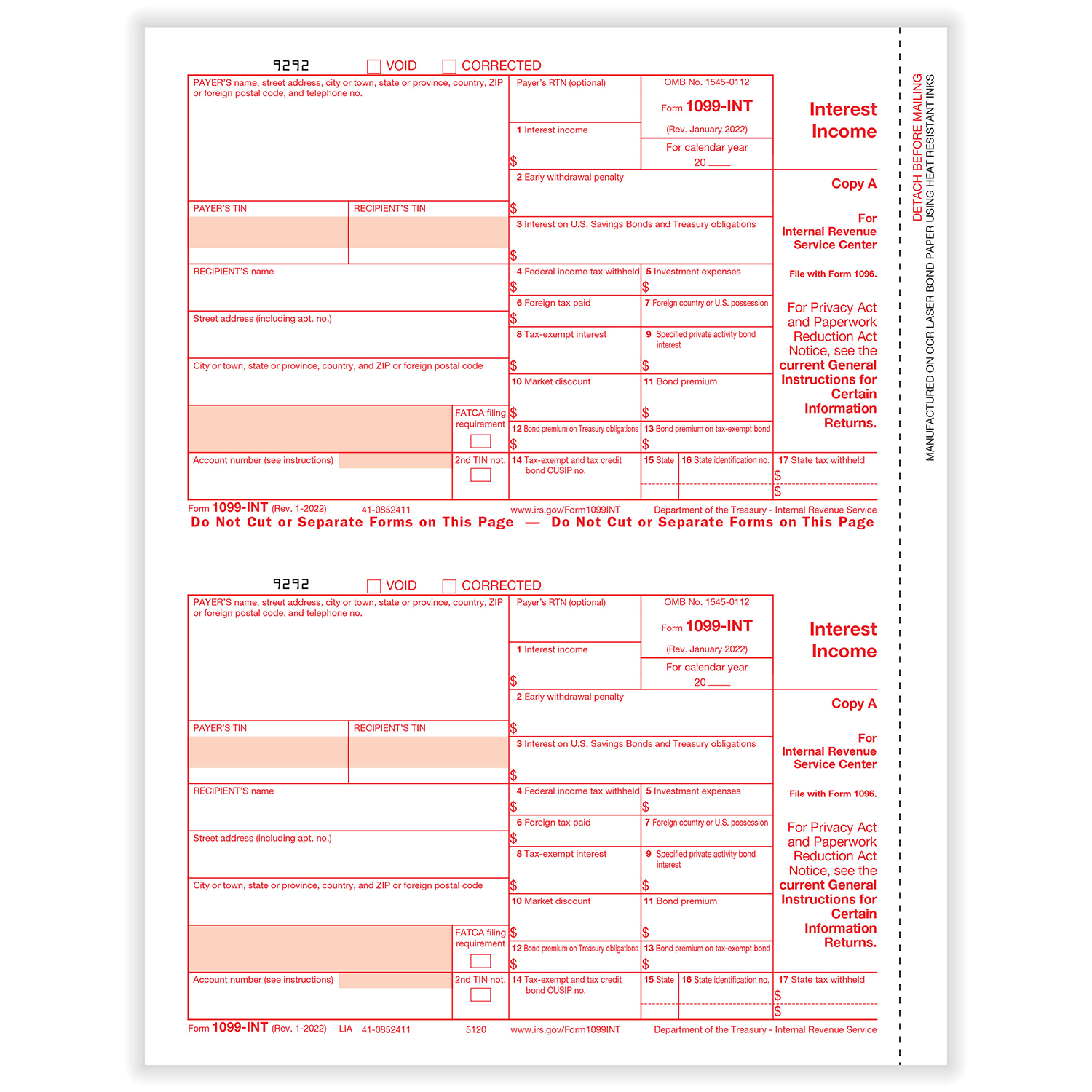

1099 Int Template

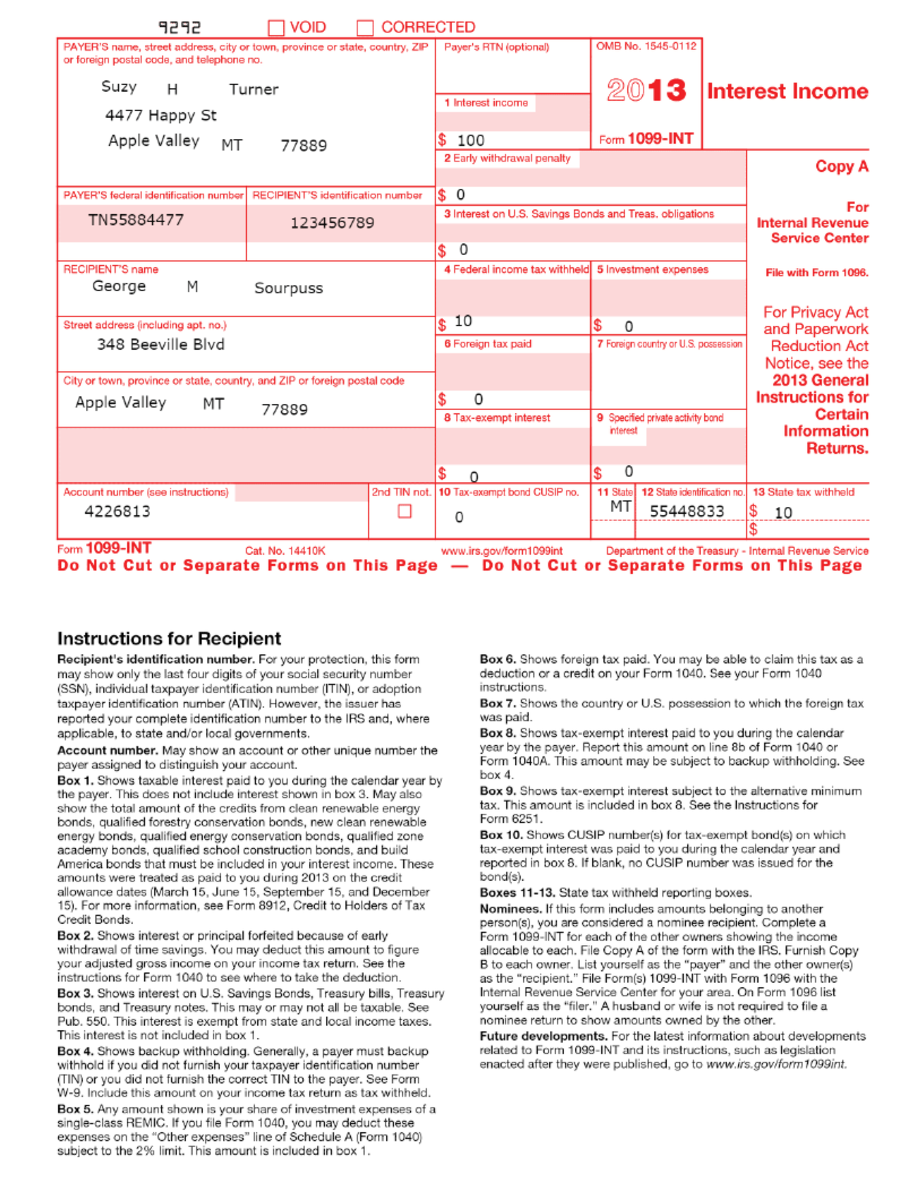

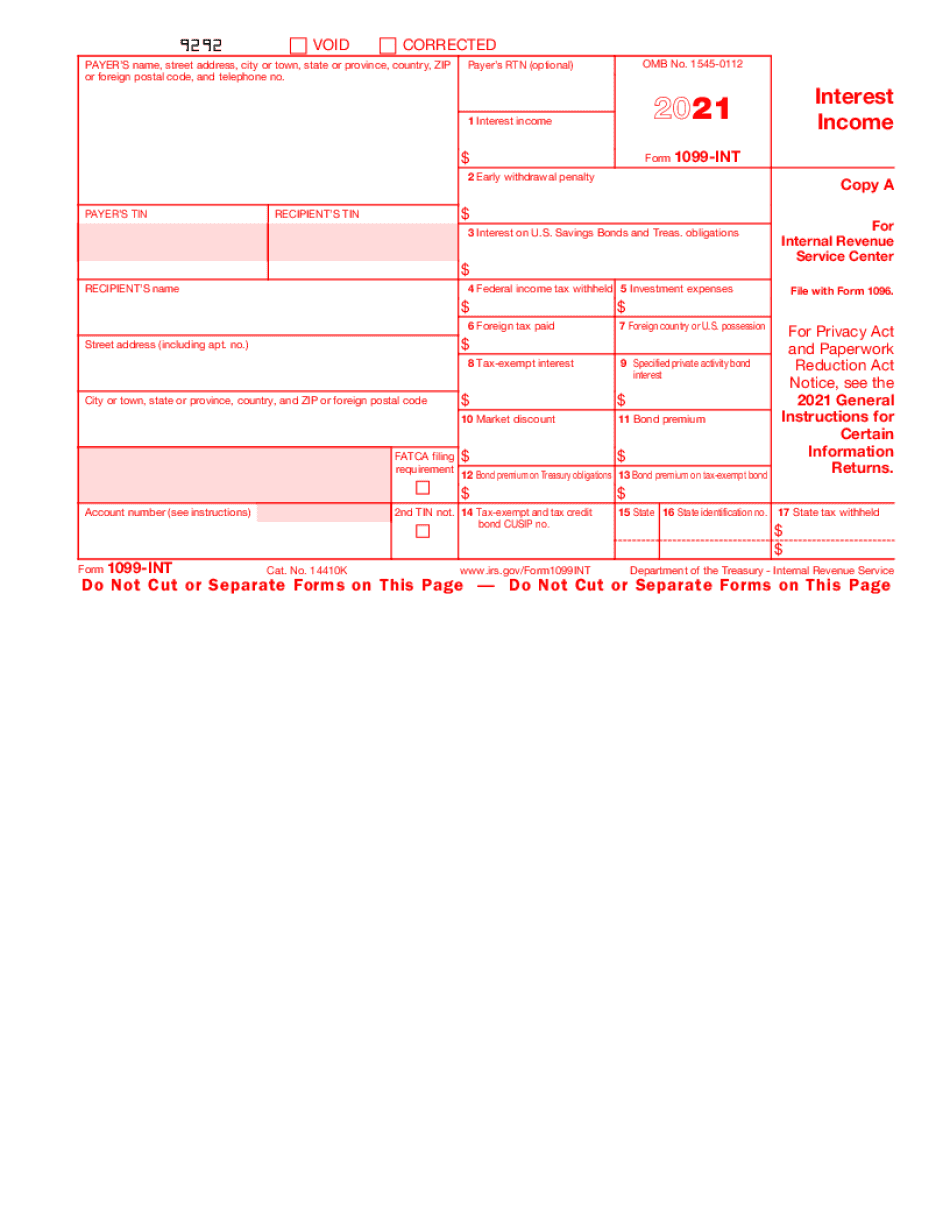

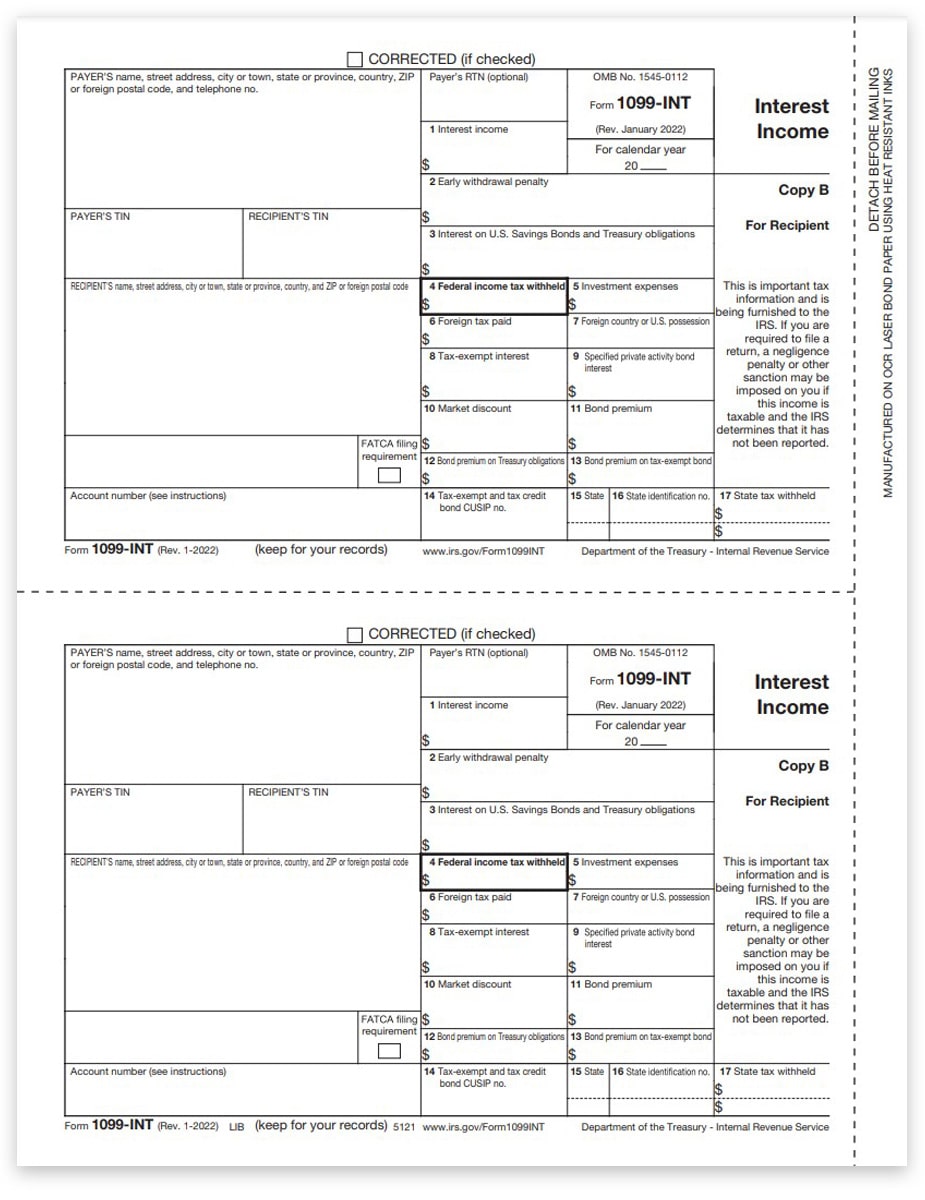

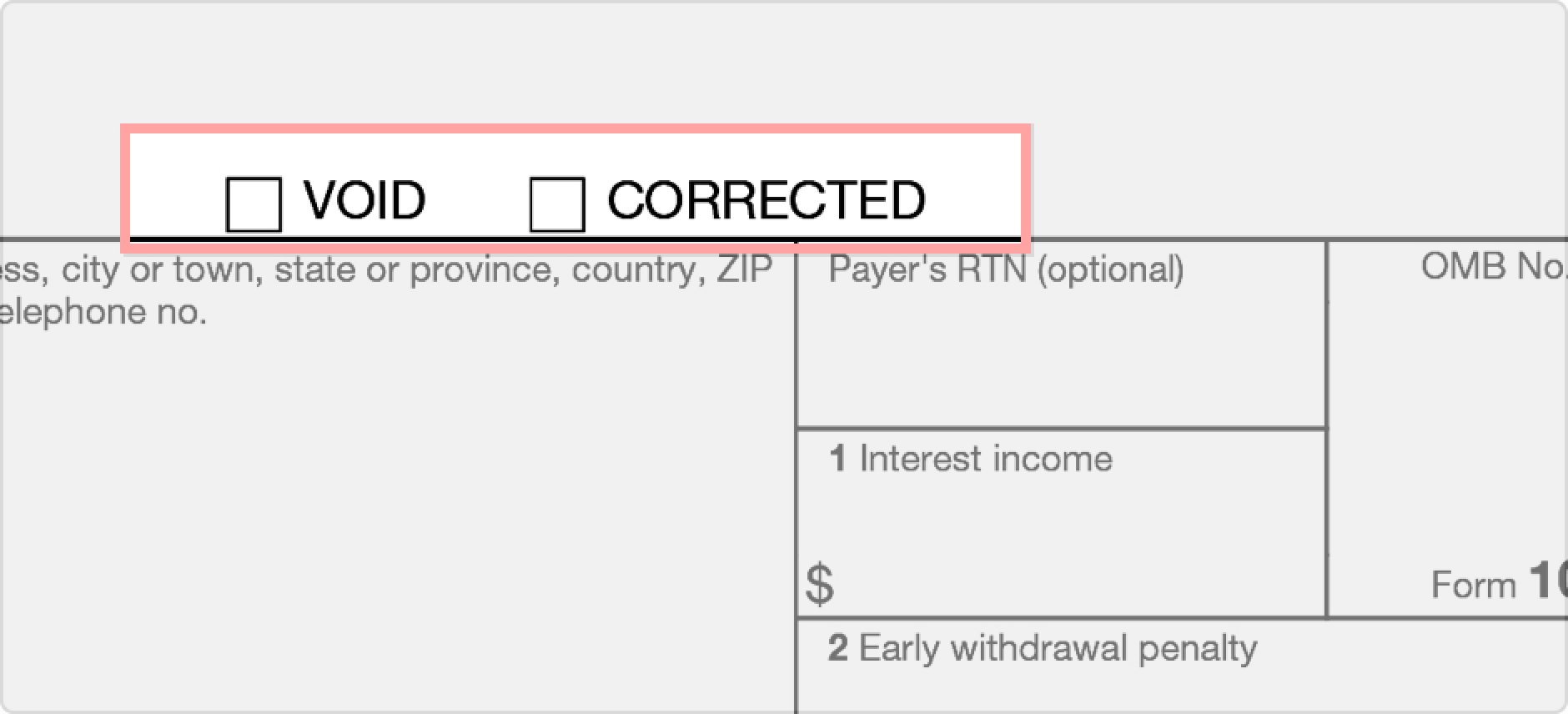

1099 Int Template - This interest is usually from a bank or government agency. The form is issued by banks, financial institutions, and other entities that pay interest. You’ll need the form — and knowledge of irs rules for reporting interest income — when you file your federal income tax return. Web for the most recent version, go to irs.gov/form1099int. Web written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 22, 2024 2:21 pm. Web use this free spreadsheet for your independent contractor expenses. For the most recent version, go to irs.gov/form1099int. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. Current general instructions for certain information returns. This form, usually not required to be filled in by individuals, is sent not only to interest recipients but also to the irs and each interest recipient’s state tax department. Current general instructions for certain information returns. This form is sent to the irs during the tax year, as well as any applicable states and individuals for their records. What is a 1099 form used for? Web page last reviewed or updated: This form, usually not required to be filled in by individuals, is sent not only to interest recipients. The form must be filed for any customer who earned at least $10 in interest income during the year. Web june 3, 2023 by ryan casarez. This interest is usually from a bank or government agency. Save, download, print, and share. Current general instructions for certain information returns. For internal revenue service center. For internal revenue service center. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. For privacy act and paperwork reduction act notice, see the. Web use. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you will. Web june 3, 2023 by ryan casarez. The form details interest payments, related expenses, and taxes owed. Web in a nutshell. This interest is usually from a bank or government agency. For internal revenue service center. For privacy act and paperwork reduction act notice, see the. January 2024) interest income and original issue discount. Web page last reviewed or updated: You’ll need the form — and knowledge of irs rules for reporting interest income — when you file your federal income tax return. Web use this free spreadsheet for your independent contractor expenses. For privacy act and paperwork reduction act notice, see the. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for box 1. You're probably. This interest is usually from a bank or government agency. For internal revenue service center. Web for the most recent version, go to irs.gov/form1099int. Web written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 22, 2024 2:21 pm. You're probably hoping to find something — anything — that can make your. For internal revenue service center. Looking for a 1099 excel template? Web for the most recent version, go to irs.gov/form1099int. January 2024) interest income and original issue discount. For privacy act and paperwork reduction act notice, see the. Sign & make it legally binding. This interest is usually from a bank or government agency. A 1099 is a type of form that shows income you received that wasn't from your employer. Save, download, print, and share. For the most recent version, go to irs.gov/form1099int. A 1099 is a type of form that shows income you received that wasn't from your employer. For internal revenue service center. For internal revenue service center. Web written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 22, 2024 2:21 pm. To whom you paid amounts reportable in boxes 1, 3,. Current general instructions for certain information returns. You're probably hoping to find something — anything — that can make your taxes less of a buzzkill. Sign & make it legally binding. For the most recent version, go to irs.gov/form1099int. This interest is usually from a bank or government agency. A 1099 is a type of form that shows income you received that wasn't from your employer. For internal revenue service center. The form is issued by banks, financial institutions, and other entities that pay interest. You’ll need the form — and knowledge of irs rules for reporting interest income — when you file your federal income tax return. This form is sent to the irs during the tax year, as well as any applicable states and individuals for their records. Web page last reviewed or updated: The form details interest payments, related expenses, and taxes owed. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you will. Save, download, print, and share. January 2024) interest income and original issue discount. For internal revenue service center.

1099INT Forms & Filing TaxFormExpress

1099 int Fill out & sign online DocHub

1099Int Template. Create A Free 1099Int Form.

Boost Efficiency With Our Editable Form For 1099 Int Form

Demystifying IRS Form 1099INT Your Complete Guide

1099INT Interest Excel Template for Printing Onto IRS Form 2022 Taxes

1099INT Tax Forms 2022, Recipient Copy B DiscountTaxForms

1099INT Form Fillable, Printable, Download. 2022 Instructions

1099 Int Federal Form 1099INT Formstax

1099INT A Quick Guide to This Key Tax Form The Motley Fool

Current General Instructions For Certain Information Returns.

Web For The Most Recent Version, Go To Irs.gov/Form1099Int.

What Is A 1099 Form Used For?

Web June 3, 2023 By Ryan Casarez.

Related Post: