Debt Repayment Plan Template

Debt Repayment Plan Template - This type of agreement specifies the amount borrowed, the interest rate (if any), the. Payday loans and other unsecured personal loans. It allows those struggling with debt to make payments towards their debts over a designated period to pay off their entire balance eventually. Write to your creditors to tell them you’re trying to sort out your debts. Also record the interest rate and minimum payment requirement for each debt. Web payment (plan) agreement template. It’s not a loan and it. You’ll also be able to see how much principal versus interest you’ll pay over the lifetime of the debt. Web debt repayment template. Minimum payment due each month. You can also view the monthly payment amount and the total interest paid if. You’ll also be able to see how much principal versus interest you’ll pay over the lifetime of the debt. A debt payment plan is an essential tool for getting out of debt. It’s never easy to tackle debt, but having a clear plan in place can. Web first, create a list of all your debts. A debt management plan lets you make a single monthly payment that covers all of your unsecured debts that are included in the plan. A debt management plan is a tailored strategy to help you repay outstanding debt and financial obligations without using a new. Unlike a monthly fee, payment plans. List all your debts in the first column. Creating a budget is one of the most important steps in financial planning. Web a payment plan allows you to acquire something or repay a debt through a series of small payments instead of paying for it in full, which many people can’t do. If you are struggling to pay off your. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take control of your financial situation. The name of the lender. Web by ben luthi. Web how to fill out this worksheet. Payday loans and other unsecured personal loans. Make a list of all your debts. This debt planner will allow you to see the big picture of what your debt looks like and help you manage your finances better. This type of agreement specifies the amount borrowed, the interest rate (if any), the. Web what is a debt management plan? The benefits of using a debt repayment tracker. It doesn't matter if you're trying to save. Web how to fill out this worksheet. The list of your debts should include: Learn the basics of debt repayment spreadsheets and templates and how to use them to reduce your debt. Unlike a monthly fee, payment plans have an interest rate that is added to the monthly pay installment, making the. It doesn't matter if you're trying to save. You’ll also be able to see how much principal versus interest you’ll pay over the lifetime of the debt. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take control of your financial situation. Focus on one debt. Find extra money to pay your debts. Web what is a debt management plan? Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. This can include money owed on: The name of the lender. Learn the basics of debt repayment spreadsheets and templates and how to use them to reduce your debt. The name of the lender. It doesn't matter if you're trying to save. Log into each account to get the actual balance (don’t just guestimate). Web debt repayment template. Payday loans and other unsecured personal loans. It allows those struggling with debt to make payments towards their debts over a designated period to pay off their entire balance eventually. Here are five steps to creating a debt repayment plan: Web free printable debt payoff planner template. Where to get advice on your debts if you need it. Write to your creditors to tell them you’re trying to sort out your debts. Research debt payoff tools and apps. Web how to use our free downloadable spreadsheet. A debt payment plan is an essential tool for getting out of debt. Focus on one debt at a time. Find extra money to pay your debts. This debt planner will allow you to see the big picture of what your debt looks like and help you manage your finances better. It’s not a loan and it. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take control of your financial situation. It’s never easy to tackle debt, but having a clear plan in place can make it a whole lot more manageable. Dealing with debt can be a stressful experience, but having a good strategy can help you save both time and money. Learn the basics of debt repayment spreadsheets and templates and how to use them to reduce your debt. This comprehensive template is designed to help you understand your current debt situation and make a plan to pay it off. This can include money owed on: Web not a debt snowball spreadsheet, this simple credit payment calculator template can help you calculate the amount of money you must pay each month to fully repay your debt. Our team knows what it feels like to.

FREE PRINTABLE! Use this Debt Repayment printable to pay down your debt

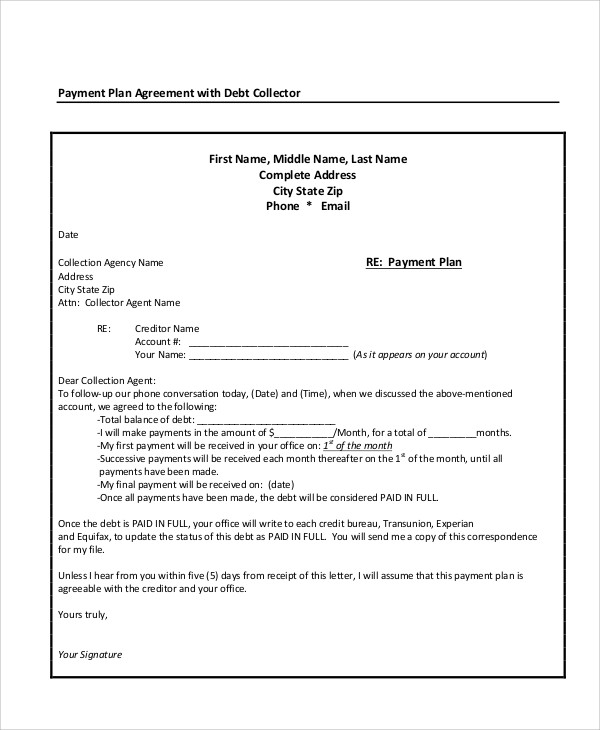

Repayment Plan Template Letter

Debt Repayment Printables Debt repayment, Budgeting, Finance printables

Free Printable Debt Repayment Plan

The Best Free DebtReduction Spreadsheets Debt repayment, Debt relief

Debt Repayment Printables Debt relief programs, Debt repayment

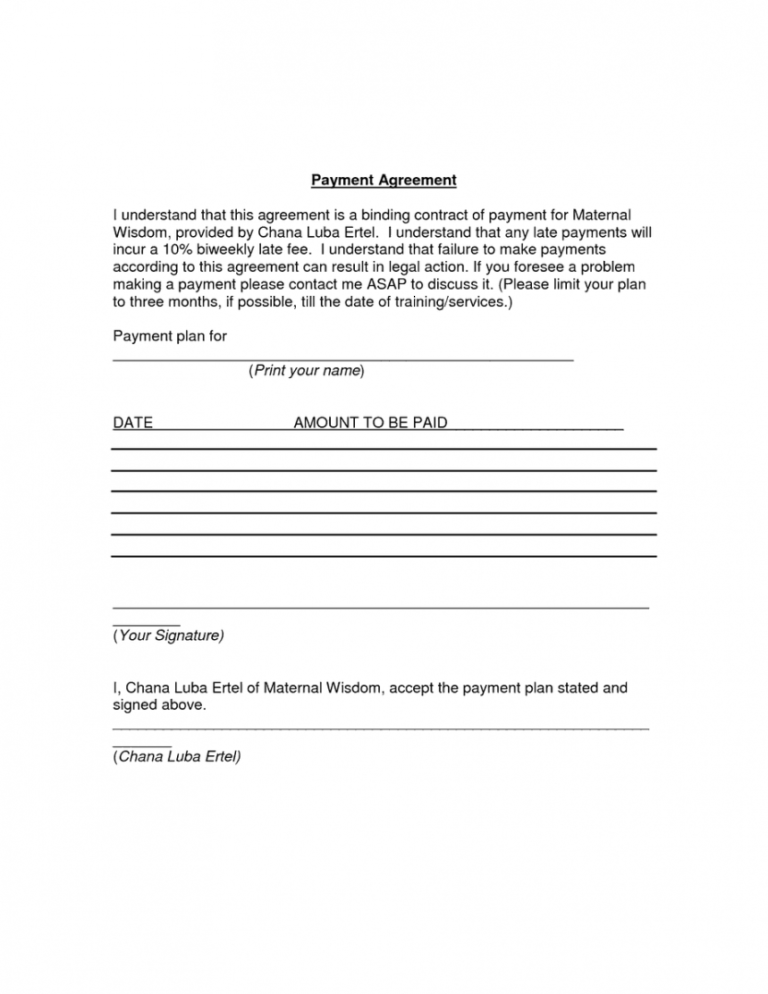

22+ Payment Plan Templates Word, PDF

The Debt Repayment Plan that will Change Your Life Debt repayment

Debt Repayment Plan Printable Planner Insert Bill Due Etsy

Editable Debt Repayment Contract Template Word Steemfriends

The List Of Your Debts Should Include:

Updated On November 15, 2021.

Web Our Calculator Can Help You Estimate When You’ll Pay Off Your Credit Card Debt Or Other Debt — Such As Auto Loans, Student Loans Or Personal Loans — And How Much You’ll Need To Pay Each Month, Based On How Much You Owe And Your Interest Rate.

A Debt Management Plan Is A Tailored Strategy To Help You Repay Outstanding Debt And Financial Obligations Without Using A New.

Related Post: