1096 Printable Form

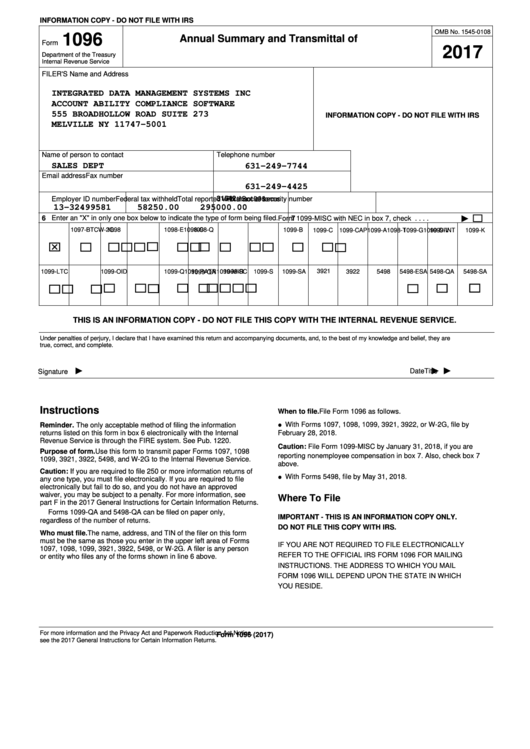

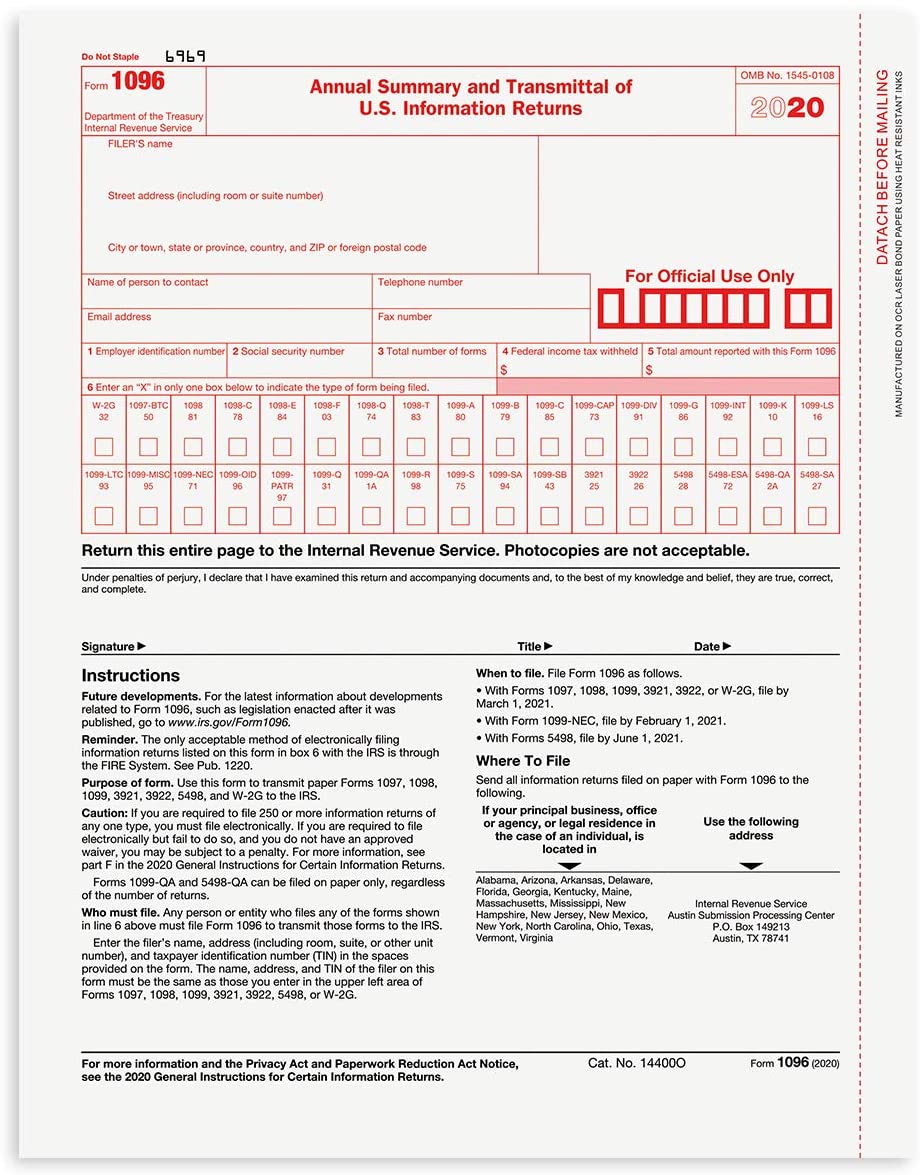

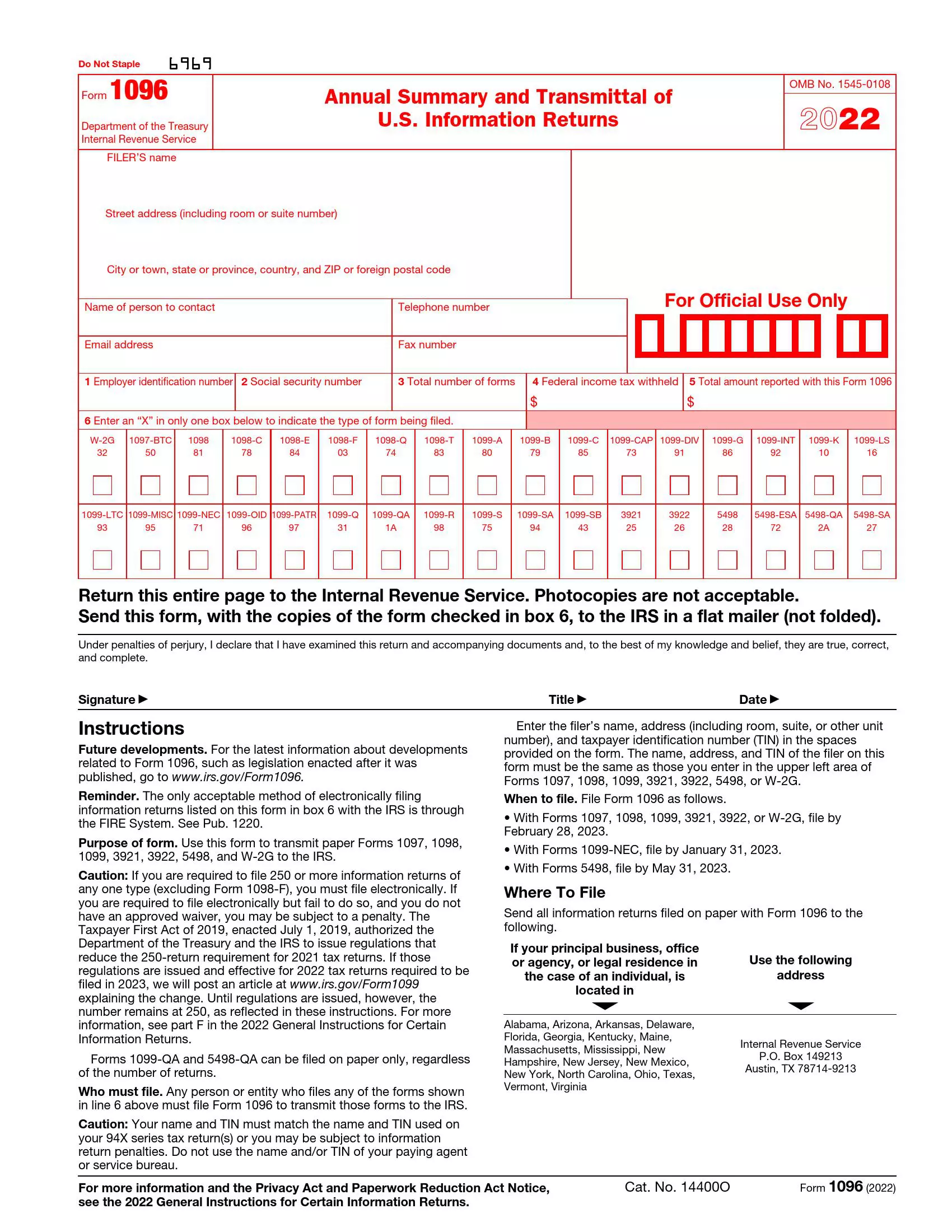

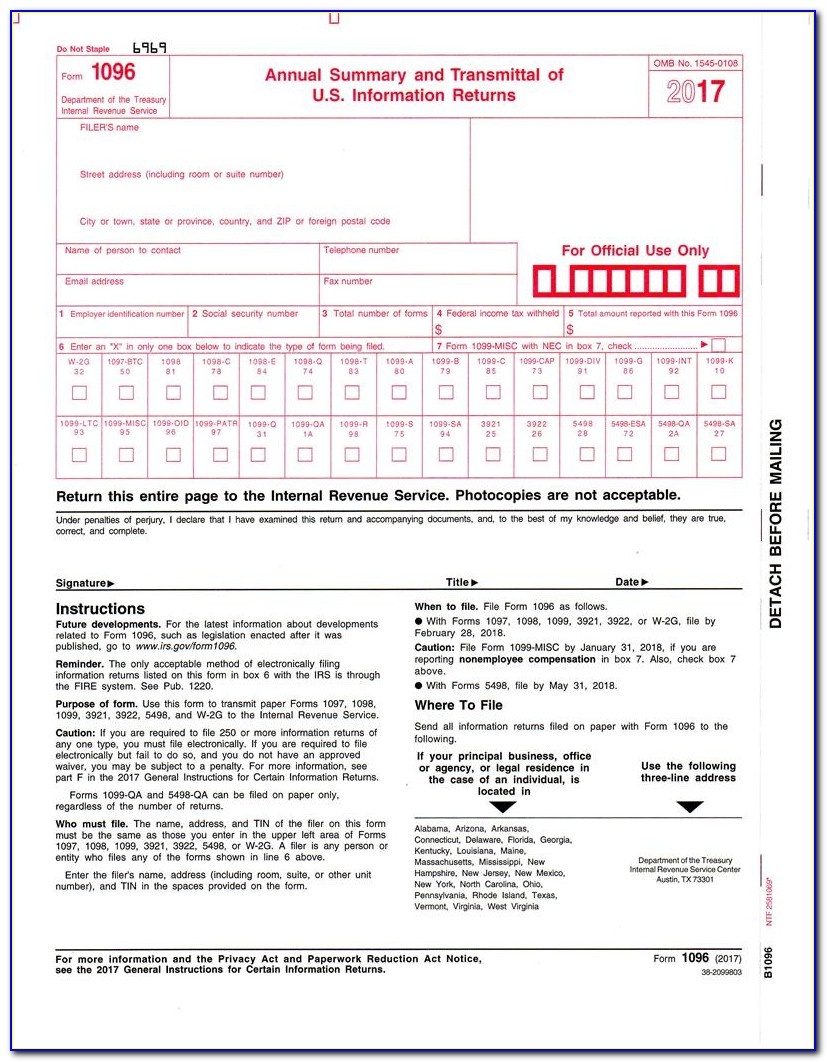

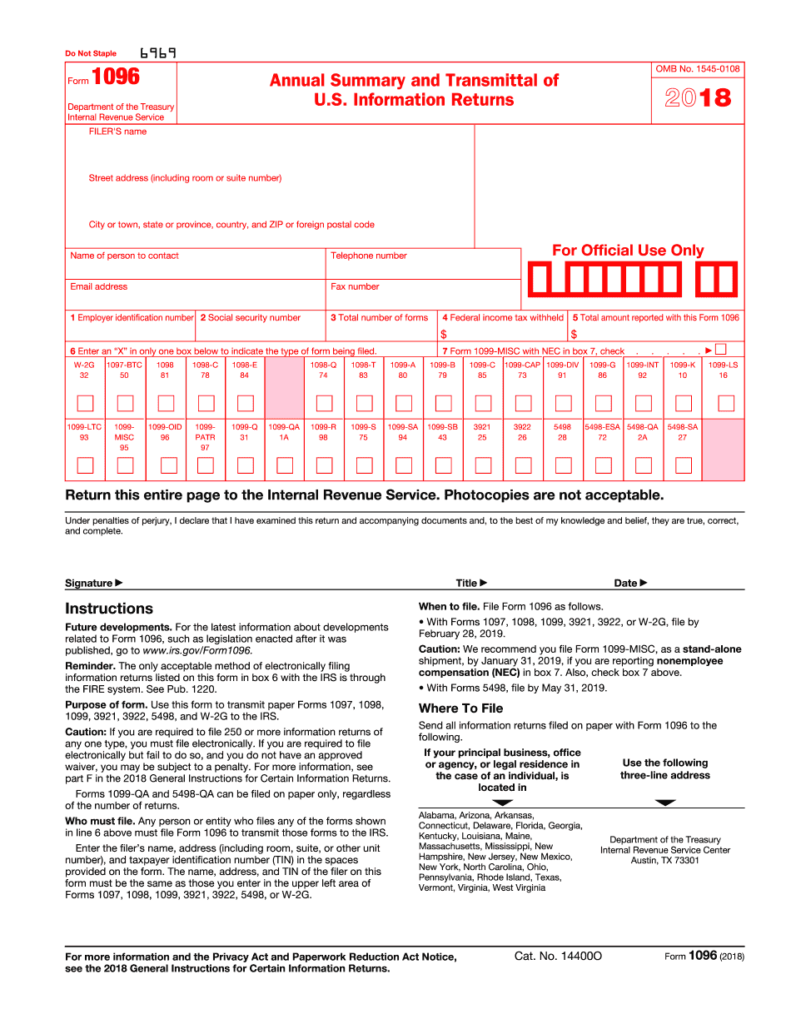

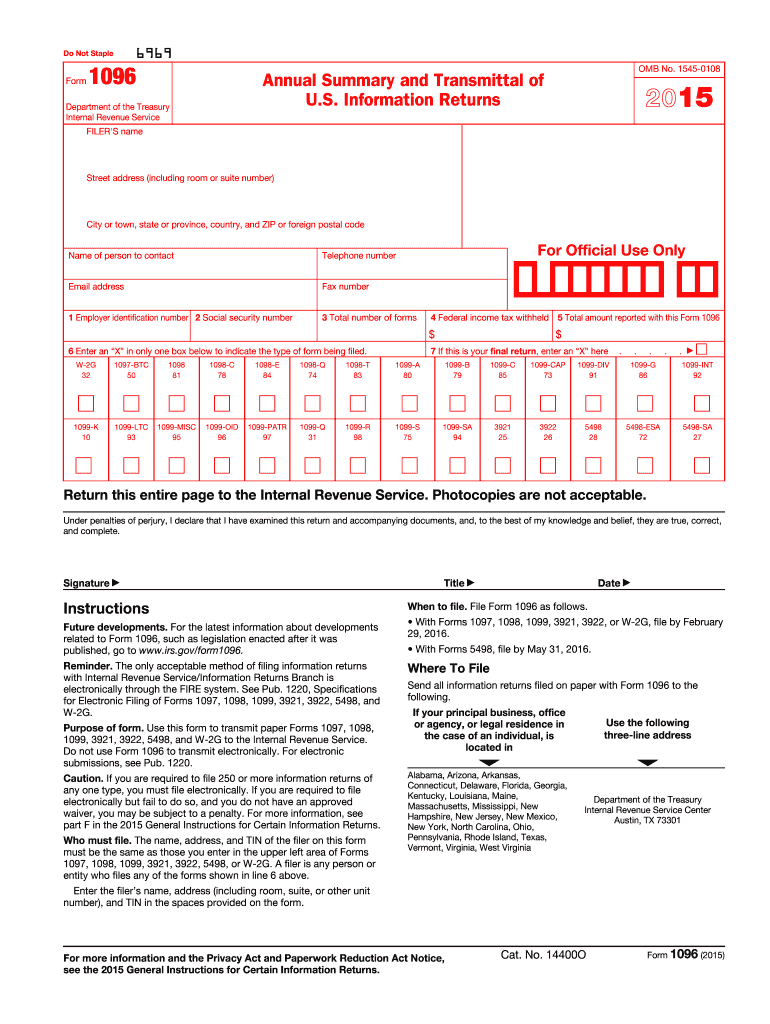

1096 Printable Form - Dan rentea / getty images. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. It appears in red, similar to the official irs form. Attention filers of form 1096: Tax forms helper automatically creates your 1096 summary transmittal from the data you’ve already collected. 2 what information is reported on form 1096? Information returns, is used as a summary or “cover sheet” to various types of other forms only when submitting a paper filing to the irs. This form is provided for informational purposes only. It appears in red, similar to the official irs form. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Do you operate or own a small business that employs independent contractors throughout the year? Web form 1096 is used when you're submitting paper 1099 forms to the irs. Information returns, including recent updates, related forms and instructions on how to file. The official printed version of this irs form is scannable, but a copy, printed from this website, is. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. Web irs form 1096, annual summary and transmittal of u.s. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Attention filers of form 1096: Information returns, including recent updates, related forms. This form is provided for informational purposes only. From your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Learn how to print 1099 and, if. Information returns, including recent updates, related forms and instructions on how to file. Information returns, is used as a summary or “cover sheet” to various types of other forms only when submitting a paper filing to the irs. Web how to fill out form 1096. This form is provided for informational purposes only. The official printed version of this irs. What is irs form 1096? Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Print your 1099 and 1096 forms. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. This form is provided for informational purposes only. If you are filing electronically, form 1096 isn't required by the irs. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. It appears in red, similar to the official irs form. It appears in red, similar to the official irs form. 1 what is irs form 1096 and what is. What is irs form 1096? Attention filers of form 1096: Attention filers of form 1096: Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Web information about form 1096, annual summary and transmittal of u.s. This form is provided for informational purposes only. When printing this form, ensure to update the following printer settings: Attention filers of form 1096: The official printed version of this irs form is scannable, but a copy, printed from this website, is not. The official printed version of this irs form is scannable, but a copy, printed from this website,. Attention filers of form 1096: Web form 1096 is used when you're submitting paper 1099 forms to the irs. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Solved•by quickbooks•1320•updated january. This form is provided for informational purposes only. Attention filers of form 1096: Solved•by quickbooks•1320•updated january 12, 2024. It appears in red, similar to the official irs form. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. How to use the 1096 form for contractor compensation. This form is provided for informational purposes only. Tax forms helper automatically creates your 1096 summary transmittal from the data you’ve already collected. This form is provided for informational purposes only. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Free delivery by tue, may 07. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. From your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. This form is provided for informational purposes only. This form is provided for informational purposes only. Attention filers of form 1096: Without registration or credit card. This form is provided for informational purposes only. Web irs form 1096 annual summary and transmittal of u.s. If you are filing electronically, form 1096 isn't required by the irs. Attention filers of form 1096:

Form 1096 Annual Summary And Transmittal Of U.s. Information Returns

Printable 1096 Form 2021 Customize and Print

1096 Compass Checks

Form 1096 Deadline 2023 Printable Forms Free Online

Free Printable 1096 Form 2015 Free Printable

Free Fillable Form 1096 Printable Forms Free Online

Form 1096 Template Word

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

Continuous Tax Form 1096 Summary & Transmittal Sheet Free Shipping

1096 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Form 1096 Is Only Necessary If You Are Submitting Paper Forms, Not If You Are Submitting Your Forms Electronically.

It Appears In Red, Similar To The Official Irs Form.

Attention Filers Of Form 1096:

2 What Information Is Reported On Form 1096?

Related Post: