Foreign Grantor Trust Template

Foreign Grantor Trust Template - May wish to set up a foreign grantor trust. Type text, add images, blackout confidential details, add comments, highlights and more. Web a foreign trust with a u.s. The form provides information about the foreign trust, its u.s. Web foreign grantor trust (fgt) for u.s. Sample irs letter to taxpayer on form 3520. Fill out & sign online | dochub. The trustee must also provide the grantor with a foreign grantor trust owner statement, Show all amounts in u.s. Web the first 3 goals can be achieved by grantor trust status. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). This primer explains the characteristics of fgt planning, the tax advantages of the fgt during the settlor’s lifetime, and the pitfalls of the fgt after the settlor’s demise. Web a foreign trust is a trust that was. Fill out & sign online | dochub. Aicpa letter to irs on rev. Beneficiaries, depending on the priorities of the settlor. Beneficiaries in order for the u.s. Owner (under section 6048(b)) go to. Person who is a u.s. Beneficiaries in order for the u.s. Show all amounts in u.s. Web the us owner must file form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, to report any transfers to a foreign trust, and must also file form 3520 annually to report ownership of the foreign trust. Web a foreign trust is a trust that was established in a foreign country and is subject to that country’s estate planning laws. Or 6) received certain gifts or For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. Tax purposes and the proper information reporting to the irs and the entity's beneficiaries after u.s. Web. For instructions and the latest information. Federal income tax purposes, a trust is foreign if it fails the “court” test or the “control” test, and is a foreign grantor trust (fgt) if it either (1) the trust is fully revocable by the foreign settlor or (2) the trust is irrevocable, and the only persons to whom income or principal may. To be classified as a fgt the trust will in most cases be fully revocable by the grantor. The foreign grantor trust allows international families to take advantage of tax benefits, increased flexibility, political stability, and secure asset protection laws. Tax purposes and the proper information reporting to the irs and the entity's beneficiaries after u.s. Web foreign grantor trust. Beneficiaries in order for the u.s. Us taxation of foreign trusts. In this document we provide an overview of the us tax rules for foreign trusts, including some of the tax risks and opportunities for us persons who are grantors/settlors or beneficiaries of such trusts, whether in. Form 3520 must be filed by the due date. 3 foreign trust without. Courts would not have any legal jurisdiction over that trust. The form provides information about the foreign trust, its u.s. Sample irs letter to taxpayer on form 3520. Beneficiaries, depending on the priorities of the settlor. Web part 1 explains the classification criteria of a foreign nongrantor trust or foreign estate for u.s. All information must be in english. Owner or beneficiary of a foreign trust and in the current tax year such foreign trust holds an outstanding qualified obligation of yours or a u.s. Web part 1 explains the classification criteria of a foreign nongrantor trust or foreign estate for u.s. Federal income tax purposes, a trust is foreign if it fails. Web aicpa draft form 1041nr, u.s. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. 3 foreign trust without us assets. Fill out & sign online | dochub. Income tax return for foreign estates and trusts, and relevant schedules, for consideration by the irs. Beneficiaries in order for the u.s. Web foreign grantor trust (fgt) for u.s. For calendar year 20 , or tax year beginning, 20 , ending.check appropriate boxes. This primer explains the characteristics of fgt planning, the tax advantages of the fgt during the settlor’s lifetime, and the pitfalls of the fgt after the settlor’s demise. Web trust with a us owner. In this document we provide an overview of the us tax rules for foreign trusts, including some of the tax risks and opportunities for us persons who are grantors/settlors or beneficiaries of such trusts, whether in. Web obligation” (note) from a foreign trust which was issued after august 20, 1996; Web part 1 explains the classification criteria of a foreign nongrantor trust or foreign estate for u.s. A grantor trust is a trust that is treated as owned by its grantor under code §671. Web foreign grantor trusts are a type of trust established under the laws of a foreign country where the grantor, or creator of the trust, retains certain rights or powers over the trust, such as the power to revoke or amend the trust. The foreign grantor trust allows international families to take advantage of tax benefits, increased flexibility, political stability, and secure asset protection laws. Web foreign families with loved ones in the u.s. Or 6) received certain gifts or Web aicpa draft form 1041nr, u.s. Show all amounts in u.s. The trust generates and realizes 10% investment returns every year for 15 years.

Grantor Trust Form Complete with ease airSlate SignNow

Sample Letter To Trust Beneficiaries

98 Number Foreign Grantor Trust To Estate Currency Of Exchange YouTube

What Is A Grantor Trust Fill Online, Printable, Fillable, Blank

Foreign grantor trust template Fill out & sign online DocHub

Grantor Trust Agreement Foreign Beneficiary US Legal Forms

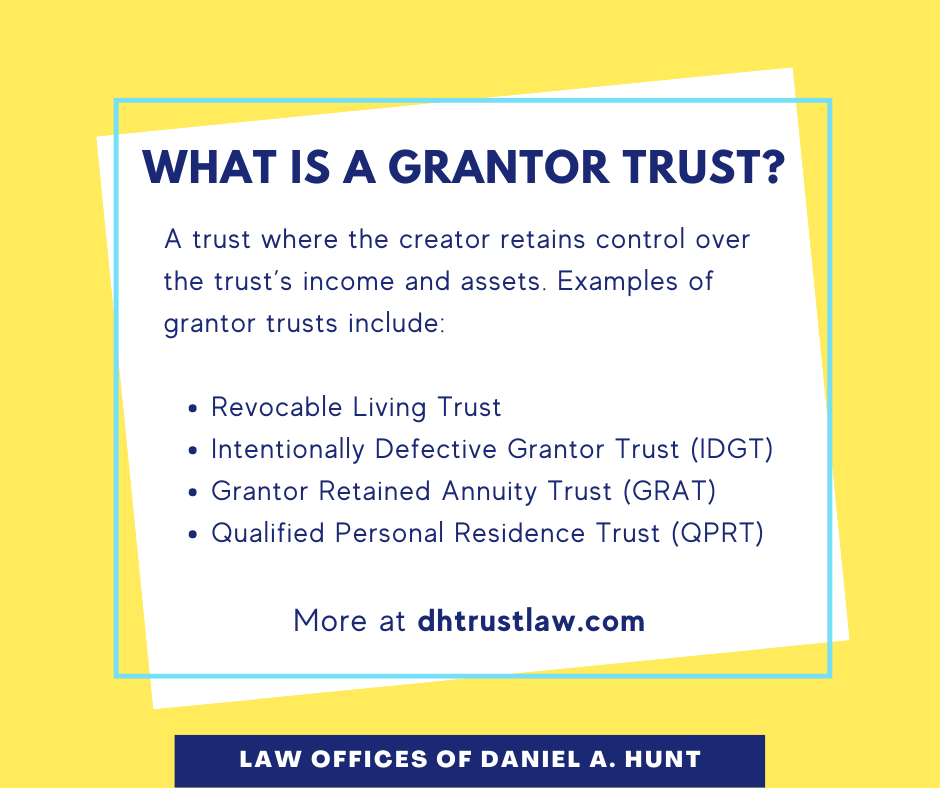

What is a Grantor Trust? • Law Offices of Daniel Hunt

What is a Foreign Grantor Trust

Foreign Grantor Trust Template

How to get the 98 EIN number (foreign grantor trust)

Web These Instructions Have Been Updated To Reference The Use Of This Form By A Foreign Partnership, Foreign Simple Trust, Or Foreign Grantor Trust That Is The Seller Of A Life Insurance Contract (Or Interest Therein) Or A Recipient Of A Reportable Death Benefit For Purposes Of Reporting Under Section 6050Y.

Or 3) Was A U.s.

The Form Provides Information About The Foreign Trust, Its U.s.

Web The First 3 Goals Can Be Achieved By Grantor Trust Status.

Related Post: