Donation Letter Tax Deduction Template

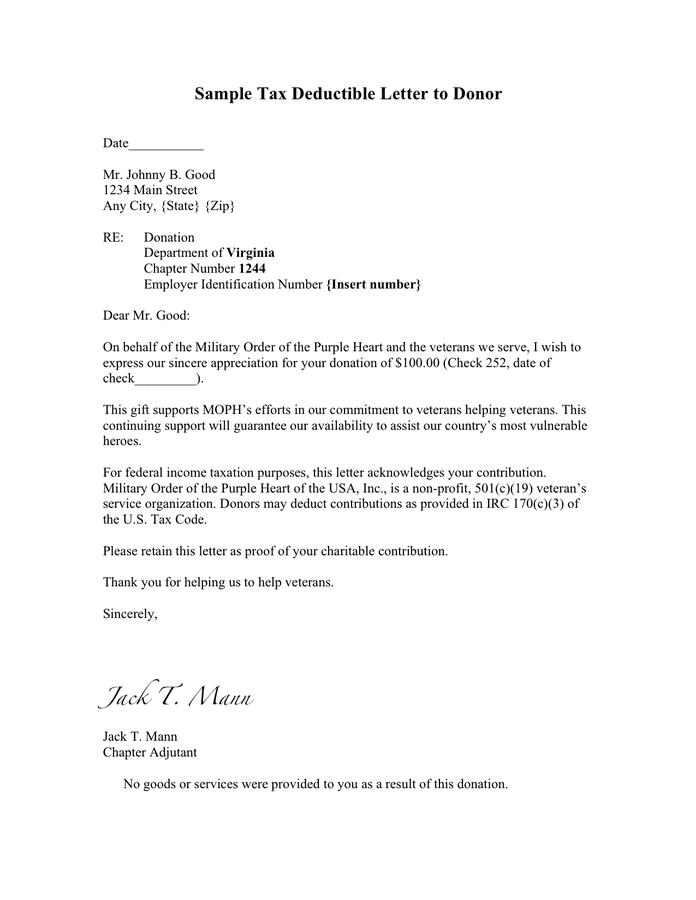

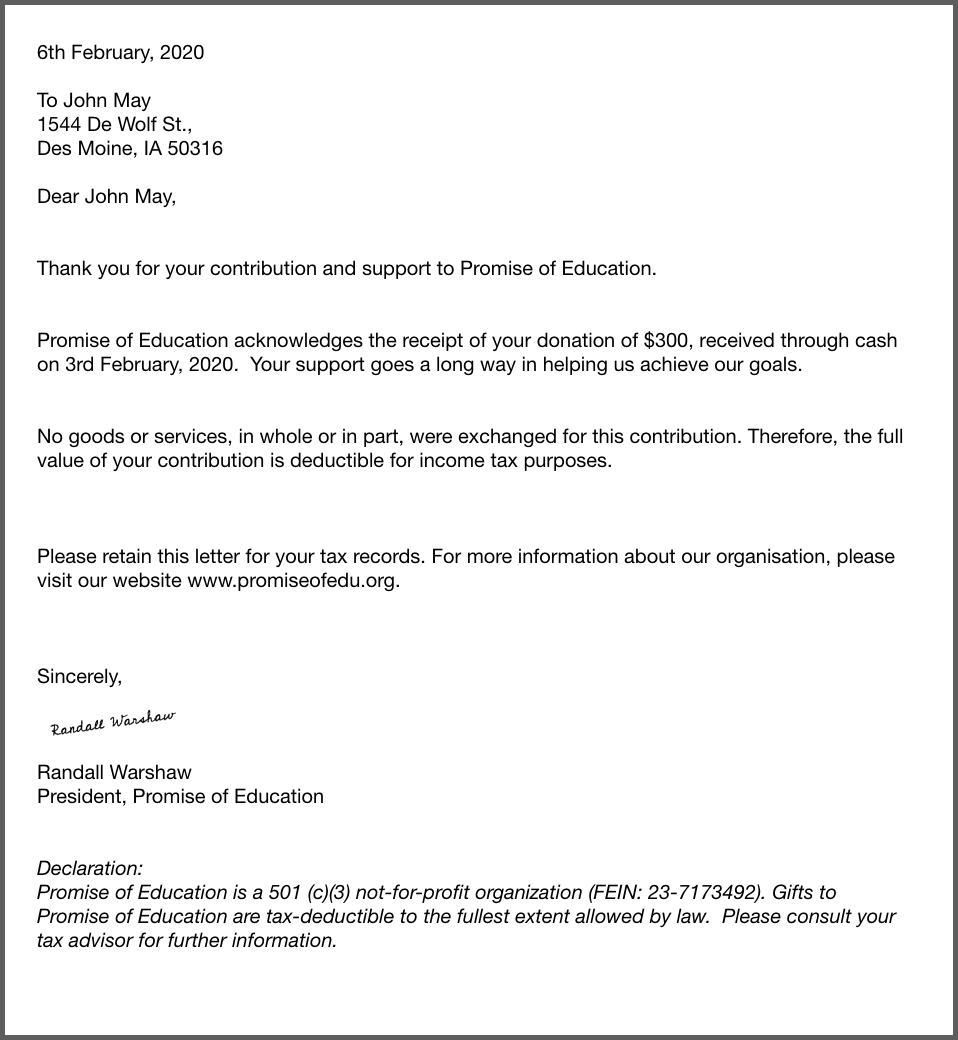

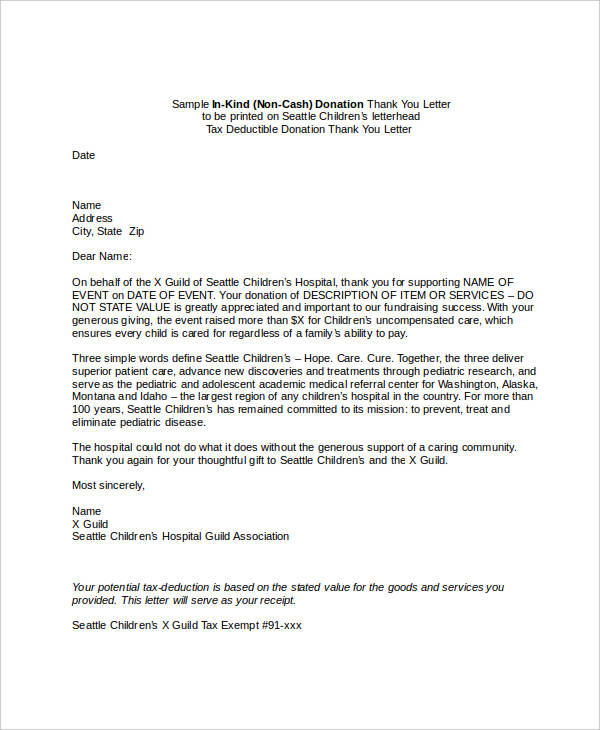

Donation Letter Tax Deduction Template - 501c3 nonprofits will give all online donors a donation receipt regardless of the donation amount. Web a donor or donation acknowledgment letter is a letter nonprofits send to thank their donors for their gifts. Tax deductible donation for orphanage. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Nonprofit receipts given to donors for donations must state that no goods or services were provided in exchange for their gifts. Clear and consistent nonprofit donation receipts help build trust with your donors. Web published july 5, 2023 • reading time: It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. As we’ll discuss below, it’s also an opportunity for you to provide the official documentation required by the. Page last reviewed or updated: Fill out online for free. Tax deductible donation letter sample. They’re important for anyone who wants to itemize their charitable giving when tax season rolls. Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. Tax deductible donation for orphanage. Web published july 5, 2023 • reading time: Web a donor or donation acknowledgment letter is a letter nonprofits send to thank their donors for their gifts. Fill out online for free. What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Web a 501(c)(3). In exchange for their contribution, donors should receive accurate, written acknowledgments of their contributions. Tax deductible donation for orphanage. They’re important for anyone who wants to itemize their charitable giving when tax season rolls. Dear sir /madam, i, ________ (name of the person) am working as a social worker with _________social service club (name of the. Donorbox tax receipts are. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web the donor will use this letter as proof of his or her donation to claim a tax deduction. Tax deductible donation for orphanage. Why do you need a donation receipt? Web donors will use form 1040. Web your amazing donation of $250 has a tax deductible amount of $200. Tax deductible donation letter sample. A church donation letter for tax purposes is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax deduction on their tax return. Web sample 501(c)(3) donation receipt. Why do you need a donation receipt? What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Fill out online for free. Web the donor will use this letter as proof of his or her donation to claim a tax deduction. Make sure you are. Web donation receipt templates. Web the donor will use this letter as proof of his or her donation to claim a tax deduction. Web donors will use form 1040 to claim tax deductions for these donations. Shared by davidmjuarez in letter. Dear sir /madam, i, ________ (name of the person) am working as a social worker with _________social service club. Use our free tax deductible donation letter to help you get started. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. A church donation receipt is a record of a charitable donation that has been made to a church. A tax deduction letter is used by charities and foundations to acknowledge donations, thank donors, and give each. The acknowledgment to the donor should include the following: What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Web donors will use form 1040 to claim tax deductions for these donations. 501c3 nonprofits will give all online donors a donation receipt regardless of the. Click here to download for free. Web published july 5, 2023 • reading time: What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Web here is the template that guides you in drafting a pleasant and professional tax deductible donation letter. Without registration or. Use our free tax deductible donation letter to help you get started. Why do you need a donation receipt? Web simply start with our free donation thank you letter template, personalize it, print it, sign it, and then send it. Fill out online for free. Web the donor will use this letter as proof of his or her donation to claim a tax deduction. What they will need from you, the nonprofit they donated to, is a written document (an email or letter) that includes the three following elements: Web a donor or donation acknowledgment letter is a letter nonprofits send to thank their donors for their gifts. Click here to download for free. In exchange for their contribution, donors should receive accurate, written acknowledgments of their contributions. Just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. Nonprofit donation receipts make donors happy and are useful for your nonprofit. Page last reviewed or updated: Donors use them as a confirmation that their gift was received; Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. Web your amazing donation of $250 has a tax deductible amount of $200. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250.

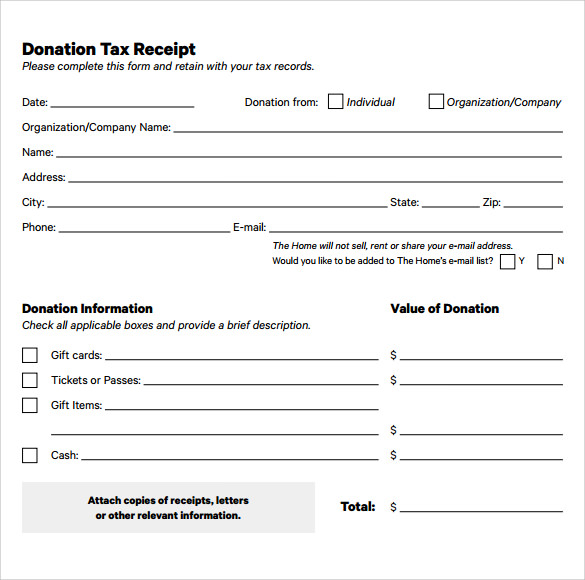

Tax Deductible Donation Receipt Template charlotte clergy coalition

Sample tax deductible letter to donor in Word and Pdf formats

Sample 501C3 Donation Request Letter For Your Needs Letter Template

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

FREE 51+ Sample Donation Letter Templates in MS Word Pages Google

Donation Thank you Letter 10+ Word, PDF Documents Download

501c3 Tax Deductible Donation Letter Template Business

Donation Letter for Taxes Template in PDF & Word (Set of 10) Donation

Tax Deductible Donation Letter Templates at

Tax Deductible Donation Letter Template DocTemplates

They’re Important For Anyone Who Wants To Itemize Their Charitable Giving When Tax Season Rolls.

Below, You Will Find A Receipt For Your Records.

Web Here Is The Template That Guides You In Drafting A Pleasant And Professional Tax Deductible Donation Letter.

Donorbox Tax Receipts Are Highly Editable And Can Be Customized To Include Important Details Regarding The Donation.

Related Post: