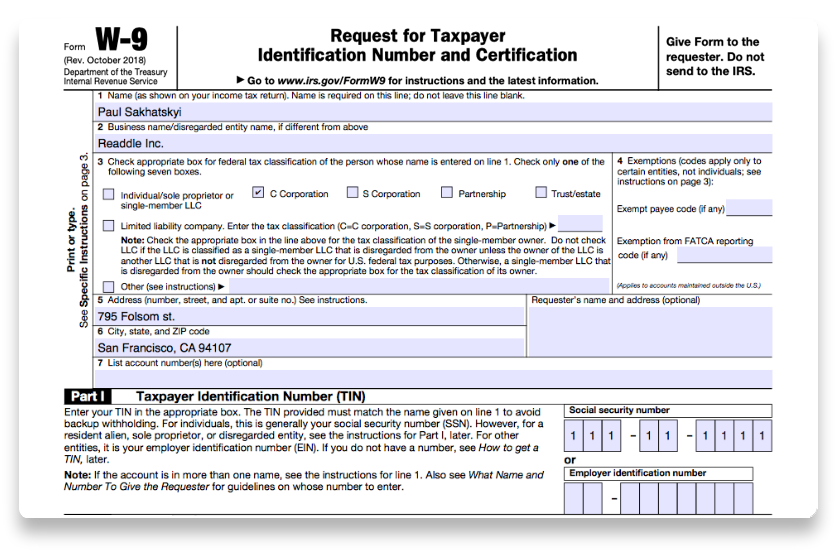

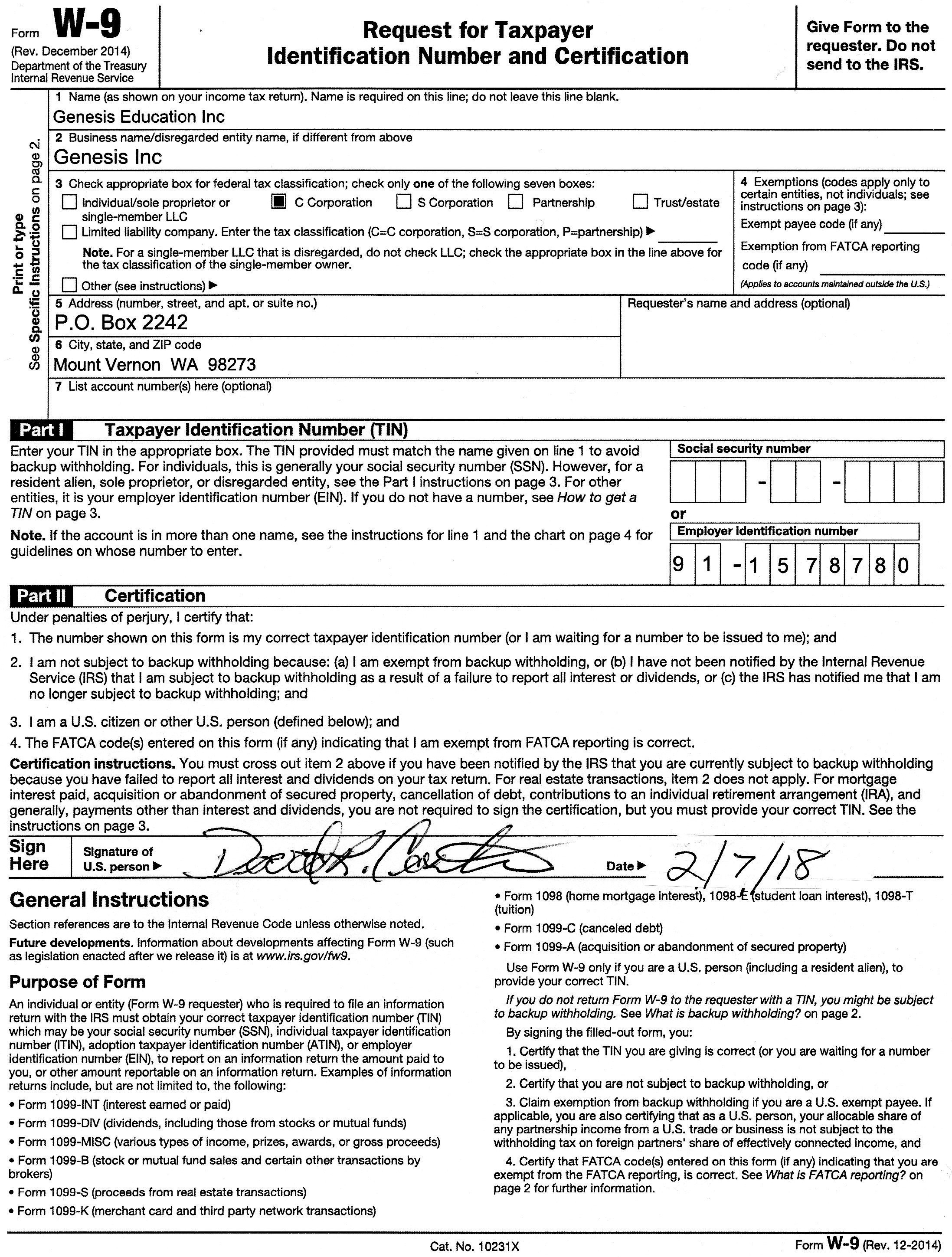

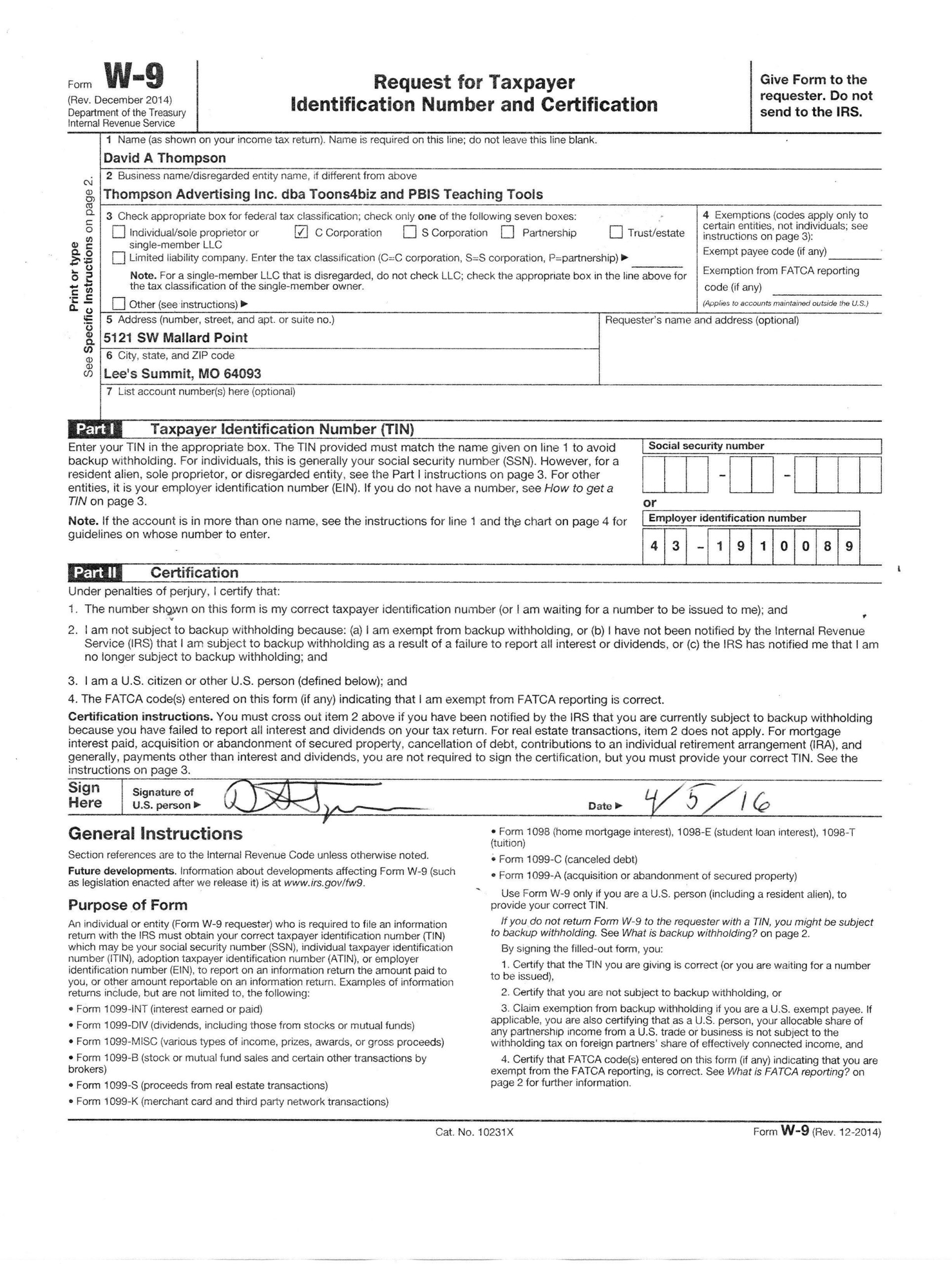

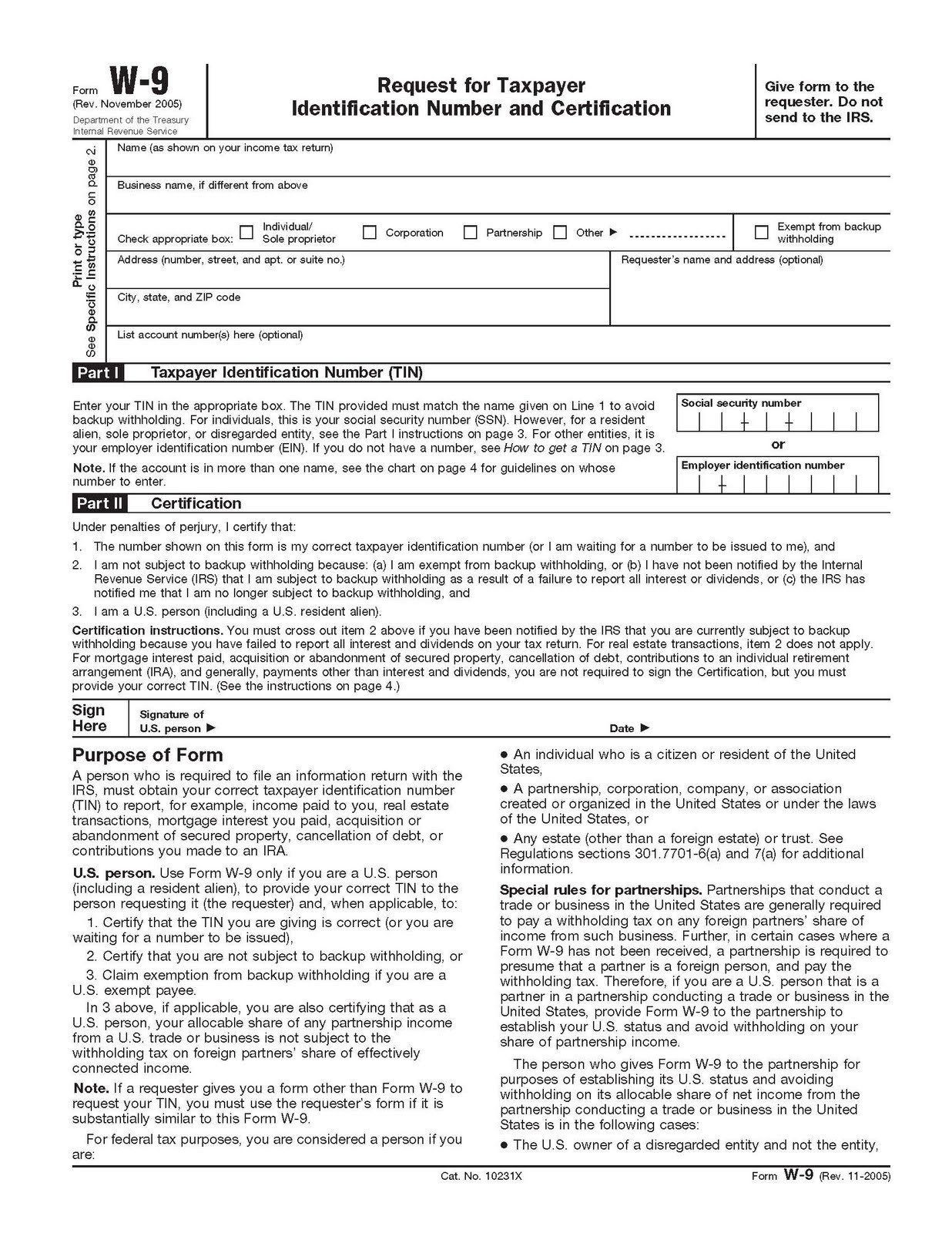

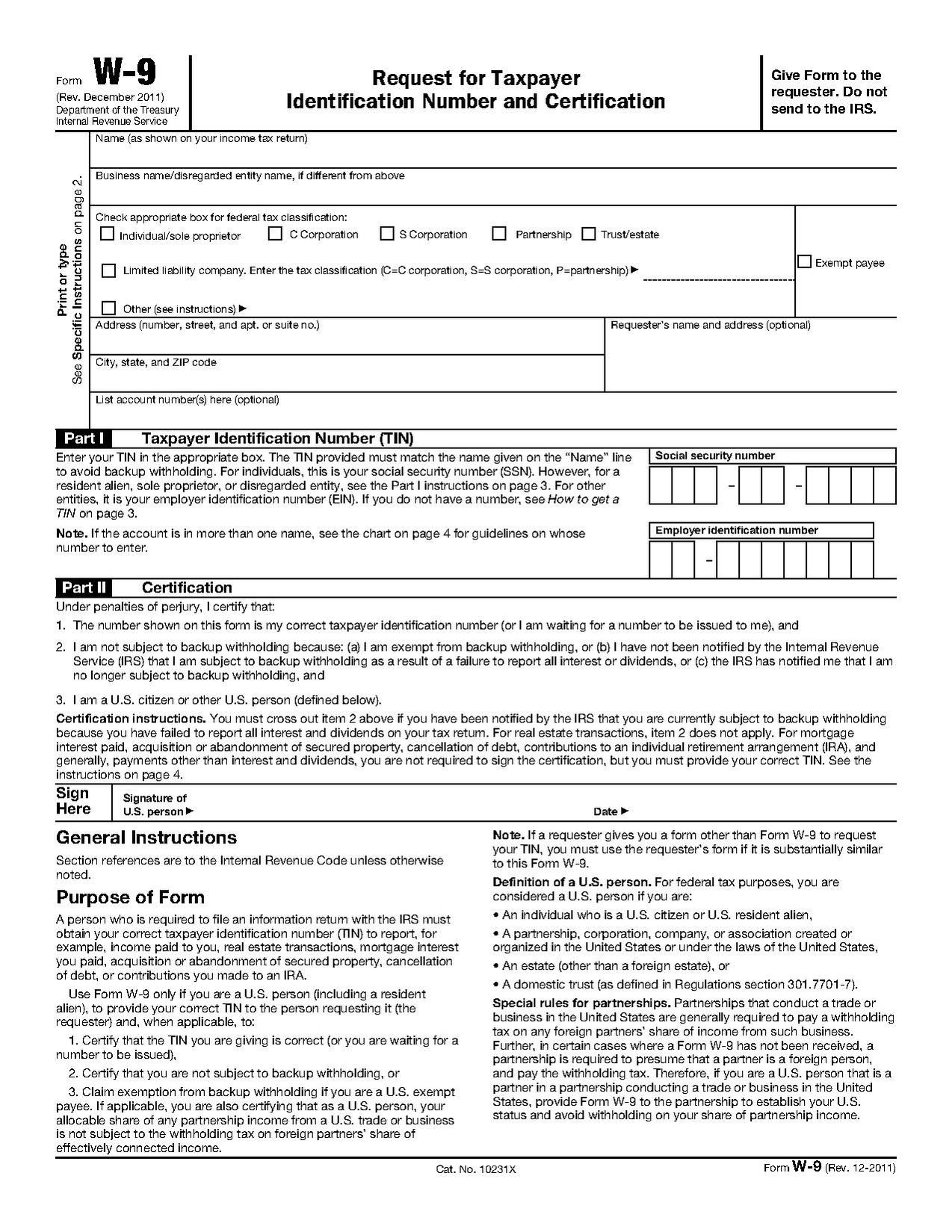

Free W 9 Form Printable

Free W 9 Form Printable - To clarify this point, the name on line 1 must match with the name the irs associates with your tin. October 2018) department of the treasury internal revenue service. Do not send to the irs. Ago to www.irs.gov/formw9 for instructions and the latest information. Give form to the requester. Request for taxpayer identification number and certification. If you are running a sole proprietorship you would enter your name. It is commonly required when making a payment and withholding taxes are not being deducted. Request for taxpayer identification number and certification. For instructions and the latest information. Request for taxpayer identification number and certification. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. If you are running a sole proprietorship you would enter your name. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Person (including a resident alien), to. October 2018) department of the treasury internal revenue service. See what is backup withholding, later. For instructions and the latest information. It is commonly required when making a payment and withholding taxes are not being deducted. Request for taxpayer identification number and certification. If you are running a sole proprietorship you would enter your name. For instructions and the latest information. It is commonly required when making a payment and withholding taxes are not being deducted. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. October 2018) department of the treasury internal revenue service. If you are running a sole proprietorship you would enter your name. It is commonly required when making a payment and withholding taxes are not being deducted. For instructions and the latest information. Request for taxpayer identification number and certification. October 2018) department of the treasury internal revenue service. See what is backup withholding, later. Do not send to the irs. October 2018) department of the treasury internal revenue service. For instructions and the latest information. October 2018) department of the treasury internal revenue service. It is commonly required when making a payment and withholding taxes are not being deducted. Give form to the requester. Request for taxpayer identification number and certification. If you are running a sole proprietorship you would enter your name. Request for taxpayer identification number and certification. Do not send to the irs. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Person (including a resident alien), to provide your correct tin. October 2018) department of the treasury internal revenue service. See what is backup withholding, later. Do not send to the irs. For instructions and the latest information. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. Person (including a resident alien), to provide your correct tin. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. October 2018) department of the treasury internal revenue service. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Give form to the requester. Person (including a resident alien), to provide your correct tin. For instructions and the latest information. If you are running a sole proprietorship you would enter your name. Afterward, you can print or save the completed form on your computer or mobile to send to your client. Person (including a resident alien), to provide your correct tin. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses,. October 2018) department of the treasury internal revenue service. Give form to the requester. Person (including a resident alien), to provide your correct tin. For instructions and the latest information. Do not send to the irs. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. The form asks for information such as the ic's name, address, social security number (ssn), and more. Request for taxpayer identification number and certification. If you are running a sole proprietorship you would enter your name. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. It is commonly required when making a payment and withholding taxes are not being deducted. October 2018) department of the treasury internal revenue service.

Fillable And Printable W 9 Form Form Resume Examples

Blank W 9 Editable Online PDF Forms to Fill out and Print

Downloadable form W 9 Printable W9 Printable Pages Tax forms, Irs

Irs Form W 9 Fillable Pdf Printable Forms Free Online

2020 W9 Blank Form Calendar Template Printable

W9 Forms 2021 Printable Pdf Example Calendar Printable

How to Submit Your W 9 Forms Pdf Free Job Application Form

Free Printable Blank W9 Form 2021 Calendar Template Printable

Form W9 Template. Create A Free Form W9 Form.

W 9 Form Pdf Online

Request For Taxpayer Identification Number And Certification.

Ago To Www.irs.gov/Formw9 For Instructions And The Latest Information.

See What Is Backup Withholding, Later.

Afterward, You Can Print Or Save The Completed Form On Your Computer Or Mobile To Send To Your Client.

Related Post: