Form W 4V Printable

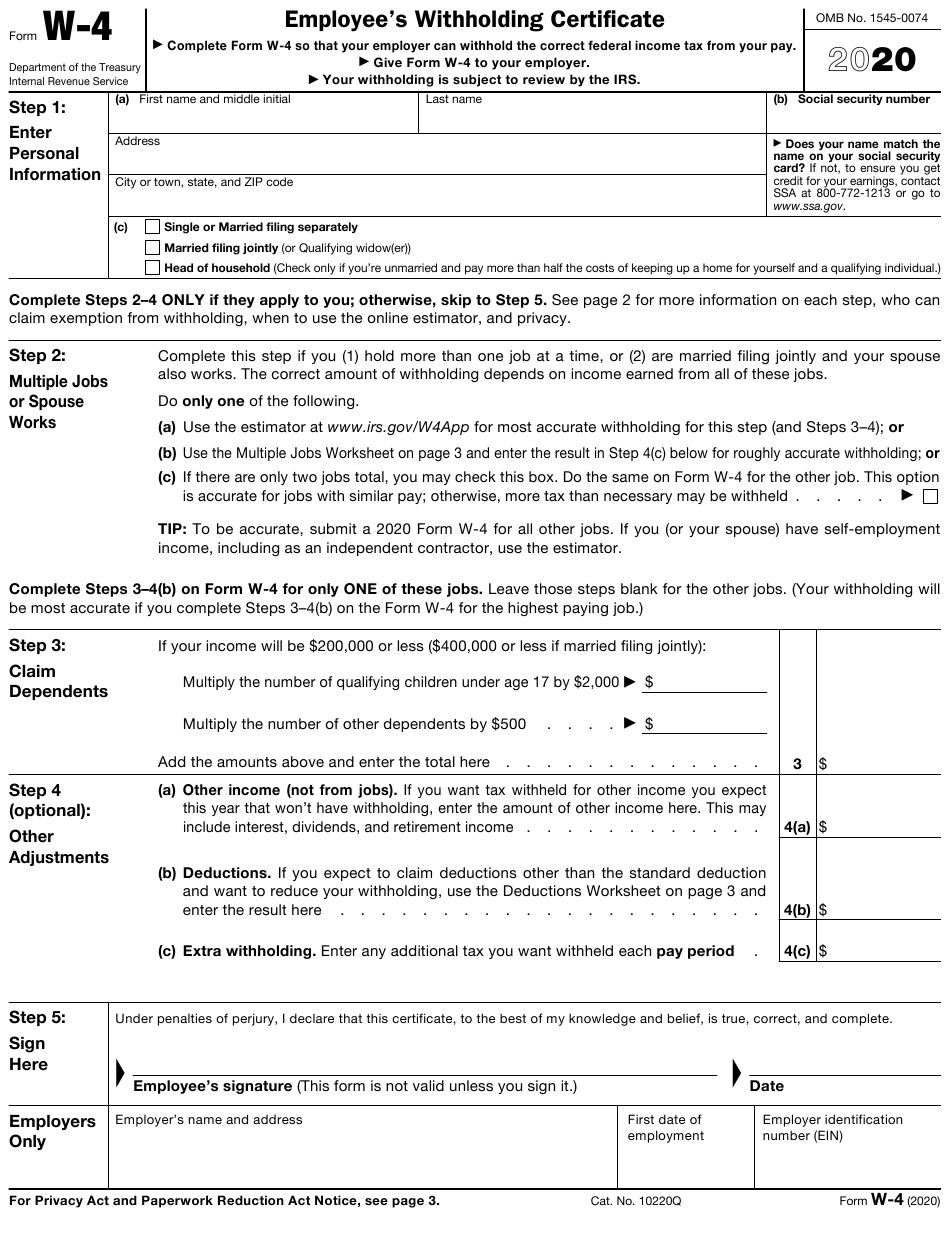

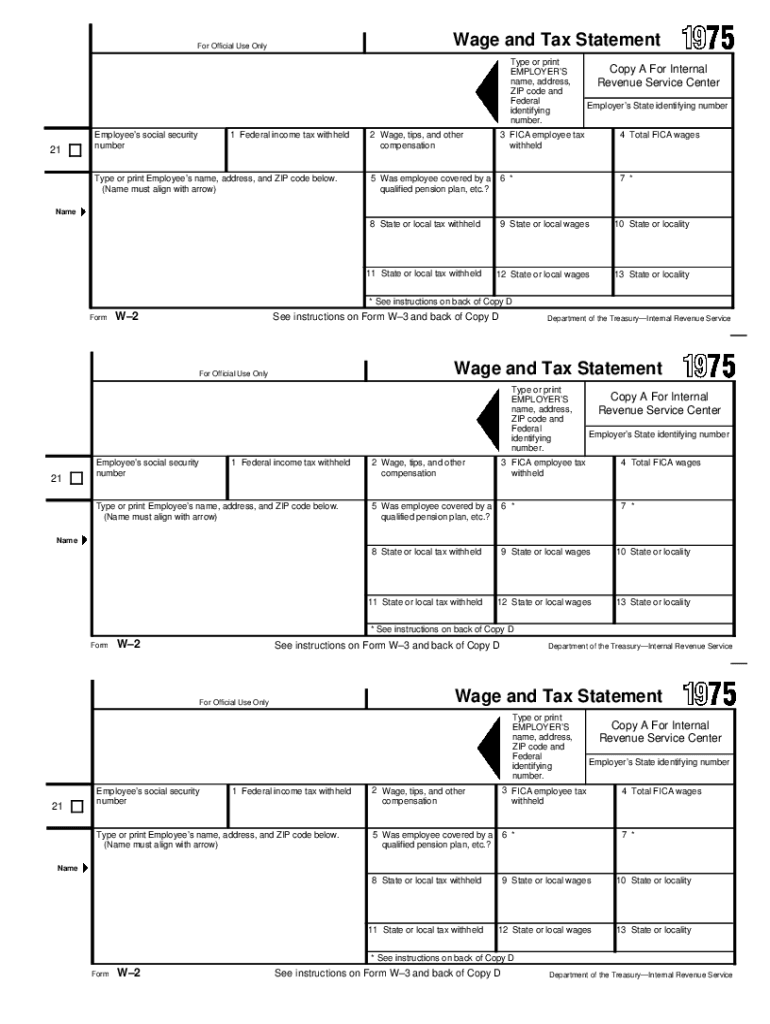

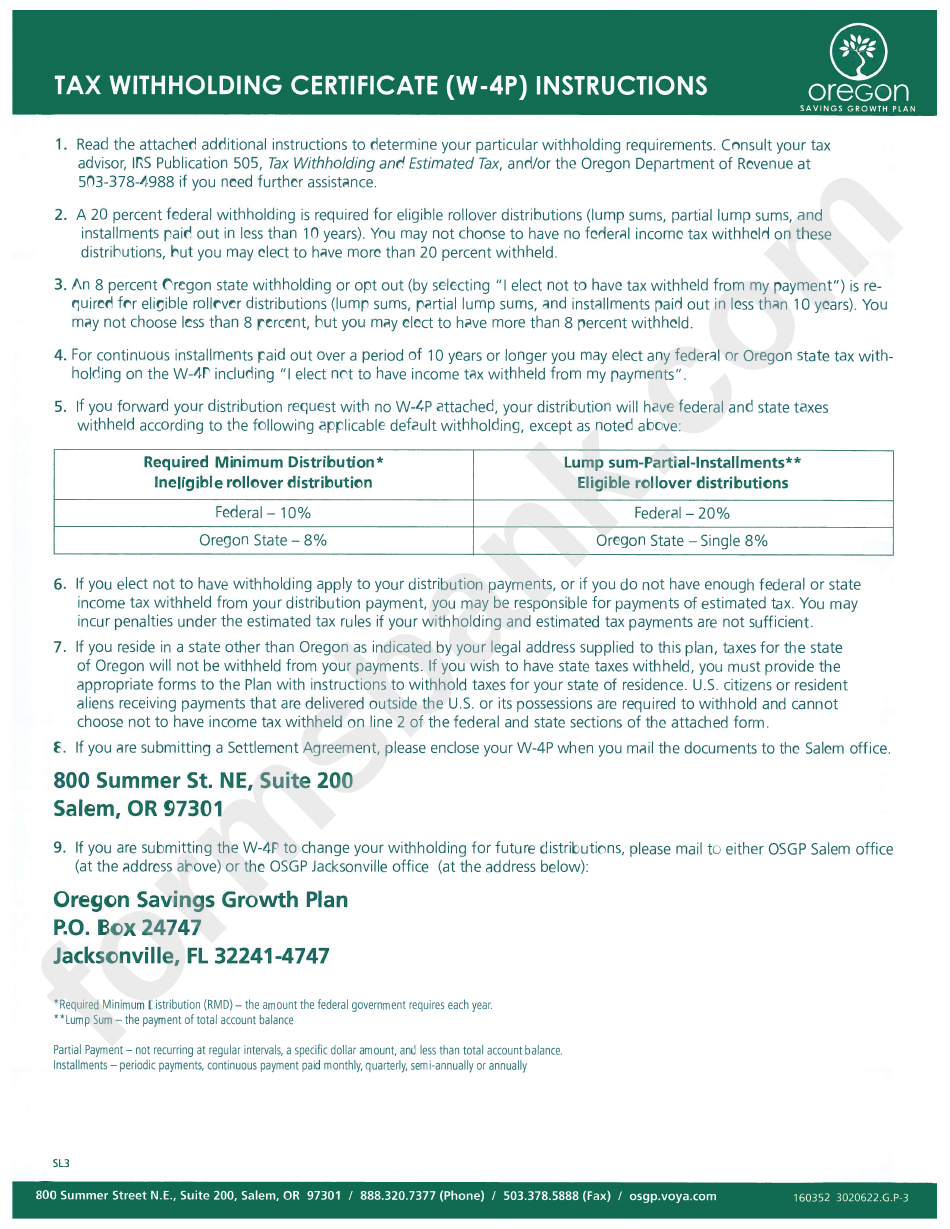

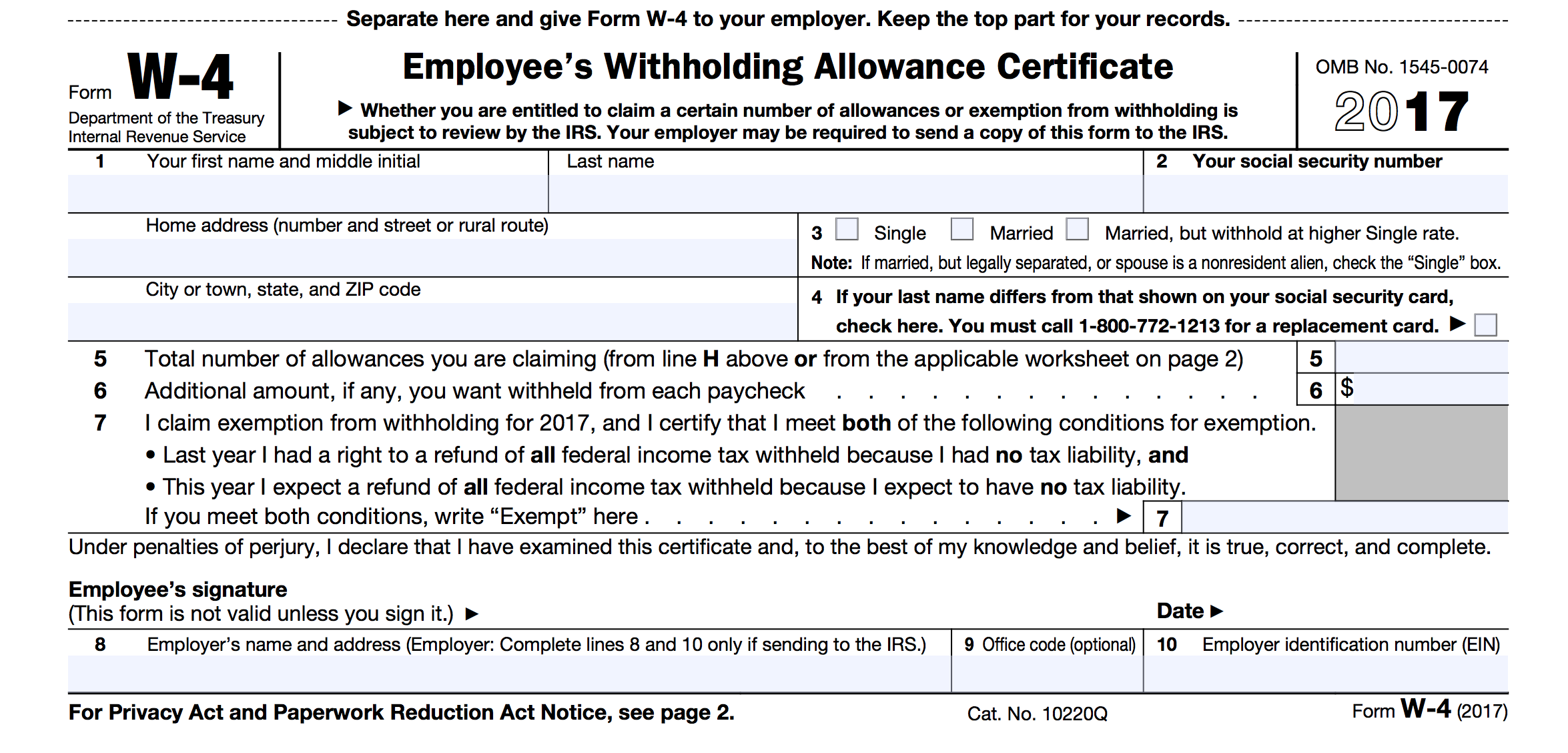

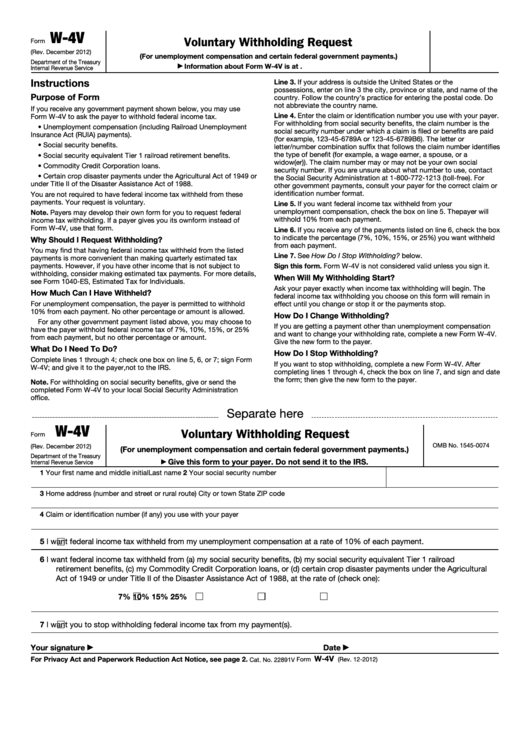

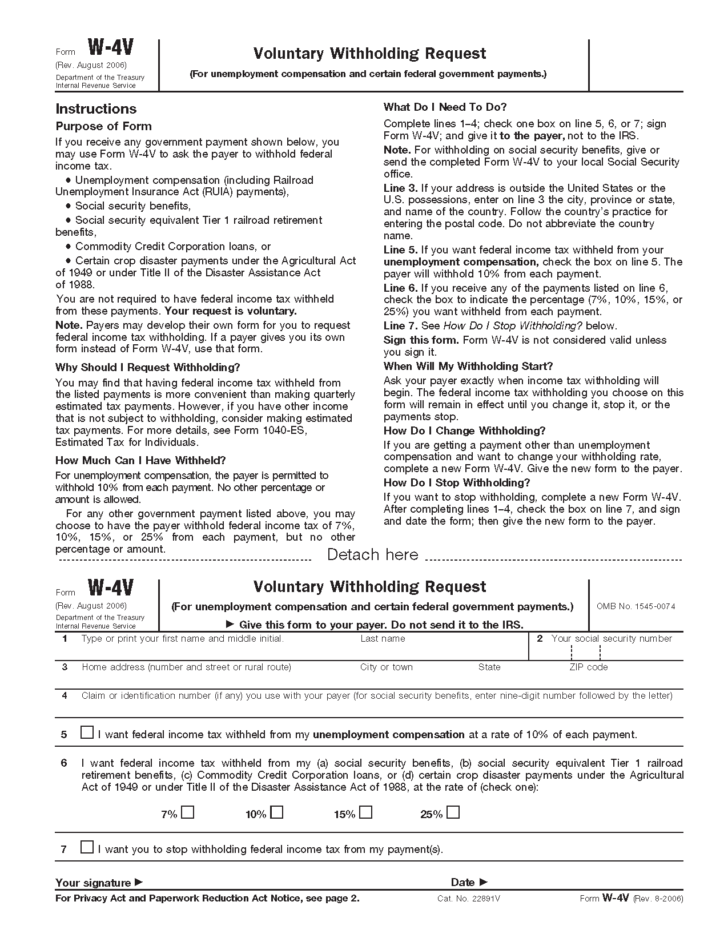

Form W 4V Printable - Web department of the treasury internal revenue service. (for unemployment compensation and certain federal government payments.) internal revenue service. Fill in your claim number on line 4. You may find that having federal income tax withheld is more convenient than making quarterly estimated tax payments. Web mail or fax us a request to withhold taxes. Wanda and dan are both retired and will file a joint return. Department of the treasury internal revenue service. Your withholding is subject to review by the irs. Then, find the social security office closest to your home and mail or fax us the completed form. Payers may develop their own form for you to request federal income tax withholding. Web your request is voluntary. February 2018) department of the treasury internal revenue service. (for unemployment compensation and certain federal government payments.) internal revenue service. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for. You can print other federal tax. Voluntary withholding request from the irs' website. We will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. This form is for income earned in tax year 2023, with tax returns due in april 2024. Amount of $4,300 appearing in. Web you can ask us to withhold federal taxes from your social security benefit payment when you first apply. February 2018) department of the treasury internal revenue service. Then, find the social security office closest to your home and mail or fax us the completed form. You can print other federal tax. Use this form to ask payers to withhold. Web your request is voluntary. Web you can ask us to withhold federal taxes from your social security benefit payment when you first apply. Solicitud de información sobre el empleo: (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest information. Voluntary withholding request from the irs' website. Web mail or fax us a request to withhold taxes. Web department of the treasury internal revenue service. For line 3, if you live outside the u.s., add the city, state or province and your country along with the postal code. Department of the treasury internal revenue service. Web your request is voluntary. Request to withdraw a hearing request: Your withholding is subject to review by the irs. Voluntary withholding request from the irs' website. Use this form to ask payers to withhold federal income tax from certain government payments. Your withholding is subject to review by the irs. Voluntary withholding request from the irs' website. Then, find the social security office closest to your home and mail or fax us the completed form. Web your request is voluntary. Unemployment compensation (including railroad unemployment insurance act (ruia) payments), 2. If too much is withheld, you will generally be due a refund. February 2018) department of the treasury internal revenue service. Amount of $4,300 appearing in box 5. Web you can ask us to withhold federal taxes from your social security benefit payment when you first apply. Social security equivalent tier 1 railroad retirement benefits, 4. Use this form to ask payers to withhold federal income tax from certain government payments. Web department of the treasury internal revenue service. (for unemployment compensation and certain federal government and other payments.) go to www.irs.gov/formw4v for the latest information. Your withholding is subject to review by the irs. Web mail or fax us a request to withhold taxes. Web your request is voluntary. You may find that having federal income tax withheld is more convenient than making quarterly estimated tax payments. Web department of the treasury internal revenue service. (for unemployment compensation and certain federal government payments.) internal revenue service. Fill in your claim number on line 4. For line 3, if you live outside the u.s., add the city, state or province. Request to withdraw a hearing request: You may find that having federal income tax withheld is more convenient than making quarterly estimated tax payments. Web your request is voluntary. We will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. Wanda and dan are both retired and will file a joint return. Department of the treasury internal revenue service. Amount of $4,300 appearing in box 5. If too much is withheld, you will generally be due a refund. Solicitud de información sobre el empleo: Your withholding is subject to review by the irs. (for unemployment compensation and certain federal government payments.) internal revenue service. Your withholding is subject to review by the irs. February 2018) department of the treasury internal revenue service. Use this form to ask payers to withhold federal income tax from certain government payments. Web mail or fax us a request to withhold taxes. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Fill Free fillable Form W4V Voluntary Withholding Request 2018 PDF form

Fillable Form W 4v Printable Forms Free Online

Irs Form W4V Printable Irs Form W4V Printable / Va State

Irs Form W4V Printable IRS Form W4V Download Printable PDF

Fillable Form W 4v Printable Forms Free Online

Irs Form W 4v Printable Fillable Form W 4v Voluntary vrogue.co

Irs Form W4V Printable Form W4v Voluntary Withholding Certificate

Irs Form W 4V Printable

Fillable Form W4v Voluntary Withholding Request printable pdf download

Form W 4V Voluntary Withholding Request W4 Form 2021 Printable

These Withholdings Are Voluntary And Can Be Revoked In Writing At Any Time.

Web Department Of The Treasury Internal Revenue Service.

(For Unemployment Compensation And Certain Federal Government And Other Payments.) Go To Www.irs.gov/Formw4V For The Latest Information.

For Line 3, If You Live Outside The U.s., Add The City, State Or Province And Your Country Along With The Postal Code.

Related Post: