Excel Debt Snowball Template

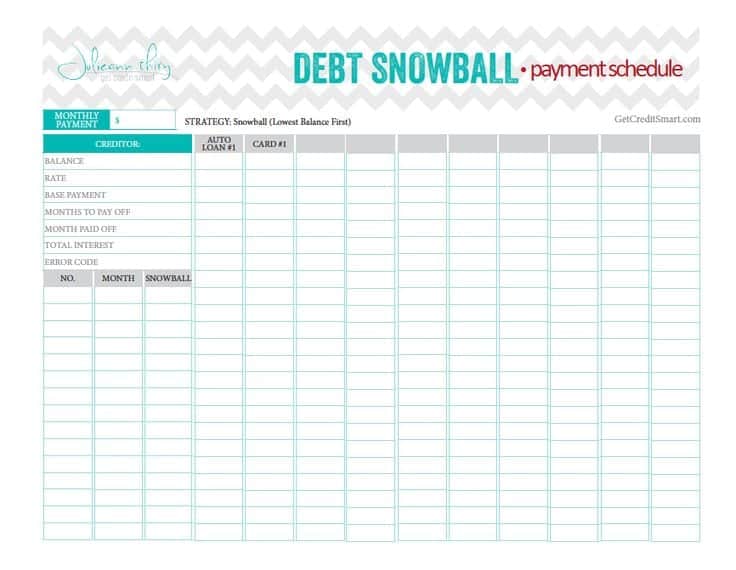

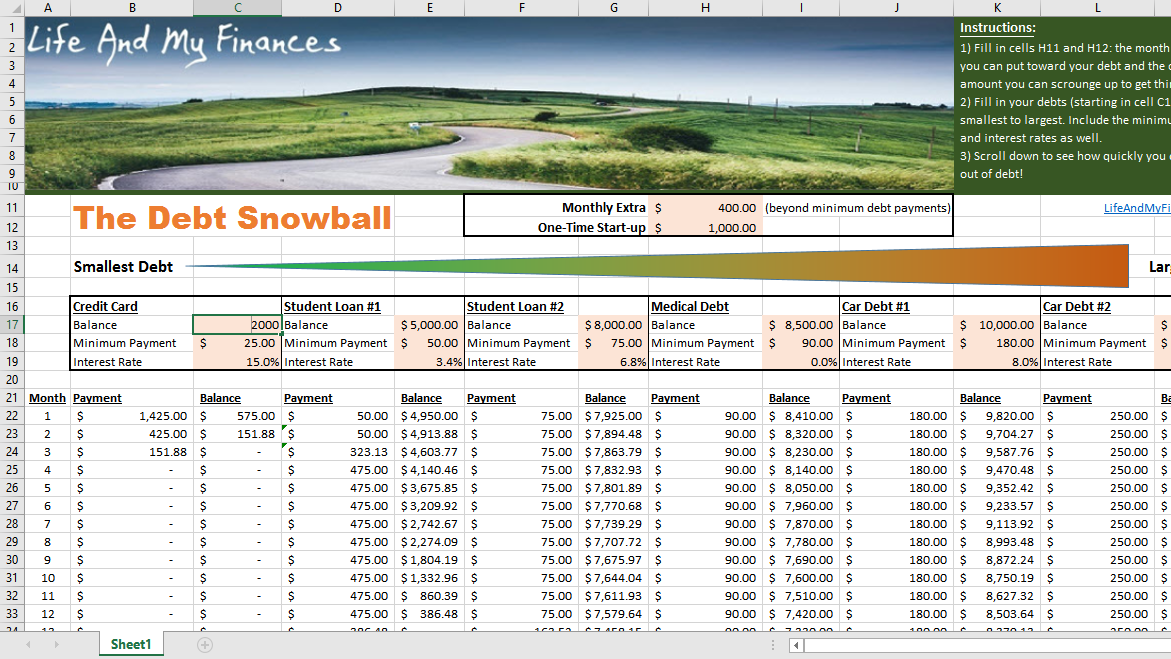

Excel Debt Snowball Template - This motivates you to keep going. Debt snowball worksheet from template lab for excel; Debt snowball spreadsheet from reddit; Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. The numbers in the pile of snowballs will update automatically. Then use the filters to sort by your current balances (for the snowball method) or the interest rate (for the avalanche method). Web debt snowball excel spreadsheet is designed in a way that you simply add your debts in it and the final accumulated result shown to you in a bit of second in the end sections of the spread sheet. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Debt reduction calculator for excel; However, if two accounts have similar balances, the one with the higher interest rate should go first. Debt reduction calculator for google sheets and excel from vertex42 What debts should i pay off first? The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Web browse debt snowball spreadsheets: It centers on the psychological win of clearing small balances. Then use the filters to sort by your current balances (for the snowball method) or the interest rate (for the avalanche method). The numbers in the pile of snowballs will update automatically. This motivates you to keep going. Web debt snowball spreadsheets. Learn how to make a debt snowball spreadsheet in excel and google sheets in just 10 minutes. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web click here to download sall's free debt snowball tool. Web in my opinion, the debt snowball excel spreadsheet is the most impactful tool out there. With this spreadsheet you can customize the amount you want. Then use the filters to sort by your current balances (for the snowball method) or the interest rate (for the avalanche method). Next, to snowball your debt, enter the additional amount you want to pay above the minimum required payment. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt. $3,000 ($70 minimum payment) 4th debt: Life and my finances/business insider. What debts should you pay off first— your student loans? It centers on the psychological win of clearing small balances. The snowball calculator is free to download. Enter your total debt in the center of the target. Web $ account name (optional) add debt. Then you’ll know how many months you’ll need to pay off all your debts. Life and my finances/business insider. $1,000 ($50 minimum payment) 2nd debt: It helps a person who owes multiple accounts pay off the smallest balances first while paying the minimum payment on larger debts. Web simply enter basic information about each of your debts, including the starting balance, current balance, interest rate, and minimum payment. It centers on the psychological win of clearing small balances. Personal use (not for distribution or resale). Tiller money offers several types of spreadsheets including a debt snowball spreadsheet. Monthly household income (optional) $ additional payment. The numbers in the pile of snowballs will update automatically. Then you’ll know how many months you’ll need to pay off all your debts. Free debt snowball vs avalanche calculator and a more extensive explanation of the debt snowball vs avalanche. Debt snowball spreadsheet from reddit; Money and budget snapshot for excel; Debt snowball spreadsheet from spreadsheet point for google sheets; Then you’ll know how many months you’ll need to pay off all your debts. Debt snowball planner for google sheets and excel; Debt reduction calculator for google sheets and excel from vertex42 Personal use (not for distribution or resale) description. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Web free debt snowball spreadsheets for excel. Throw snowballs at your debt target with this printable worksheet. It honestly doesn’t matter if you make your debt payoff spreadsheet in excel or google. Money and budget snapshot for excel; The first step is to list all your debt in ascending order by the balance due, as the snowball method focuses on the smallest debt first. Tiller money offers several types of spreadsheets including a debt snowball spreadsheet. Web the debt snowball method is a debt reduction strategy designed for you to pay off your debts efficiently. Web with the debt snowball method, you simply start with the smallest debt first, and so you would order them accordingly: Web debt snowball excel spreadsheet is designed in a way that you simply add your debts in it and the final accumulated result shown to you in a bit of second in the end sections of the spread sheet. Debt snowball spreadsheet from spreadsheet point for google sheets; Though your debts might feel overwhelming, the spreadsheet breaks them down into a simple payment. This video gives you a plan to pay off. Monthly household income (optional) $ additional payment. With this spreadsheet you can customize the amount you want to pay on each debt to work with your personal budget. Web simply enter basic information about each of your debts, including the starting balance, current balance, interest rate, and minimum payment. Enter your total debt in the center of the target. Web in my opinion, the debt snowball excel spreadsheet is the most impactful tool out there.

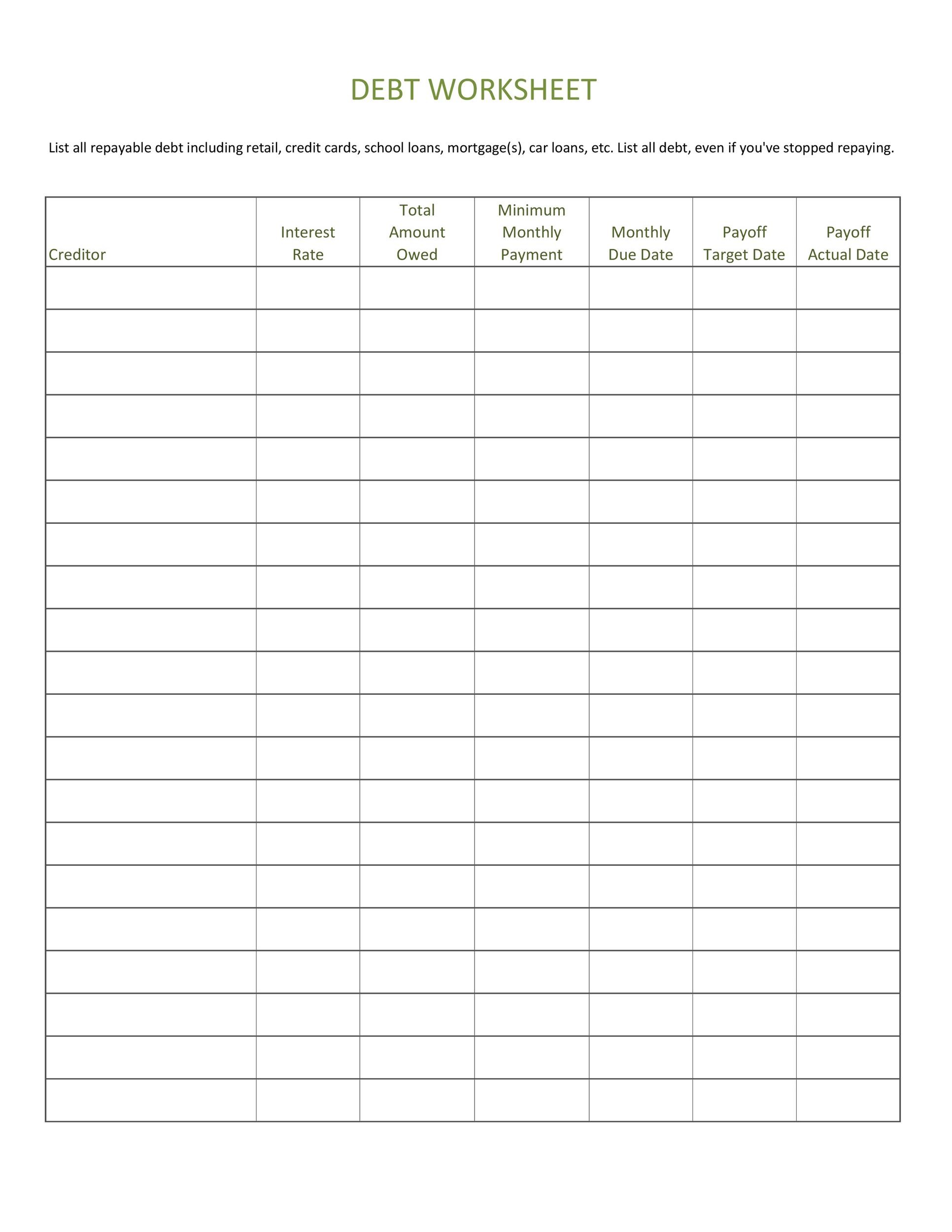

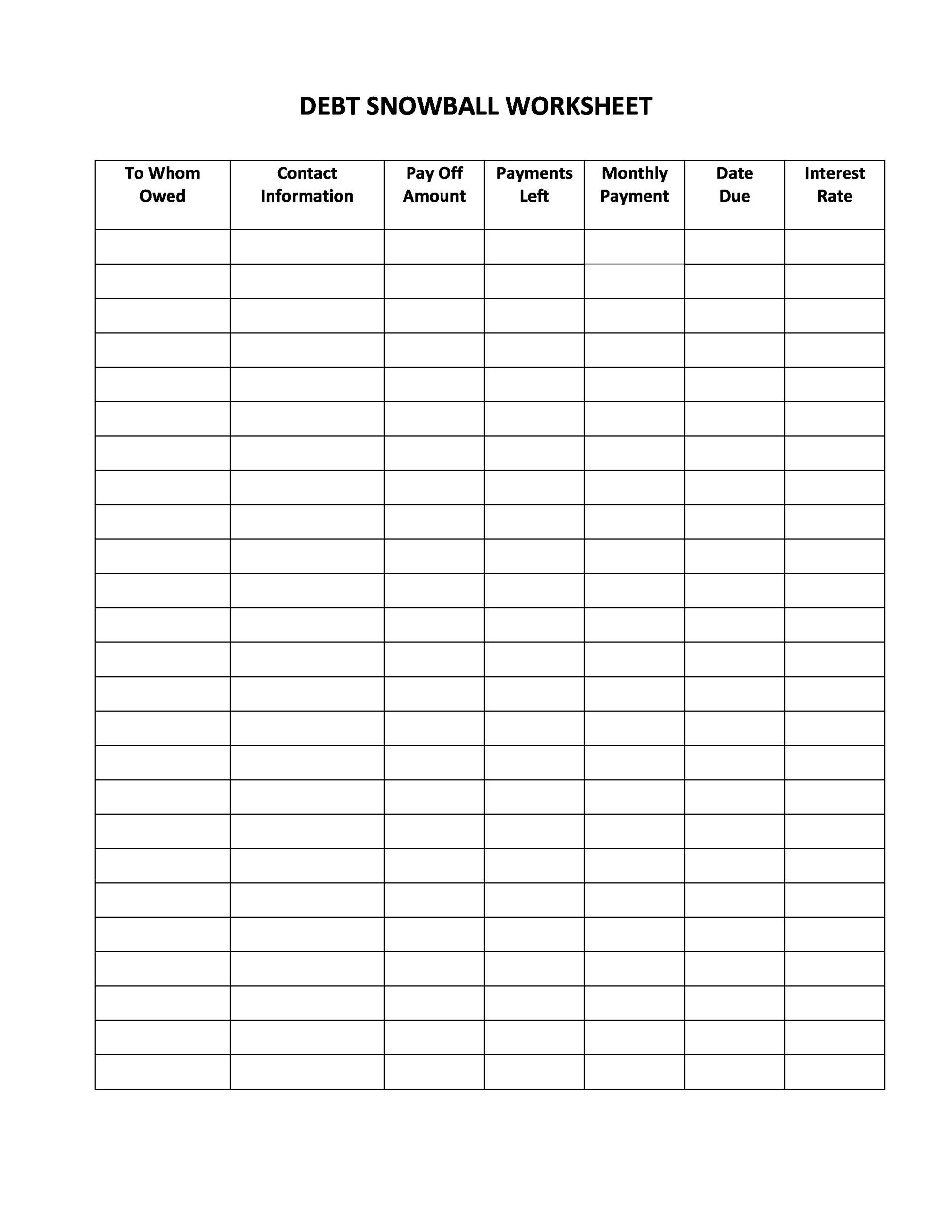

Fillable Debt Snowball Form Printable Forms Free Online

Debt Snowball Form Fillable Printable Forms Free Online

50 Free Excel Templates to Make Your Life Easier Updated August 2021

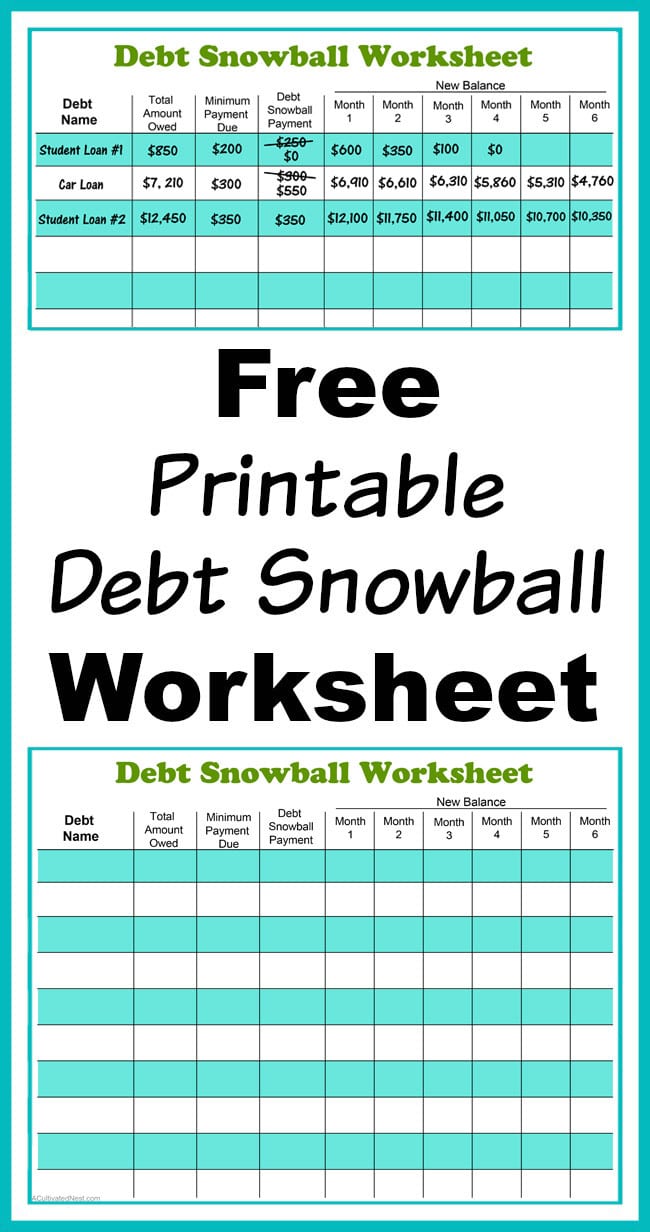

Free Printable Debt Snowball Worksheet Pay Down Your Debt —

![Best Debt Snowball Spreadsheet [Free Excel Download 2023] Debt](https://i.pinimg.com/736x/2f/ec/e7/2fece7b89bd2969101421de046c31c71.jpg)

Best Debt Snowball Spreadsheet [Free Excel Download 2023] Debt

Debt Snowball Google Sheets Template Debt Payoff Calculator Google

Dave Ramsey inspired Debt Snowball Spreadsheet Excel Etsy

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

9+ Debt Snowball Excel Templates Excel Templates

This Spreadsheet Calculates When You'll Pay Off Debt With The Snowball

Then You’ll Know How Many Months You’ll Need To Pay Off All Your Debts.

This Includes Any Income You Make Each Month After Taxes (Your Paycheck, Your Side Hustle—It All Counts).

Learn How To Make A Debt Snowball Spreadsheet In Excel And Google Sheets In Just 10 Minutes.

Web $ Account Name (Optional) Add Debt.

Related Post: