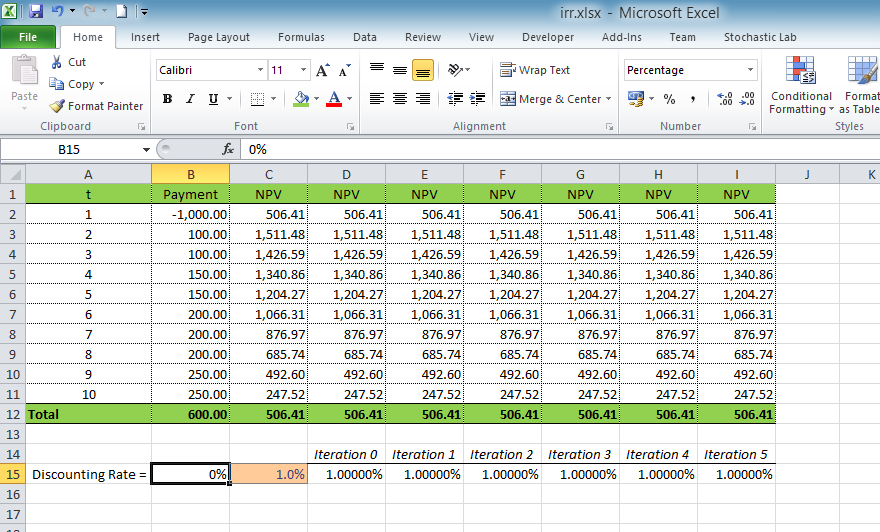

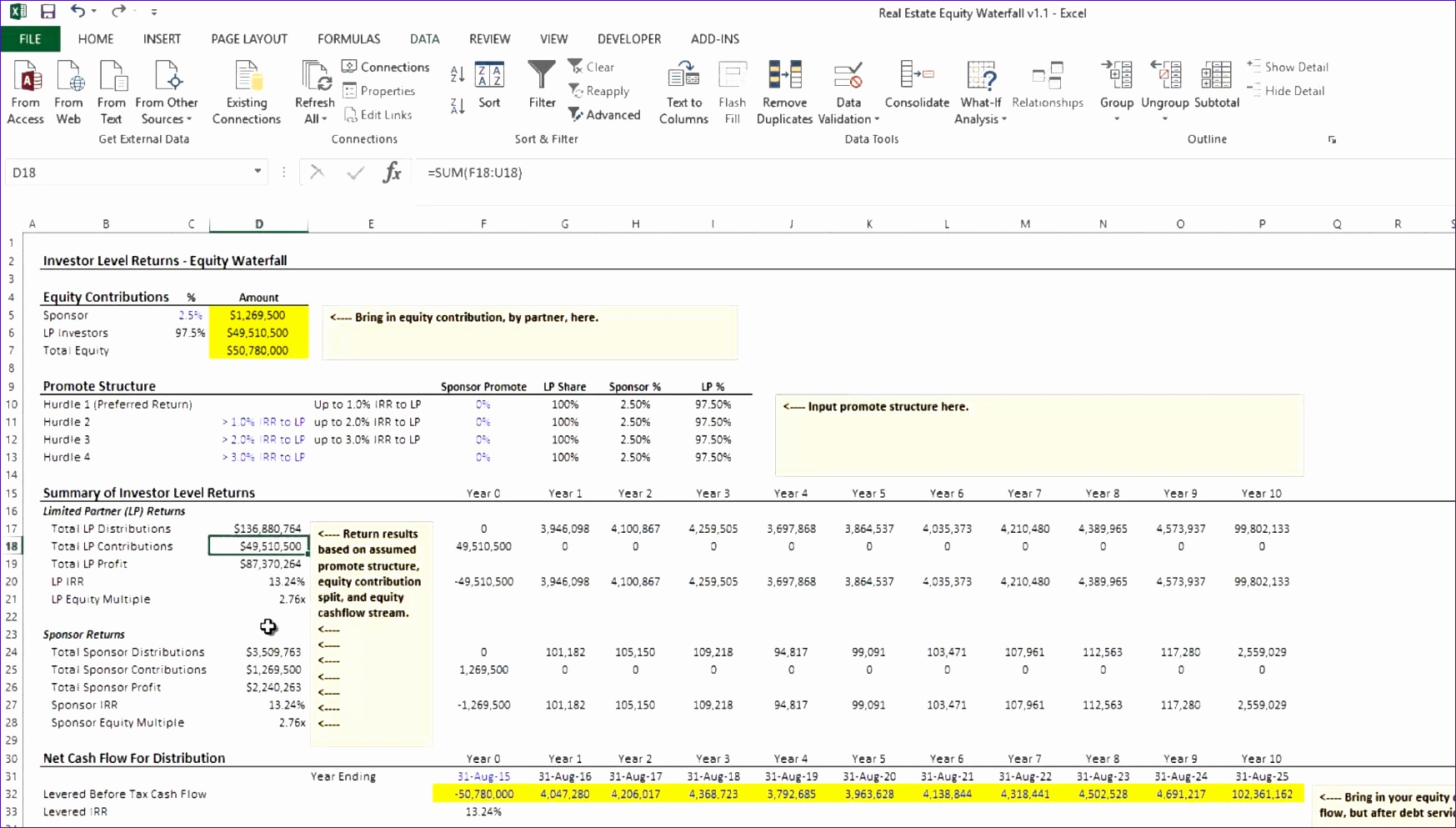

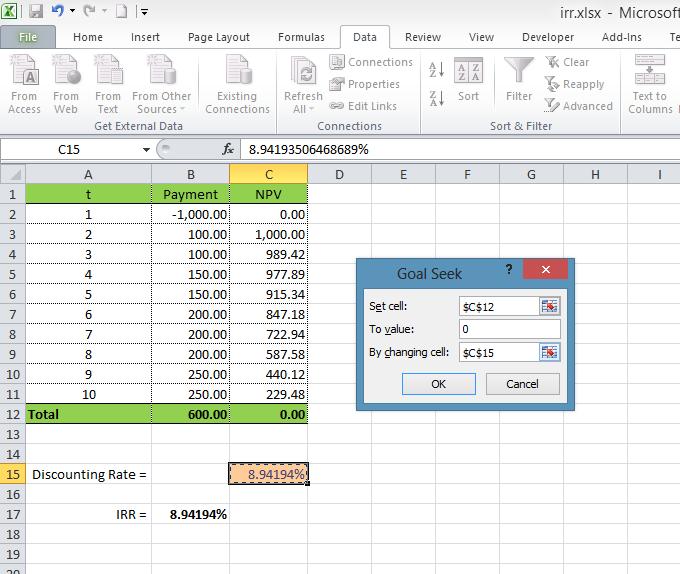

Irr Template - How to calculate & formula | biggerpockets blog. Web internal rate of return (irr), also called time adjusted rate of return, is defined as the rate of interest that equates ( i ) with the ( pv ) of future cash inflows. Below is a preview of. Next time that someone asks you what the irr of your project is, do ask him in return (if circumstances permit) to explain to you what the irr is. Web download the essential excel templates to perform a variety of roi tasks, including content marketing metrics, website roi analysis, healthcare quality initiative roi, event roi calculator, plm roi calculator, it roi, cost avoidance calculator, and tco roi. Web r = internal rate of return. You can think of it as a special case of npv, where the rate of return that is calculated is the interest rate corresponding to a 0 (zero) net present value. The irr is used to make the npv of cash flows from a project/investment equal to zero. Using the xirr function to calculate irr with dates. Businesses use it to determine which discount rate makes the present value of. Using the xirr function to calculate irr with dates. Next time that someone asks you what the irr of your project is, do ask him in return (if circumstances permit) to explain to you what the irr is. Using the mirr function to calculate irr with different interest rates. Cash flow roi and template. Web the tutorial shows how to. How to calculate irr with example. Businesses use it to determine which discount rate makes the present value of. The internal rate of return (irr) is a core component of capital budgeting and corporate finance. You will also learn how to create an internal rate of return template to do all irr calculations automatically. You can think of it as. Other ways to calculate irr in excel. Irr is a discount rate that makes the net present value (npv). The irr function in excel uses the same series of cash flows as the npv, but it must have at least one negative (usually at t=0) and one positive value and it requires an initial guess at the rate because the. In other words, it is the expected compound annual rate of return that will be earned on a project or investment. Below is a screenshot of the xirr vs. Web download the essential excel templates to perform a variety of roi tasks, including content marketing metrics, website roi analysis, healthcare quality initiative roi, event roi calculator, plm roi calculator, it. Npv = net present value. Where n is the number of cash flows, and i is the interest or discount rate. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. Internal rate of return (irr) explained. Basically, the irr can be defined as the interest rate that equates. You can think of it as a special case of npv, where the rate of return that is calculated is the interest rate corresponding to a 0 (zero) net present value. Cash flow roi and template. Irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. The irr function. Lbo returns analysis (irr and mom) expand +. What is the internal rate of return (irr)? The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. What is the irr function? Next time that someone asks you what the irr of your project is, do. Find out when the investment yields positive irr. Using irr function to compare multiple projects. Where n is the number of cash flows, and i is the interest or discount rate. Irr is based on npv. Lbo returns analysis (irr and mom) expand +. Internal rate of return (irr). You will also learn how to create an internal rate of return template to do all irr calculations automatically. Irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. Use our easy formula to get started. Web the internal rate of return or irr. Next time that someone asks you what the irr of your project is, do ask him in return (if circumstances permit) to explain to you what the irr is. Web the tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Using the xirr function to calculate irr with dates. How to. Use our easy formula to get started. Lbo returns analysis (irr and mom) expand +. The internal rate of return (irr) is the discount rate that makes the net present value (npv) of a project zero. Web internal rate of return (irr): Suppose a company plans to invest in a project with initial investment amount of $10000. The irr function in excel uses the same series of cash flows as the npv, but it must have at least one negative (usually at t=0) and one positive value and it requires an initial guess at the rate because the calculation is iterative. Web here, we will discuss how to calculate the irr in excel, formula, significance, and uses as well as example templates that you can use as a reference. What is the irr function? What is the internal rate of return (irr)? Irr is a discount rate that makes the net present value (npv). Web this capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net present value (npv), internal rate of return (irr), and payback period. What is the internal rate of return (irr)? What is the internal rate of return (irr)? It is used to estimate the profitability of a potential investment. The expected net cash flow for three years are to be $4500,$4000 and $5500 repectively. Calculating irr for irregular cashflows.

11 Irr Template Excel Excel Templates

Internal Rate of Return (IRR) How to use the IRR Formula

Irr Formula

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

8 Irr Calculator Excel Template Excel Templates

How To Calculate Irr In Excel For Sip Haiper

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

Irr Template

8 Npv Irr Calculator Excel Template Excel Templates

Web Irr Calculator | Excel Template.

The Internal Rate Of Return (Irr) Is The Discount Rate Providing A Net Value Of Zero For A Future Series Of Cash Flows.

Syntax For The Irr Function.

Calculating Irr For Varying Cash Flows.

Related Post: