Calendar Year Vs Plan Year

Calendar Year Vs Plan Year - A plan year (not to be confused with tax year or fiscal year) can be different. The insurer, the employer and even the. Web for calendar year plans, these dates are easy to manage; Find out the differences and similarities for. Web a calendar year deductible, what most health plans operate on, begins on january 1st and ends on december 31st. 401k plan year, calendar plan. Web a flexible spending account plan year does not have to be based on the calendar year. The calendar year commonly coincides with the. Detailed comparison pros and cons. 31, or a fiscal year, which is either a period of 12 consecutive months. Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. Web updated june 24, 2022. Web calendar plan year vs. Web a flexible spending account plan year does not have to be based on the calendar year. Web a calendar year deductible, which most health plans operate on, begins. Web a calendar year deductible, what most health plans operate on, begins on january 1st and ends on december 31st. The one between you and your primary care provider. Detailed comparison pros and cons. A plan year (not to be confused with tax year or fiscal year) can be different. Web a calendar year deductible, which most health plans operate. 31, or a fiscal year, which is either a period of 12 consecutive months. We specialize in administering level. 401k plan year, calendar plan. Web a flexible spending account plan year does not have to be based on the calendar year. The calendar year commonly coincides with the. Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. A plan year (not to be confused with tax year or fiscal year) can be different. Web learn how to determine your plan year, stability period, measurement period, and administrative period for aca pay or play compliance. The choice. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. The insurer, the employer and even the. June 5th, 2017 | categories: Web at decent, we build health plans around the most important relationship in healthcare: 31, or a fiscal year, which is either a period of 12 consecutive months. Web however, for the most part keeping health plans on a calendar year is easier and more efficient for most involved: Web a calendar year deductible, what most health plans operate on, begins on january 1st and ends on december 31st. Web calendar plan year vs. Web a tax year may be either a calendar year, which is a period. Web at decent, we build health plans around the most important relationship in healthcare: The insurer, the employer and even the. Web essentially, a plan year revolves around the start and end dates that an employer designates for their insurance and benefit plans, which might not necessarily. As part of the new planner, we’re enhancing task. The one between you. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. Web essentially, a plan year revolves around the start and end dates that an employer designates for their insurance and benefit plans, which might not necessarily. 31, or a fiscal year, which is either a period of 12 consecutive months. Off. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. As part of the new planner, we’re enhancing task. Detailed comparison pros and cons. The one between you and your primary care provider. 401k plan year, calendar plan. Web at decent, we build health plans around the most important relationship in healthcare: Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. The one between you and your primary care provider. Web a calendar year deductible, what most health plans operate on, begins on january 1st and ends. Web however, if the plan’s deductible is administered on a basis other than the policy year (for example, the calendar year), the plan year will be the year used for administering the. The insurer, the employer and even the. It might align with the fiscal year, or any other annual period that. Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. Detailed comparison pros and cons. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. Web a calendar year deductible, what most health plans operate on, begins on january 1st and ends on december 31st. Web plan year vs calendar year: The one between you and your primary care provider. Web for calendar year plans, these dates are easy to manage; Web web this video explains the difference between a calendar year vs a plan year, and what happens with your deductible and out of pocket max. We specialize in administering level. 31, or a fiscal year, which is either a period of 12 consecutive months. 401k plan year, calendar plan. The fsa plan administrator or employer decides when the fsa plan year begins, and.

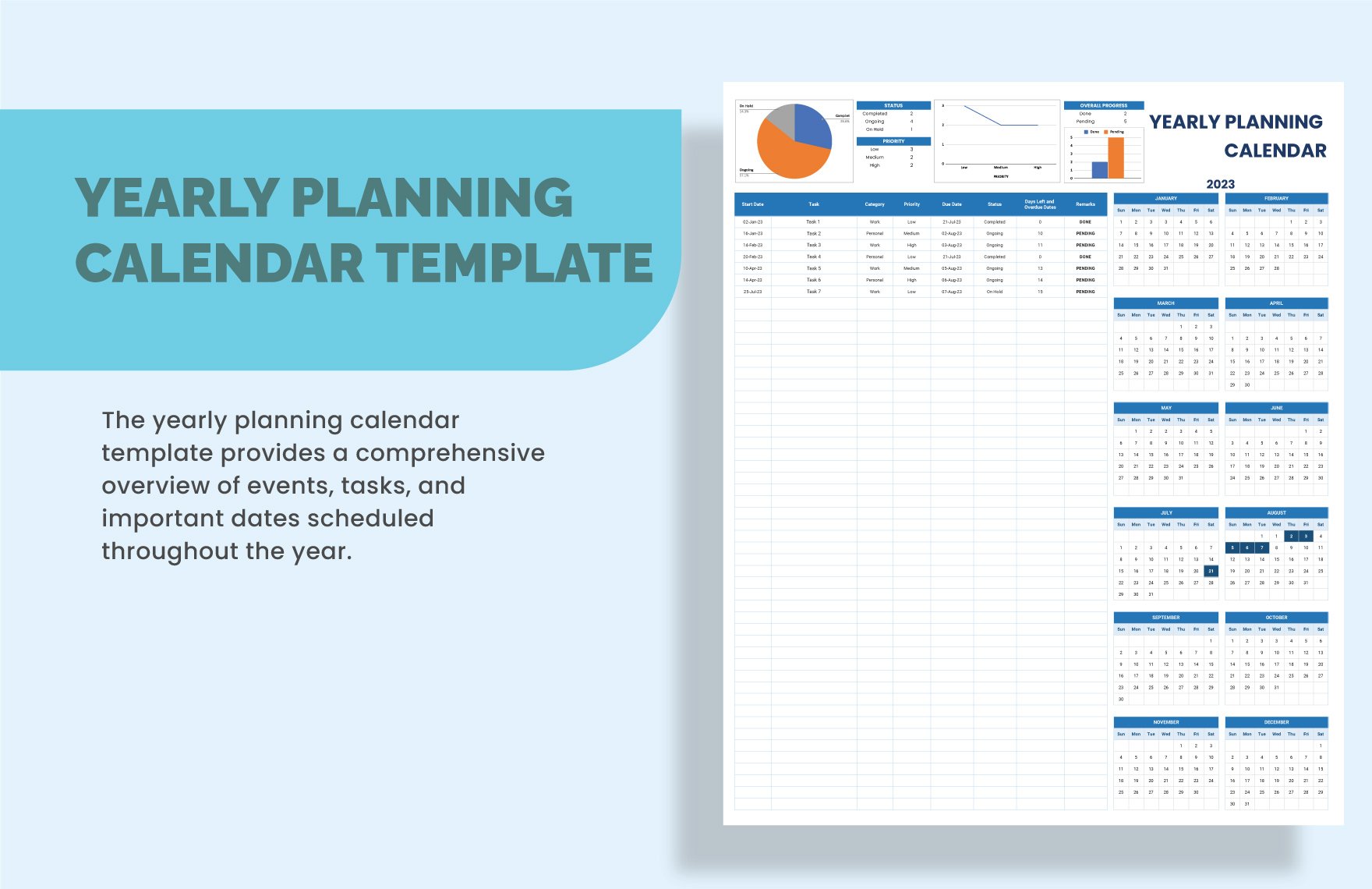

FREE Yearly Plan Template Download in Word, Google Docs, Excel, PDF

Free Printable Yearly Planner Template in PDF, Word & Excel

Yearly Plan Template

EXCEL of Blue and Simple Calendar for Work Plan.xlsx WPS Free Templates

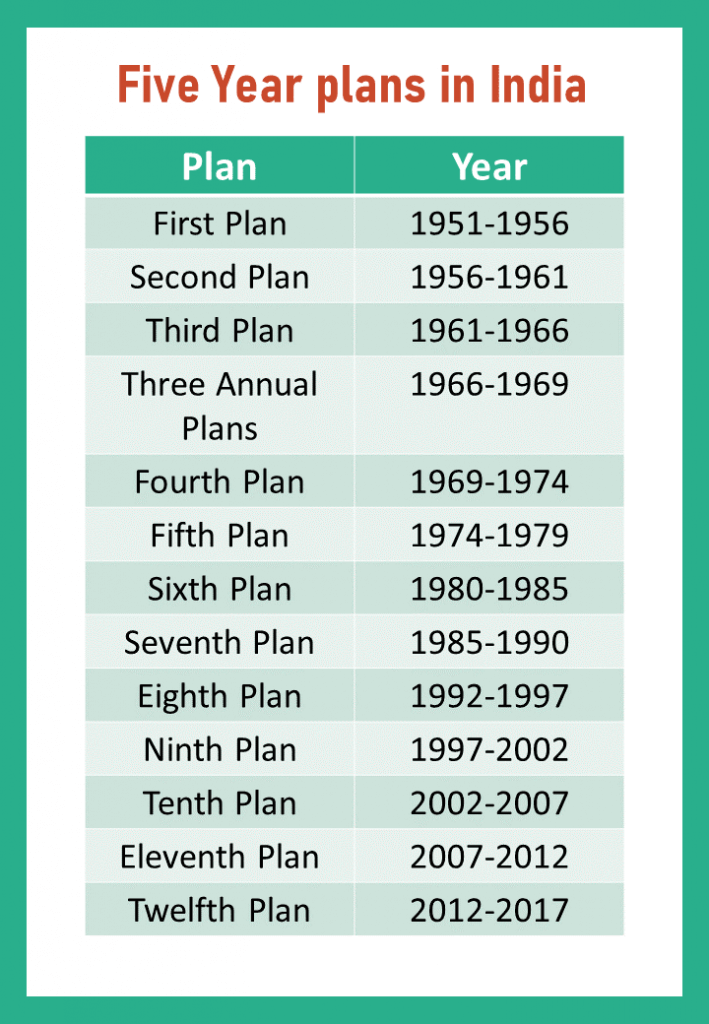

List of all Five Year Plans in India UPSC

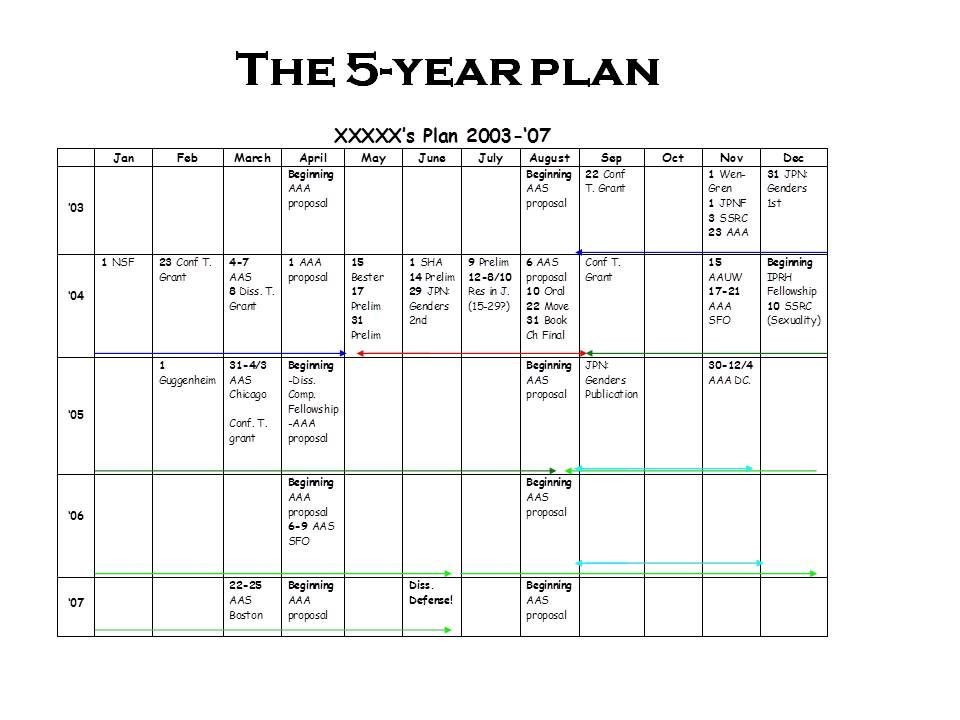

20 Personal 5 Year Plan Template

full year calendar 2022 2022 year calendar yearly printable Damon

Fillable Online Calendar Year vs. Plan Year Deductible Health

Calendar vs Plan Year What is the difference? Medical Billing YouTube

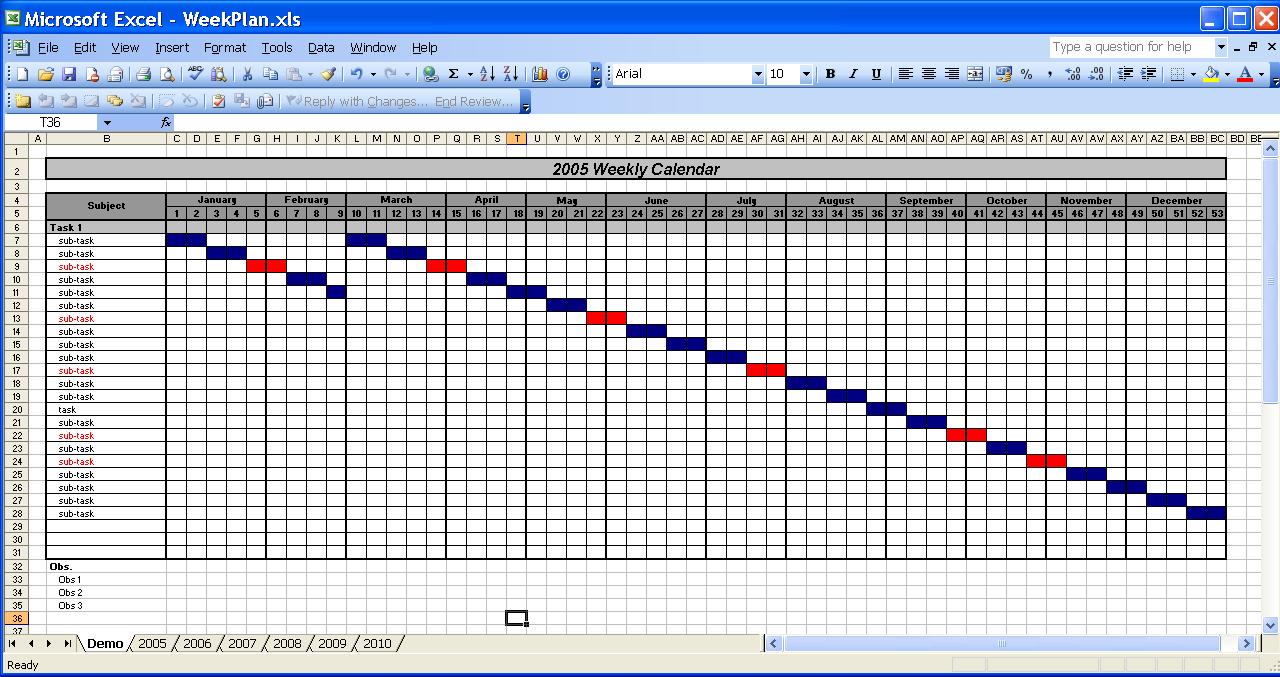

OfficeHelp Template (00031) Calendar Templates 2005 / 2010 Yearly

Web Learn The Difference Between Calendar Year And Plan Year Deductibles In Health Insurance Policies.

June 5Th, 2017 | Categories:

Web Learn How To Determine Your Plan Year, Stability Period, Measurement Period, And Administrative Period For Aca Pay Or Play Compliance.

Find Out The Differences And Similarities For.

Related Post: