Collections Dispute Letter Template

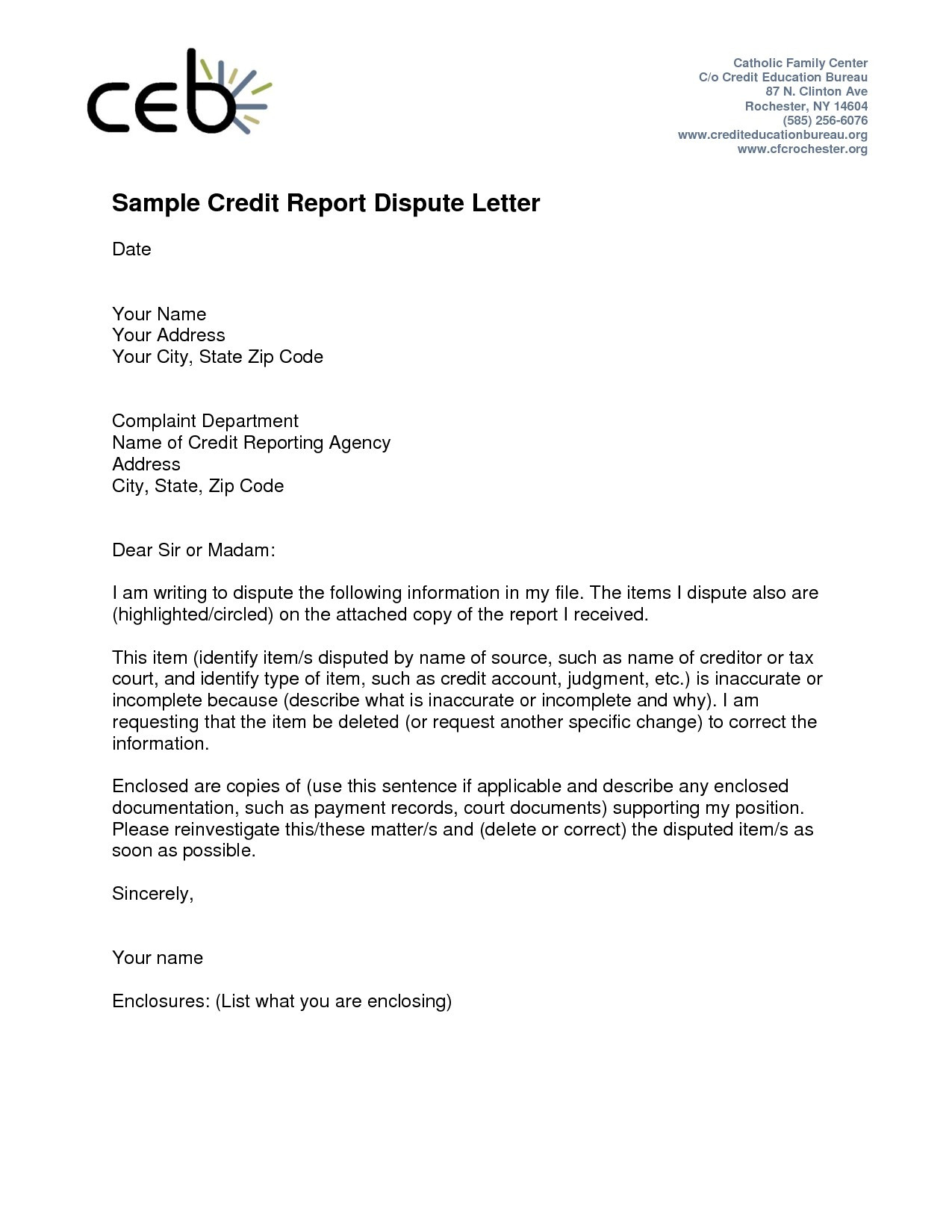

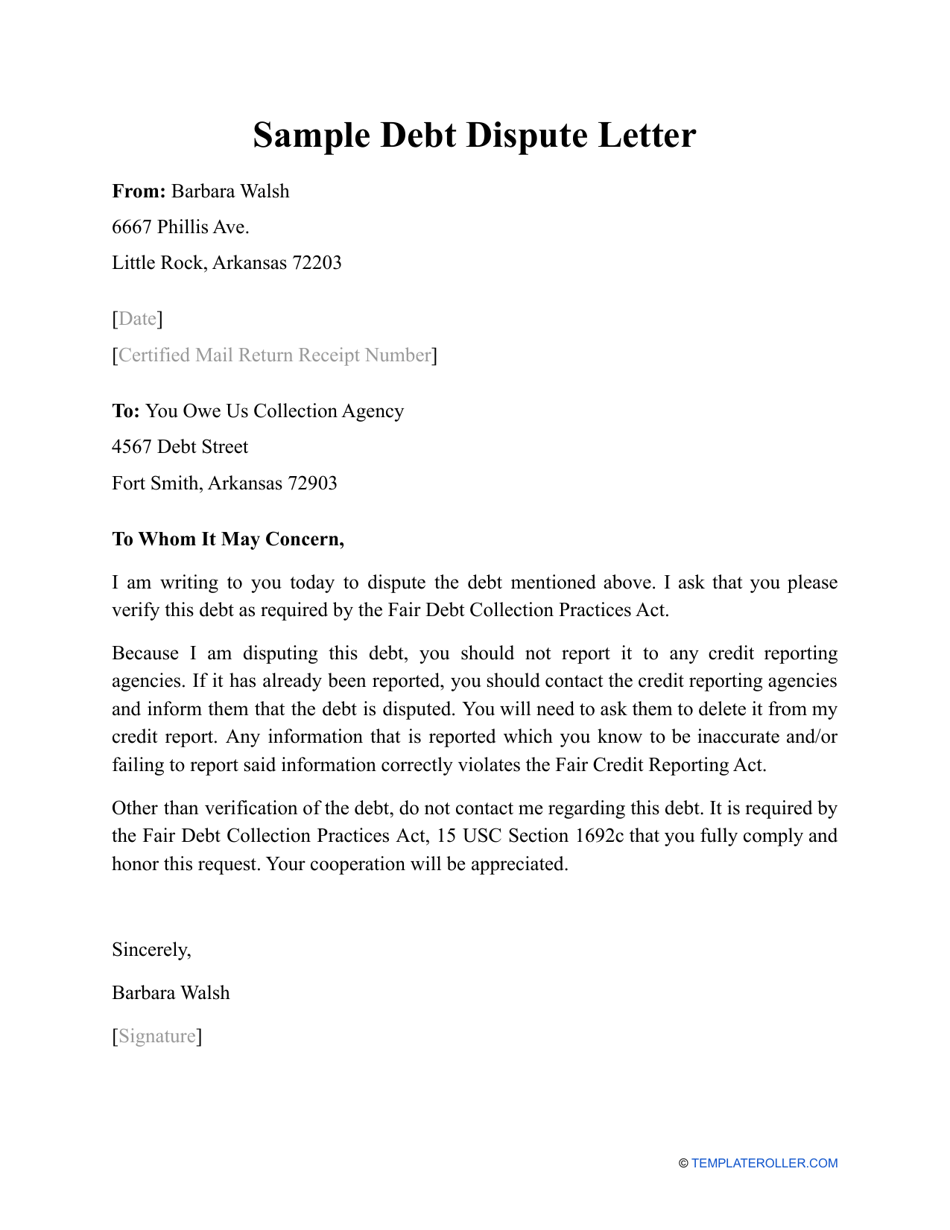

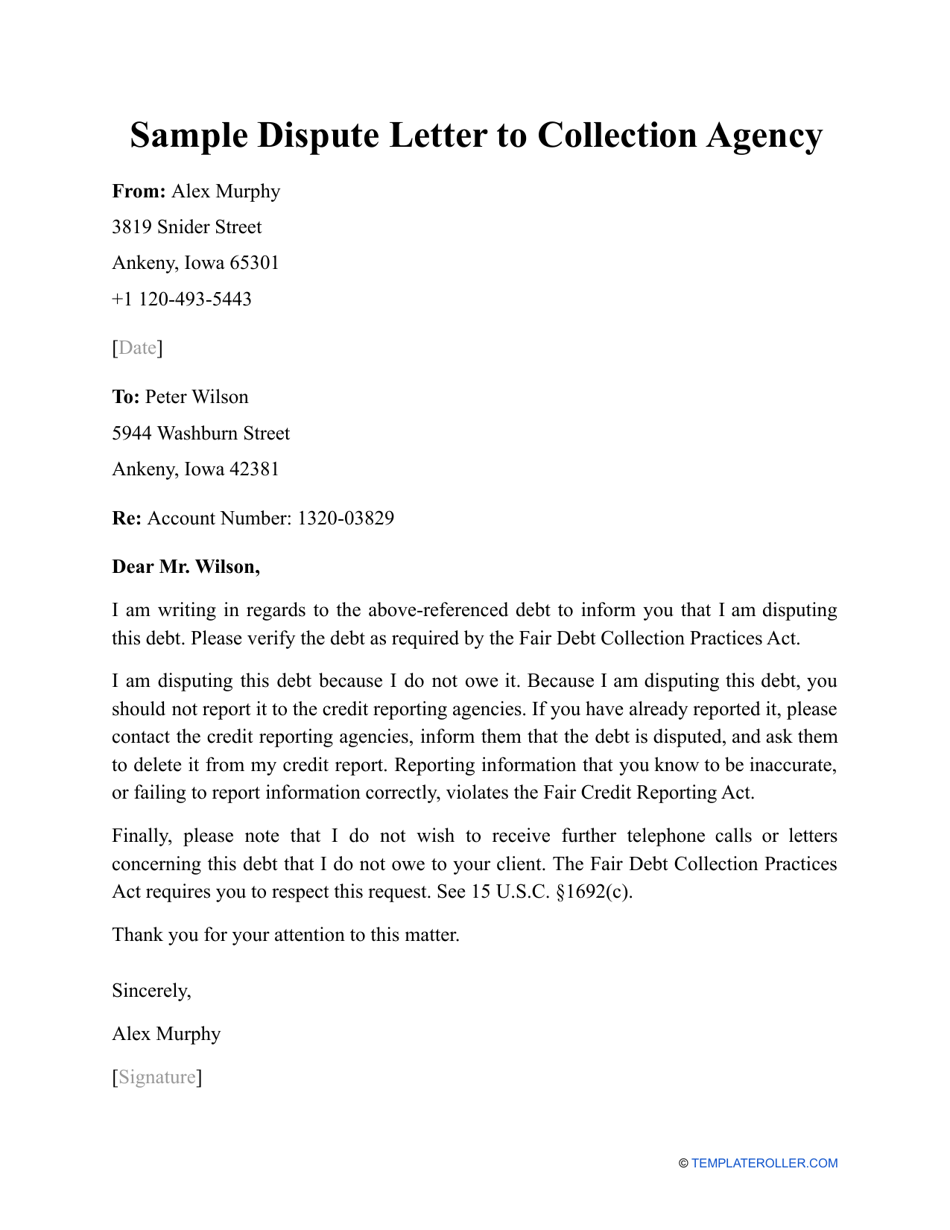

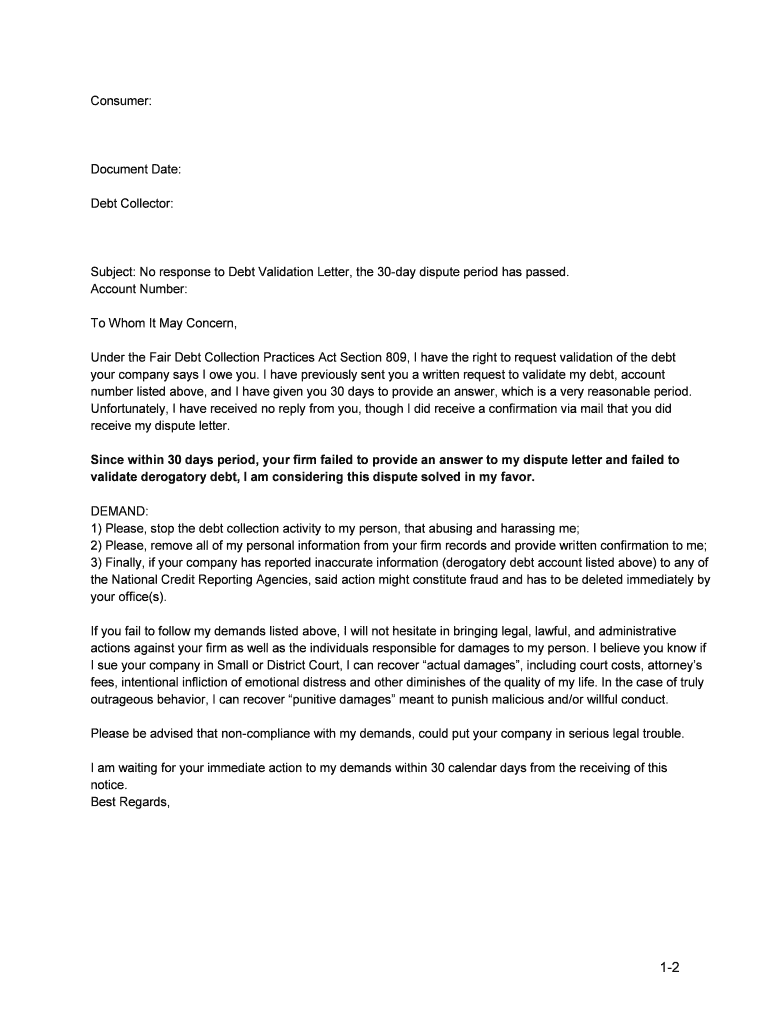

Collections Dispute Letter Template - Web respectfully request that you provide me with the following: Collection verification letter to credit bureaus, round 1. Web wish to dispute the following charges that your company is attempting collection of: This letter is sent to credit bureaus and requests they verify the. Web collection agency’s name and address re: The name of the creditor to whom the debt is owed; This letter is intended to obtain from the collection agency all relevant information about the debt. Am disputing this debt because i do not owe it. Web collection letter templates are created to provide written notice that there is money owed that will be sent to collections. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. The amount of the alleged debt; A collection dispute letter can be sent to the collection agency, requesting proof of the debt and addressing any discrepancies. Web compose a letter that clearly outlines your claim regarding the disputed debt. Web respectfully request that you provide me with the following: A credit report dispute letter is used to remove an invalid. Please verify the debt as required by the fair debt collection practices act. Was your credit or debit card charged for something you returned, ordered but never got, or don’t recognize? Web respectfully request that you provide me with the following: The full name and mailing address of the original creditor for this alleged debt; According to the fair credit. Web compose a letter that clearly outlines your claim regarding the disputed debt. Verification or copy of any judgment (if applicable); Was your credit or debit card charged for something you returned, ordered but never got, or don’t recognize? Web valid reasons to dispute a collection include inaccurate or incomplete information, lack of proof of debt, already paid debt, expired. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collection activities until it verifies the debt. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more. Proof that you are licensed to collect debts in maine; Web compose a letter that clearly outlines your claim regarding the disputed debt. A collection dispute letter can be sent to the collection agency, requesting proof of the debt and addressing any discrepancies. If you want to dispute information on a credit report, you may need to send a dispute. A collection dispute letter can be sent to the collection agency, requesting proof of the debt and addressing any discrepancies. Sample letter for disputing credit and debit card charges. Documentation showing you have verified that i am responsible for this. The name of the creditor to whom the debt is owed; This letter is intended to obtain from the collection. Be concise and persuasive, while maintaining a professional tone. The glendale apartments have alleged that i owe $450 for replacement of the carpet. Collection verification letter to credit bureaus, round 1. Verification or copy of any judgment (if applicable); Box 2000 chester, pa 19016. [list charges] dispute the charges for the following reason(s): Web debt dispute letter. Was your credit or debit card charged for something you returned, ordered but never got, or don’t recognize? The letter will also make an offer to settle the debt at a lower amount. The amount of the alleged debt; Web respectfully request that you provide me with the following: The letter will also make an offer to settle the debt at a lower amount. Web use this letter template if you need to dispute a hard inquiry on your credit report. Web wish to dispute the following charges that your company is attempting collection of: Web debt dispute letter. Web collection letter templates are created to provide written notice that there is money owed that will be sent to collections. Web if you dispute the debt, make a copy of your written dispute and send the original to the debt collector. This can be used for inquiries that show up in error, forcing a bureau to prove it was. Were you charged without your permission, more than you agreed to pay, or for things you didn’t buy? Web ðï ࡱ á> þÿ f h. Transunion llc consumer dispute center p.o. This can be used for inquiries that show up in error, forcing a bureau to prove it was authorized and legitimate, or inquiries that were due to fraud/stolen. [list charges] dispute the charges for the following reason(s): Verification or copy of any judgment (if applicable); If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Avoid any emotional language or unnecessary details that could detract from the main purpose of your letter. Web start your letter by clearly stating your intention to dispute the debt and request that the collection agency provides comprehensive proof of the debt they claim you owe. (4) proof that you are licensed to collect debts in (insert name of your state) If you doubt that you owe a debt, or that the amount owed is not accurate, your best recourse is to send a debt dispute letter to the collection agency asking that the debt be validated. You just say you’re responding to a collection contact and you don’t think you owe the debt. (2) the name of the creditor to whom the debt is owed; The amount of the debt; The amount of the alleged debt; Web collection agency’s name and address re:![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab Credit](https://i.pinimg.com/736x/a3/bc/0a/a3bc0a5aaa97a7bb070aa1271a720dd0.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab Credit

Experian Dispute Letter Template Collection Letter Template Collection

Fantastic Collections Dispute Regarding Receipt Of Debtletter Template

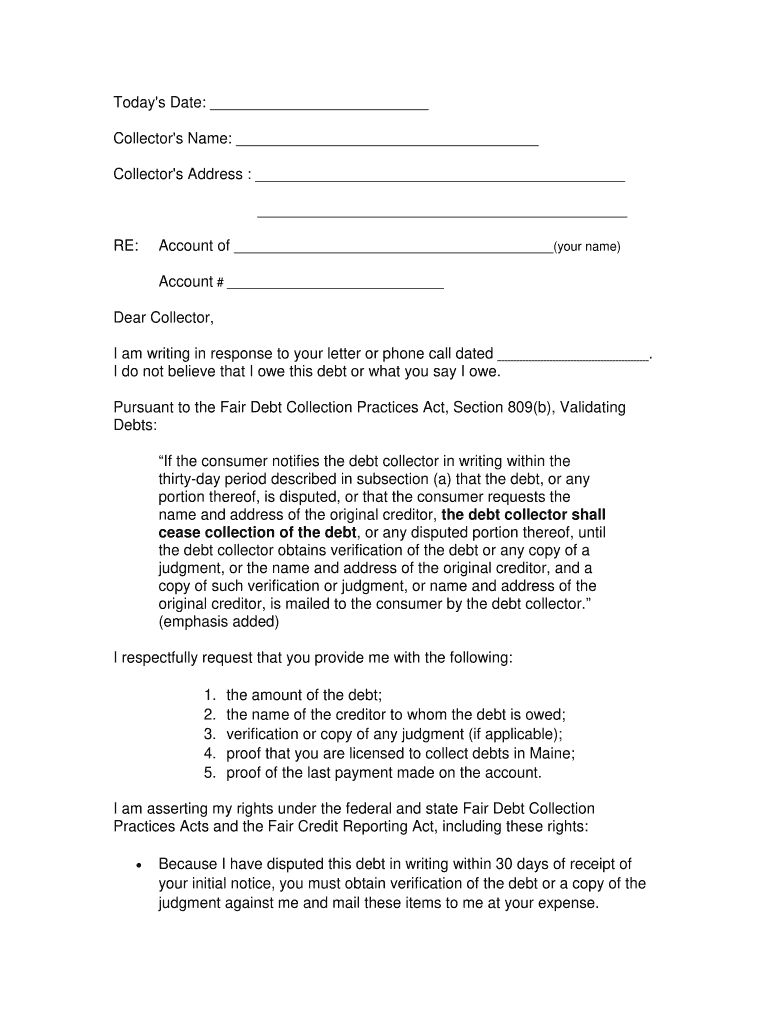

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

40+ Sample Letter Dispute Debt Collection Agency Cecilprax

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-18.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01-790x1022.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Debt Dispute Letter Template Fill Online, Printable, Fillable, Blank

Dispute Letter Template Form Fill Out and Sign Printable PDF Template

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Collectors Make A Lot Of Mistakes, And Disputing The Debt May Help Resolve The Matter.

A Credit Report Dispute Letter Is Used To Remove An Invalid Collection From A Person’s Credit History That Was Either Paid, Falsely Listed, Or If The Debt Is More Than Seven Years Old.

The Full Name And Mailing Address Of The Original Creditor For This Alleged Debt;

The Glendale Apartments Have Alleged That I Owe $450 For Replacement Of The Carpet.

Related Post: