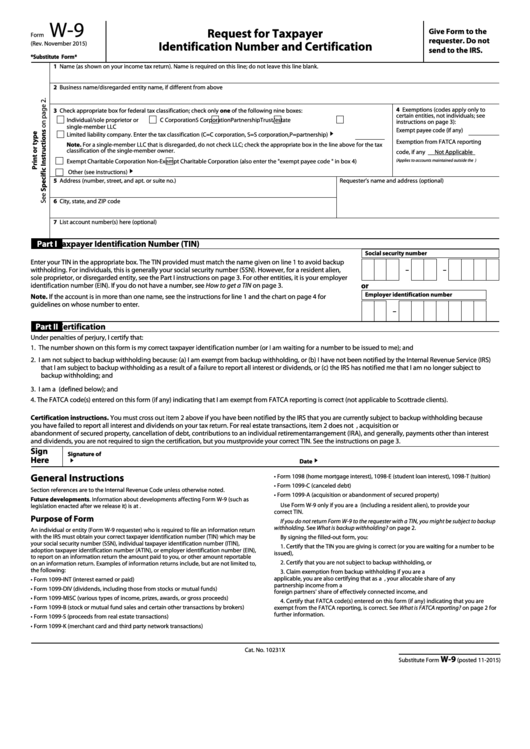

Form W 9 Printable

Form W 9 Printable - Section references are to the internal revenue code. If you are running a sole proprietorship you would enter your name. It is commonly required when making a payment and withholding taxes are not being deducted. March 2024) department of the treasury internal revenue service. Web october 23, 2023 by hung nguyen. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable. Request for taxpayer identification number and certification. Contributions you made to an ira. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. Person date employer identification number print or type. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Certify that you are not subject to backup withholding, or 3. Person date employer identification number print or type. Person (including a resident alien), to provide your correct tin. March 2024) department. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. Independent contractors who were paid at least $600 during the year. Person (including a resident alien), to provide your correct tin. Section references are to the internal revenue code. If you are a u.s. Acquisition or abandonment of secured property. Request for taxpayer identification number and certification. Contributions you made to an ira. Person date employer identification number print or type. Certify that you are not subject to backup withholding, or 3. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Name (as shown on your income tax return). Go to www.irs.gov/formw9 for instructions and the latest information. If you are a u.s. If you are running a sole proprietorship you would enter your name. Tax information center irs forms. March 2024) department of the treasury internal revenue service. Person (including a resident alien), to provide your correct tin. Give form to the requester. Go to www.irs.gov/formw9 for instructions and the latest information. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Name is required on this line; Go to www.irs.gov/formw9 for instructions and the latest information. Go to www.irs.gov/formw9 for instructions and the latest information. If you are a u.s. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. Name (as shown on your income tax return). Owner of a disregarded entity and not the entity, the u.s. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Person date employer identification number. October 2018) department of the treasury internal revenue service. Status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the united states is in the following cases: Contributions you made to an ira. Certify that you are not subject to backup withholding, or 3. Certify that the tin you are. March 2024) department of the treasury internal revenue service. Sign here signature of u.s. Web october 23, 2023 by hung nguyen. Go to www.irs.gov/formw9 for instructions and the latest information. The form asks for information such as the ic's name, address, social security number (ssn), and more. March 2024) department of the treasury internal revenue service. Section references are to the internal revenue code. Do not leave this line blank. For federal tax purposes, you are considered a u.s. Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. The form asks for information such as the ic's name, address, social security number (ssn), and more. If an account holder fails to provide its tin, then the withholding rate is 30%. Person (including a resident alien), to provide your correct tin. See what is backup withholding, later. Web here’s what to know. Request for taxpayer identification number and certification. Acquisition or abandonment of secured property. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. Status and avoid section 1446 withholding on your share of partnership income. Owner of a disregarded entity and not the entity, the u.s. March 2024) department of the treasury internal revenue service. Certify that you are not subject to backup withholding, or 3. Section references are to the internal revenue code. Sign here signature of u.s. March 2024) request for taxpayer identification number and certiication. Go to www.irs.gov/formw9 for instructions and the latest information.

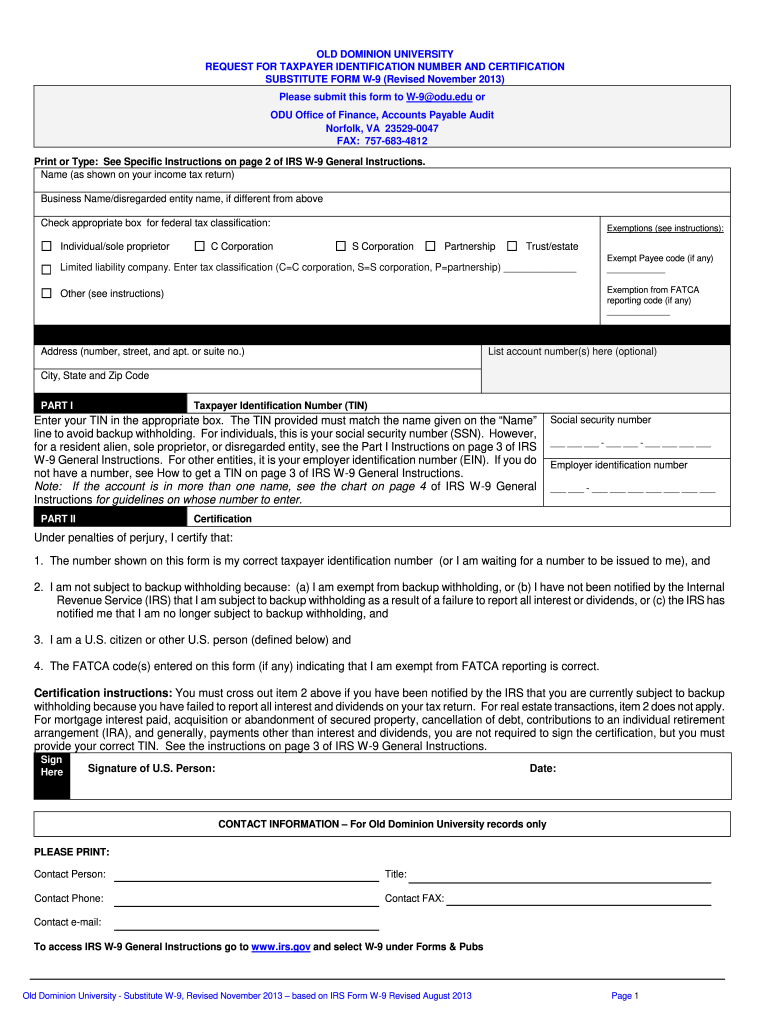

W9 Fillable 20132024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

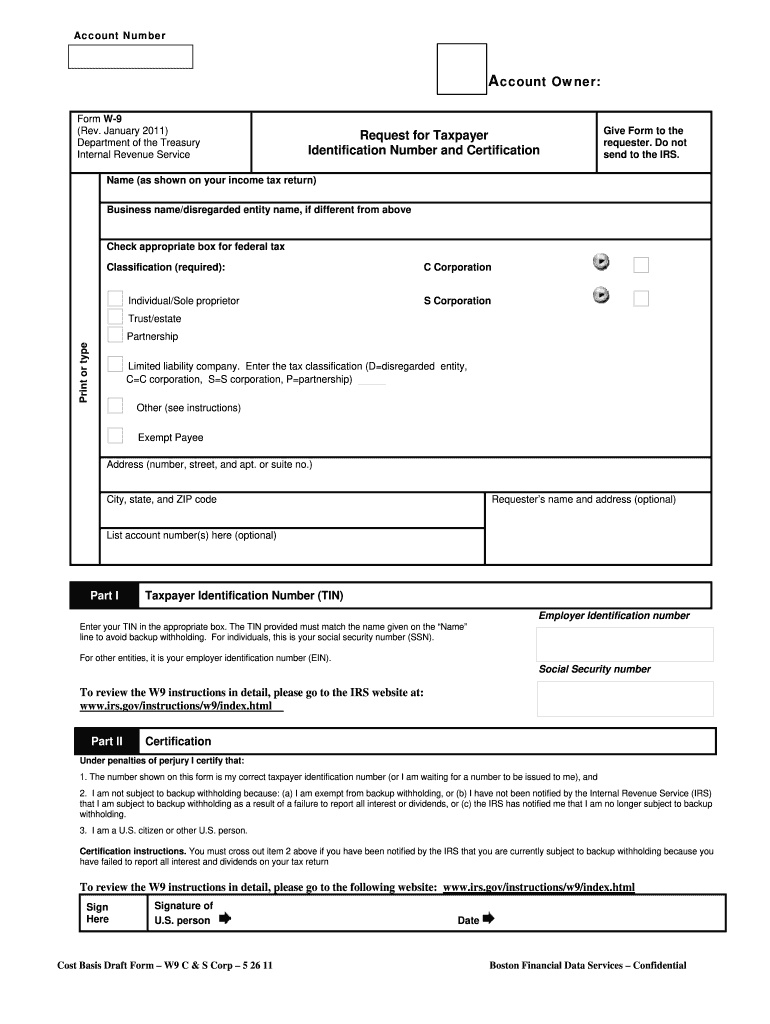

W9 Editable PDF Form Fill Out and Sign Printable PDF Template signNow

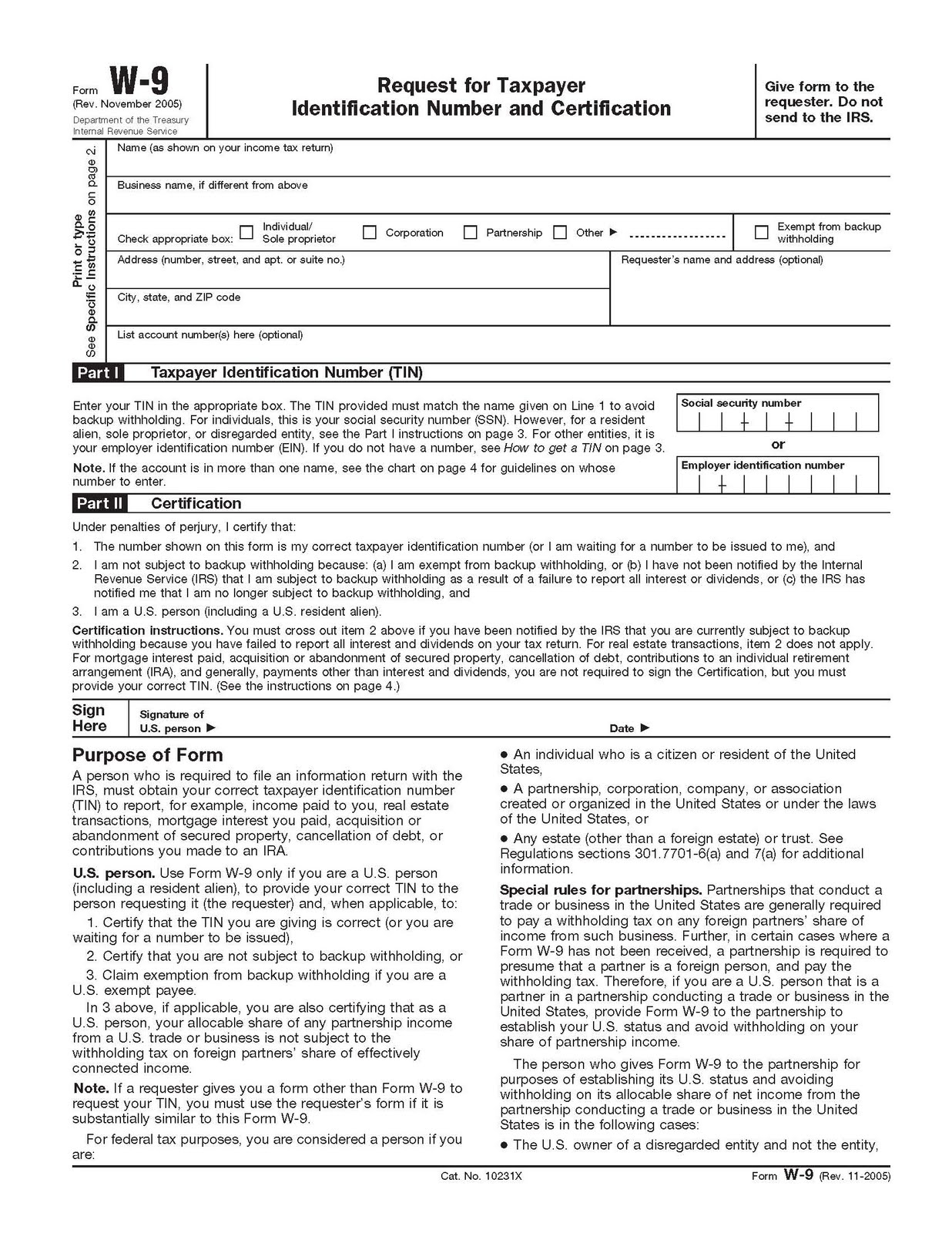

Blank Printable W9 Form

W 9 Form 2020 Printable Pdf Irs Calendar Printable Free

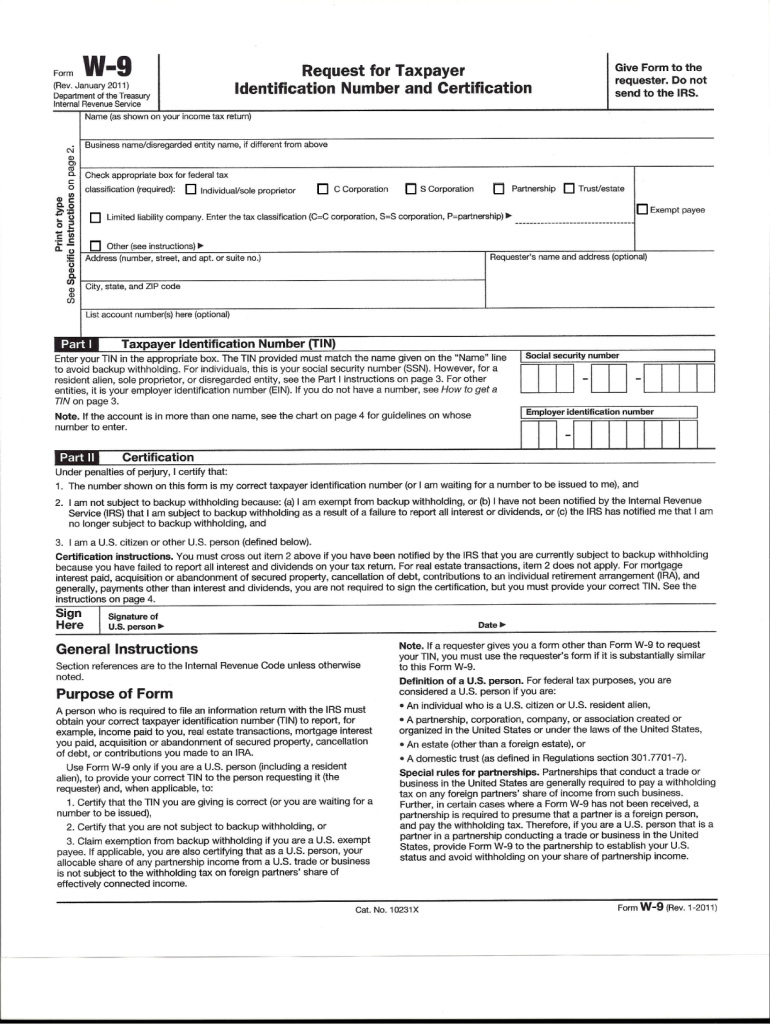

Blank W9 Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Form W9 Request For Taxpayer Identification Number And Certification 2015

Fill Free fillable W92018 W9 2018 Copy.pdf PDF form

W9 Form 2022

W9 Federal Withholding Form Printable W9 Form 2023 (Updated Version)

Fillable Form W9 Request For Taxpayer Identification Number And Certification Internal

For Federal Tax Purposes, You Are Considered A U.s.

Certify That The Tin You Are Giving Is Correct (Or You Are Waiting For A Number To Be Issued), 2.

Name Is Required On This Line;

It Is Commonly Required When Making A Payment And Withholding Taxes Are Not Being Deducted.

Related Post: